Municipals were little changed to a touch weaker on Monday, underperforming a slightly better U.S. Treasury market while the S&P 500 and Nasdaq rallied. The New York City Transitional Finance Authority priced $950 million of future tax-secured bonds for day one of a two-day retail order period.

Nearly all categories of municipals appear poised to end August with returns in the red. August returns of negative 0.40% would be the third-worst August performance of the past 10 years, according to Bloomberg Intelligence. The 1.49% year-to-date return for the Bloomberg U.S. Municipal Index ranks as the fourth lowest through eight months over the past 10 years.

Total returns for high-yield for August is negative 0.21% but positive 7.17% year-to-date and taxables are at negative 0.19% for August but positive 1.76% for all of 2021, according to Bloomberg Barclays indexes.

High-yield saw two weeks of lower inflows into municipal bond mutual funds in August, contributing to the weaker performance, after a months-long series of large and record-breaking inflows throughout 2021.

U.S. Treasury yields fell and ratios rose Monday with the 10-year muni-to-Treasury ratio at 71% and the 30-year at 80%, according to Refinitiv MMD. The 10-year muni-to-Treasury ratio was at 74% while the 30-year was at 79%, according to ICE Data Services.

In the primary, RBC Capital Markets priced for retail investors the New York City Transitional Finance Authority (Aa1/AAA/AAA/) $950 million of future tax-secured subordinate bonds: Bonds in 8/2023 with a 3% coupon yield 0.14%, 5s of 2026 at 0.50%, 5s of 2034 at 1.37%, 4s of 2036 at 1.58%, 4s of 2041 at 1.82%, 5s of 2045 at 1.80%, 3s of 2048 at 2.24% and 4s of 2048 at 2.00%.

“Municipal yields are low on an absolute level, so it would be hard for prices to rally dramatically,” according to a weekly report from Nuveen. “However, demand remains strong for tax-exempt bonds. We expect municipal rates to remain range-bound, and we would see any potential sell off as a buying opportunity.”

The municipal market is gearing up for continued supply-demand imbalances this fall, though not as dramatic as the summer months. Thirty-day visible supply is at $9.26 billion, per Bond Buyer data while net negative supply sits at $9.044 billion, per Bloomberg.

“The municipal market is typically conditioned to expect volatility and weaker technicals almost immediately after the last of summer redemptions are addressed,” Jonathan Law, portfolio manager at Advisors Asset Management said on Monday.

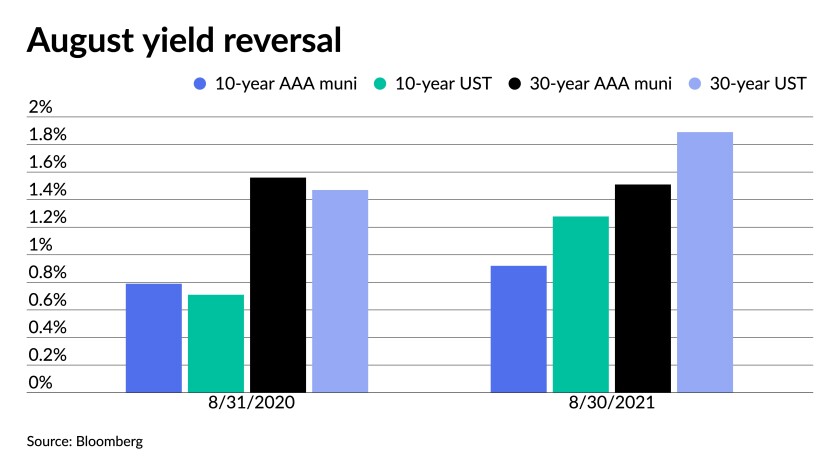

“Despite the record weekly inflows continuing to overwhelm new issuance, we are seeing the market take a breather this month with yields a few basis points higher than their 60-day averages, which seems very similar to how August 2020 played out, when yields eased off their historic lows,” he said.

With a little less than $4 billion set to price in the primary market this week, it means September reinvestment demand could easily outpace supply at least until after the Labor Day holiday, Law noted.

“Demand should remain relatively robust through year end,” he said. “It’s hard to see the billions of inflows into tax-exempt paper simply drop off in an instant. That said, given growing inflationary pressures and Federal Reserve tapering around the corner, it would not be a surprise to see muni investors hold back a bit and embrace more of a defensive approach, like we’ve seen in stretches throughout August.”

With year-end positioning already in play, now might be the time to upgrade credit quality, according to Richard Ciccarone, president of Merritt Research Services.

“Credit quality has been faring better than originally anticipated due, in no small part, to the billions of federal dollars that have stimulated the economy and indirectly or directly boosted revenues for most municipal bond obligors,” he said on Friday.

“Investors holding intermediate- to long-maturity bonds might be wise to exit credits that lack long-term credit durability and replace them with better quality new issue or secondary market bonds that currently have similar yields,” he added.

Secondary trading and scales

A few trades of the recently issued Montgomery County, Maryland, were weaker in the secondary: 5s of 2023 at 0.12% versus 0.08% original. Montgomery County 5s of 2025 traded at 0.30% versus 0.25% original. Montgomery County 5s of 2027 at 0.56% versus 0.52% original.

Trading showed a mostly steady tone, elsewhere. New York Dorm PITs 5s of 2022 traded at 0.06%. South Carolina 5s of 2022 at 0.10%. Ohio GARVEE 5s of 2026 at 0.49%-0.47%. Delaware 5s of 2026 at 0.34%-0.33% versus 0.32%-0.31% a week ago. Energy Northwest 5s of 2026 at 0.44%-0.43%.

Wisconsin 5s of 2028 traded at 0.68%. Massachusetts 5s of 2029 at 0.82% versus 0.78% on Aug. 16.

California 5s of 2032 at 1.04% versus 1.04%-1.03% on Aug. 16.

Washington 5s of 2035 at 1.25%-1.24%, the same as Wednesday. Georgia road and tollway 4s of 2035 at 1.30%-1.25% versus 1.31% on Aug. 13.

University of North Carolina Chapel Hill 5s of 2038 at 1.28%-1.27%. San Antonio, Texas, water 5s of 2046 at 1.62%-1.54% (original on June 21, 1.71%).

Short yields rose one basis point to 0.08% in 2022 and 0.11% in 2023 on Refinitiv MMD’s scale. The yield on the 10-year rose one to 0.92% while the yield on the 30-year sat at 1.52%.

The ICE municipal yield curve showed bonds steady in 2022 at 0.08% and up one to 0.13% in 2023. The 10-year maturity rose one to 0.93% and the 30-year yield was steady at 1.50%.

The IHS Markit municipal analytics curve showed short yields rise one basis point to 0.08% and 0.10% in 2022 and 2023. The 10-year yield up one basis point at 0.93% and the 30-year yield steady at 1.52%.

The Bloomberg BVAL curve showed short yields steady at 0.07% and 0.07% in 2022 and 2023. The 10-year yield stayed at 0.92% and the 30-year yield at 1.51%.

In late trading, Treasuries were better as equities were mixed.

The 10-year Treasury was yielding 1.283% and the 30-year Treasury was yielding 1.898%. The Dow Jones Industrial Average lost 29 points or 0.08%, the S&P 500 rose 0.51% while the Nasdaq gained 0.95%.

Taper still debated

Following Federal Reserve Board Chair Jerome Powell’s speech to the Jackson Hole symposium on Friday, there is still no consensus among analysts on when a tapering announcement will come.

The announcement is expected at the December meeting, according to Morgan Stanley Chief U.S. Economist Ellen Zentner. “While Powell indicated that the taper decision may well come this year, he did layer in enough dovish discussion about the transitory nature of inflation, and the higher bar for maximum employment in the liftoff guidance, to draw a distinction between the taper decision and the implications for rate hikes,” she said in a note.

Based on his words, Zentner said, “a lot needs to change for him to become significantly less comfortable with the state of inflation.” Further, the chair “emphasized that tightening policy in response to transitory inflation could ‘do more harm than good.’”

And while Powell seems dovish about tapering, “a handful of hawks on the Fed have been pushing hard for an earlier start to tapering, and we think it is relevant that so many of them are going on the record,” Zentner said. “While the timing is far from settled, this may represent an effort to position themselves slightly to one side of where the Committee is likely to go to make sure the timing does not slip.”

Of course, the September Federal Open Market Committee post-meeting statement could offer hints. “If the language on the taper suggests it may be appropriate ‘in coming meetings,’ I will remain confident in the December call,” she said. “If the statement points to tapering ‘in coming months,’ then November comes into play. And if the statement provides that tapering ‘could soon be appropriate’ then November becomes all but certain.”

But, Scott Ruesterholz, a portfolio manager at Insight Investment, believes tapering could start “in November or December, though the Fed retains the option to delay it further if economic data were to soften.”

The speech, he said, “reaffirmed that Powell is clearly in the dovish camp, and that the Fed will be very deliberate in extricating itself from extraordinary policy.”

“Simply put, the Fed does not want to overreact to inflation and in the process slow the healing of the labor market,” Ruesterholz said. “That is why even when the Fed does begin tapering, there is no rush to begin raising rates with there being a higher hurdle on jobs and inflation before acting on rates.”

November may be the time for the announcement, said David Kelly, chief global strategist at JPMorgan, since the chair has promised to give notice in advance of tapering. “If the Fed begins to taper in December, it will likely announce that plan at either its September 21st/22nd meeting or at its November 2nd/3rd meeting.”

This will allow the panel time to watch the impact of the Delta variant and how the labor market recovers “after federal enhanced unemployment benefits come to an end next week.”

The pace is likely to be “$10 billion from Treasuries and $5 billion from mortgage-backed securities, bringing the reducing the total monthly pace of accumulation from $120 billion in November 2021 to zero by July 2022,” Kelly said. That end date, will give the Fed some leeway before liftoff, “which they may want to do by the end of 2022.”

But, he added, “there is also an unacknowledged reason the Fed would like a little more time – they need to know what will happen with fiscal policy,” specifically the $3.5 trillion budget package, “which contains many priorities of the Democrats, can only be passed through the reconciliation process and will need every one of the 50 Democratic and Independent senators to pass it.”

A blip, “which is quite possible,” Kelly said, could cause “complete confusion on actual fiscal policy for 2022, … a federal government shutdown and yet another episode where the U.S. comes close to defaulting on its debt due to its debt-ceiling rules.”

So it makes sense for the Fed to wait out the voting on the budget bill, he said.

Inflation, however, may become a big issue, said Jay Hatfield, founder, portfolio manager and chief investment officer of Infrastructure Capital Advisors. “We believe that Powell continues to ignore signs that inflation is accelerating in sectors that Fed policy directly impacts, which are housing and consumer durables.” He believes the announcement will come in November.

He points to “rents, which are increasing over 10% per year and steel prices which are in a hyperinflation increasing 200% over the last year. Consequently, we expect the Fed will have to raise rates at least twice in 2022.”

In data released Monday, pending home sales unexpectedly fell 1.8% in July after a 2.0% drop in June.

Economists polled by IFR Markets expected sales to grow 0.4% in the month.

“The market may be starting to cool slightly, but at the moment there is not enough supply to match the demand from would-be buyers,” said National Association of Realtors Chief Economist Lawrence Yun. “That said, inventory is slowly increasing and home shoppers should begin to see more options in the coming months.”

Separately, The Texas-area manufacturing sector expanded at a slower pace in August, according to the Dallas Fed’s Texas Manufacturing Outlook Survey.

“There were widespread reports of difficulty sourcing needed materials, and 72% of firms said supply-chain disruptions were restraining revenues,” said Dallas Fed senior business economist Emily Kerr. “Price and wage indexes continue to indicate notable increases. Outlooks remain optimistic, though uncertainty is rising amid surging COVID-19 infections and persistent material and labor shortages.”

Primary market to come

The New York City Transitional Finance Authority (Aa1/AAA/AAA/) is set to price on Wednesday $950 million of future tax-secured subordinate bonds, serials 2023-2027, 2034-2042, terms 2045, 2048. Retail day two on Tuesday. RBC Capital Markets.

The TFA is also set to sell $250 million of taxable future tax-secured bonds at 10:45 a.m. Eastern on Wednesday.

The New Hope Cultural Education Facilities Finance Corp., Texas, (nonrated) is set to price $483.535 million of Sanctuary LTC project senior living revenue bonds on Wednesday, consisting of: $413.515 million of Series S21A1, serials 2025-2057; $16.95 million Series S21A2, serials 2022-2025; and $53 million of Series S21B, serials 2022-2057. HilltopSecurities.

Wisconsin (Aa1/AA+//AAA) is set to price $327.4 million of taxable general obligation refunding bonds on Tuesday, serials 2023, 2027-2036. Stifel, Nicolaus & Company, Inc.

The New Jersey Healthcare Facilities Authority (/AA-/AA-/) is set to price on Tuesday $200.46 million of Atlanticare Health System Obligated Group revenue bonds. BofA Securities.

The California Community Housing Agency is set to price $143.92 million of essential housing revenue bonds (Summit at Sausalito Apartments), $85.4 million of Series 2021A-1 senior bonds, term 2057 and $58.52 million of Series 2021A-2 junior bonds, term 2050. Jefferies LLC.

American Municipal Power, Inc., Ohio, (/A//) is set to price on Tuesday $141.55 million of Prairie State Energy Campus project revenue refunding bonds. BofA Securities.

Santa Cruz County, California, (/AAA//) is set to price $124.19 million of taxable pension obligation bonds on Thursday. Serials 2022-2036, terms 2041, 2047. Stifel, Nicolaus & Company, Inc.

New Orleans (A2/A+/A/) is set to price on Wednesday $120.9 million of taxable limited tax refunding bonds, serials 2022-2030. Loop Capital Markets

Akron, Ohio, (/AA-//) is set to price $113.265 million of community learning center income tax revenue refunding forward delivery bonds, serials 2022-2033. Stifel, Nicolaus & Company, Inc.

In the competitive market Tuesday, Miami-Dade County, Florida, (/AA/) is set to sell $113.73 million of Public Health Trust general obligation bonds at 10:30 a.m. Eastern.

Cary, North Carolina, (Aaa/AAA/AAA/) is set to sell $125 million of general obligation bonds at 11 a.m.

Harrisonburg, Virginia, (Aa2/AA+//) is set to sell $153.945 million of general obligation bonds at 10:45 a.m.

The South Carolina Association of Governments is set to sell $147.202 million of certificates of participation (MIG-1) at 11 a.m.

On Thursday, Fremont Unified School District, California, is set to sell $116 million of taxable refunding bonds at 12:30 p.m.