Municipals were steady to slightly firmer Wednesday as inflows returned to muni mutual funds. U.S. Treasury yields fell and equities ended up.

The two-year muni-to-Treasury ratio Wednesday was at 60%, the three-year at 60%, the five-year at 60%, the 10-year at 60% and the 30-year at 87%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 59%, the three-year at 58%, the five-year at 57%, the 10-year at 59% and the 30-year at 85% at 3 p.m.

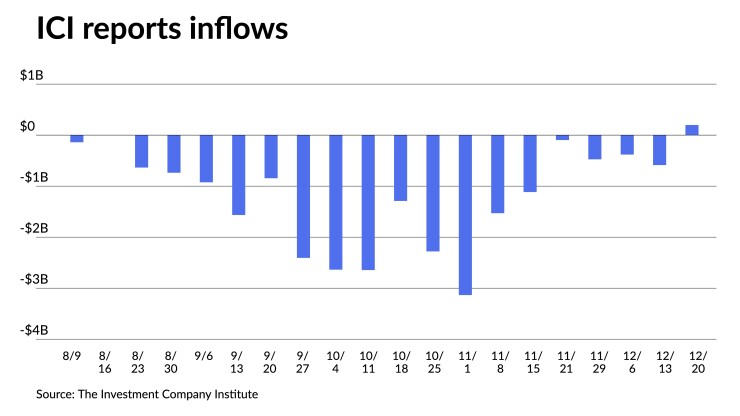

The Investment Company Institute reported inflows from municipal bond mutual funds for the week ending Dec. 20, with investors adding $198 million to the funds following $588 million of outflows the week prior. Exchange-traded funds also saw inflows of $982 million following $11 million of inflows the week prior.

Late-month volumes are “waning as it appears the year’s

“Secondary flows are running at about 25% of a typical day, but the themes are much the same — steady yields, fair-ish ratios (the longer the final, the better the level) and credit spreads that remain compressed due to light issuance,” she said.

Similar to 2020 and 2021, the rally in the fourth quarter rally has benefited wider credit categories with a broader risk-on trade: “healthcare is slated to outperform a main index by about 100 basis points and transportation bonds will end ahead of the broad market by nearly 75 basis points,” she said.

Meanwhile, Olsan noted buyers have been “less willing to push more mainstream revenue prices, as a water/sewer index is lagging by 60 basis points.”

The 10-year Refinitiv MMD yield has fallen 35 basis points since the end of November, topping the average gain of 13 basis points from Dec. 1 through Jan. 31 since 2018.

Curve slope had a “material impact” on where allocations were made this year, according to Olsan.

The major spot levels “never traded to an inverted average during 2022” as the muni curve inversion happened in December of that year, she said.

A healthy median 48 basis point 5s1s Bloomberg BVAL curve “offered extension value that was largely eclipsed a year later,” she said.

The 5s1s slope in 2023 “traded to a median negative 36 basis points, reaching a steep negative 55 basis points at a point when real yields were 3.50% or higher,” she said.

Much like the crowded T-bill trade, Olsan said “short-dated munis saw heavy flows from both opportunistic and defensive investors.”

The intermediate range varied as well since last year, she noted.

Over the year, Olsan said “the 10s5s BVAL curve ran from negative 8 basis points to positive 13 basis points, with barely a positive slope on average” versus 2022’s “positive 27 basis point curve where duration was more fairly rewarded.”

Sweet spots happened past 10 years on the curve during the year, she said.

Unlike 2022’s flat-ish intermediate slope, “the steepness in the curve — and high absolute yields — encouraged extension for meaningful pickups,” she said.

The average 20s10s BVAL slope was more than double 2022’s range at 75 basis points, Olsan said.

At the tip of the curve, “the 30s10s slope traded in a narrow but attractive 92-109 basis point slope,” she said.

Although long durations were hammered in 2022, she said this year’s trade has been rewarded with a 9% gain.

With expectations for some easing from the Federal Open Market Committee next year, insights into the muni curve can be seen based on the 2019 period.

“When an easing cycle began in July 2019 and continued into year-end (totaling 50 basis points), the muni curve flattened about 40 basis points into the close of Q3 but then had steepened 30 basis points by the end of December,” she said. “At a current 3.36%, the 30-year AAA BVAL yield would trade through 3% if a similar pattern develops through the year.”

Secondary trading

North Carolina 5s of 2024 at 2.80%. Minnesota 5s of 2024 at 2.79%. Massachusetts 5s of 2025 at 2.66%-2.60%.

Washington 5s of 2027 at 2.36% versus 2.45% on 12/19. Nebo School District, Utah, 5s of 2028 at 2.33%. LA DWP 5s of 2029 at 2.06% versus 2.11% on 12/20.

Calvert County, Maryland, 5s of 2031 at 2.26%. Florida BOE 5s of 2032 at 2.28%. Connecticut 5s of 2034 at 2.38% versus 2.44% on 12/21 and 2.50% original on 12/20.

NYC 5s of 2045 at 3.42%-3.43% versus 3.69% on 12/7. Massachusetts 5s of 2050 at 3.66%-3.65%.

AAA scales

Refinitiv MMD’s scale was bumped up to two basis points: The one-year was at 2.69% (unch) and 2.54% (unch) in two years. The five-year was at 2.28% (unch), the 10-year at 2.28% (unch) and the 30-year at 3.45% (-2) at 3 p.m.

The ICE AAA yield curve was bumped up to three basis points: 2.74% (unch) in 2024 and 2.55% (unch) in 2025. The five-year was at 2.25% (-2), the 10-year was at 2.29% (-2) and the 30-year was at 3.42% (-3) at 3 p.m.

The S&P Global Market Intelligence municipal curve was bumped up to two basis points: The one-year was at 2.68% (unch) in 2024 and 2.55% (unch) in 2025. The five-year was at 2.29% (-2), the 10-year was at 2.32% (-2) and the 30-year yield was at 3.41% (-2), according to a 3 p.m. read.

Bloomberg BVAL was unchanged: 2.58% in 2024 and 2.49% in 2025. The five-year at 2.20%, the 10-year at 2.27% and the 30-year at 3.36% at 3 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.243 (-10), the three-year was at 3.987% (-7), the five-year at 3.796% (-9), the 10-year at 3.793% (-10), the 20-year at 4.104% (-10) and the 30-year Treasury was yielding 3.952% (-9) at 3:15 p.m.