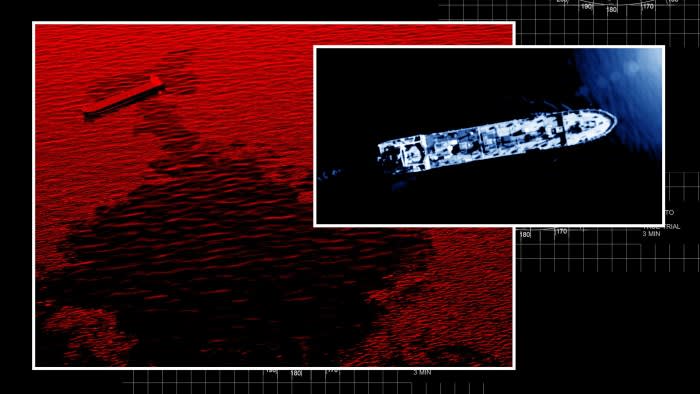

Russian oil tankers circumventing western sanctions are relying on insurance that appears impossible to claim against, according to leaked documents exposing the risks taken by Moscow’s “dark fleet”.

The cache of shipping files, seen by the Financial Times and the Danish media group Danwatch, reveals that a number of Russian vessels travelling from the Baltic are relying on insurance that can be easily voided in the event of a disaster.

Ingosstrakh, a Moscow-based insurer, provides coverage that is essential for its shipping clients to enter ports around the world. But the contractual fine print includes a “sanctions exclusion clause”, which would invalidate claims involving most tankers moving Russian oil.

The Russian dark fleet’s insurance arrangements with Ingosstrakh potentially expose coastal states in Europe and Asia to huge potential clean-up costs in the event of a spill.

It also highlights how a complicated western sanctions regime, which sought to crimp Moscow’s energy revenues following its 2022 full-scale invasion of Ukraine, may have inadvertently increased environmental threats from inadequately insured ships.

Michelle Wiese Bockmann, an analyst at Lloyd’s List, said: “This presents serious environmental and safety risks in key chokepoints where Russian oil is shipped — including through Denmark’s waters and the English channel, which are international routes through which these tankers sail daily”.

Craig Kennedy, a Russian oil expert at Harvard, said that many coastal states are not using their full rights under maritime law to protect themselves against underinsured vessels. “If there’s a spill, voters will demand to know why their governments didn’t do more.”

Under the terms of the G7-designed price cap, western insurers, shipowners and ship managers are required to avoid involvement in Russian oil exports sold for more than a maximum price, fixed at $60 per barrel for crude.

The Russian government responded by building up the dark fleet of vessels, whose ownership and control is obscured through the use of secrecy jurisdictions. Building this fleet allows Russia to sell oil above the cap. More than 90 per cent of Russian crude exported from the Baltic in December was sold in excess of the price cap, according to the Kyiv School of Economics.

The FT and Danwatch identified a number of dark fleet tankers that now use Ingosstrakh insurance when sailing through Danish waters and the English channel en route to India.

An Ingosstrakh contract from the cache expressly requires Russian oil exports to be “in compliance with the applicable US, UK and (or) EU laws”, and explicitly cites an EU regulation that includes the price cap.

Ingosstrakh separately confirmed that it reserved the right to cancel cover for vessels caught selling oil above the price cap — even if vessels had avoided using western services. A spokesperson said they wished to avoid the risk of “secondary sanctions and damaged reputation”.

Asked whether Ingosstrakh would not pay out if a spill came from a vessel moving oil priced above the cap, the spokesperson said the response “will not be different” to “any other international insurer”. “Ingosstrakh does not tolerate such clients’ behaviour,” the spokesperson added.

Ingosstrakh, which evolved out of the Soviet-era Chief Agency of Foreign Insurance, is one of Russia’s largest insurers. Insurance for shipping is a small part of its portfolio. Ingosstrakh says it still has “reinsurance relationships with some non-Russian entities”.

The company is part owned by the Italian insurer Generali, but its stake has been “frozen” since the invasion. Generali now plays no role in Ingosstrakh’s management.

Danish foreign minister Lars Løkke Rasmussen said the findings were concerning and that Denmark was “open to additional EU measures” against Russia’s shadow fleet.

“It is highly problematic if these tankers are involved in circumventing the sanctions and sail without adequate insurance,” Rasmussen said.

Questions over the dark fleet’s insurance are a long-standing industry concern, with doubts over the ability and willingness to cover the costs of a large spill such as the Exxon Valdez disaster or the Braer grounding off Shetland 30 years ago.

The number of tankers shipping Russian oil without western insurance has risen since the introduction of the cap. In the three months from December, Kpler, a data analytics company, identified 191 crude tanker voyages leaving Russia’s Baltic ports. Of these, 140 were on vessels that held no insurance from western providers. Many were very old — a hallmark of the dark fleet.

Last spring the UAE-managed Canis Power oil tanker broke down while carrying Russian crude through the narrow Danish straits. The then-18-year-old vessel lay stranded for six hours, dangerously close to the coastline. A later inspection identified 11 faults with the vessel, including issues with its emergency power system and firefighting equipment.

Tanker owners must be able to prove they hold adequate insurance against spills in order to be allowed to access ports and other facilities.

If required, an international fund — maintained by seaborne oil importers — can also be called upon to make a contribution of up to about $1bn. Exxon’s total costs for cleaning up the Valdez spill in 1989, including damages claims and fines, were estimated to be as much as $7bn — or $17bn when adjusted for inflation.

The leaked documents show that Ingosstrakh has insured several ships recently passing through Danish waters from the Baltic.

These include the Naxos, a 17 year-old tanker flagged in Panama. On December 14 2023, the vessel moved a cargo of oil from Primorsk. The cargo was identified by Kpler as coming from Rosneft, Moscow’s state-owned oil champion and Russia’s largest producer.

According to Russian customs data, there were no journeys involving Rosneft for two weeks either side of the Naxos’s departure that carried crude priced at less than $60 per barrel.

Ingosstrakh said it would “look into this matter” but that “the investigation will require some time”. Caishan Ship Management, an Indian ship manager that runs the Naxos, did not respond to requests for comment. Ingosstrakh said it maintains higher standards on vetting clients than many rivals.