Municipals struck a firmer tone on the short end Tuesday as the new-issue calendar got underway, with strong competitive loans, while U.S. Treasuries held steady and equities strengthened into the afternoon.

Triple-A benchmark yield curves were bumped on the short end as bonds inside of 10 years have been more tightly bid.

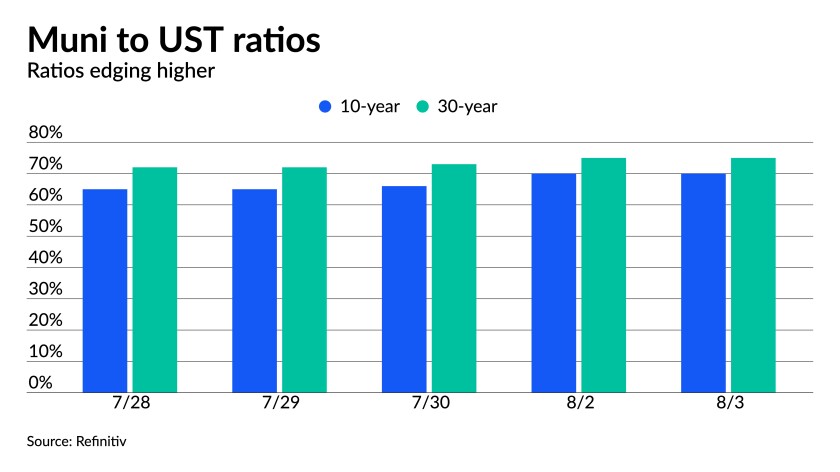

Municipal-to-UST ratios were little changed, but have edged higher in recent trading sessions. ICE Data Services showed the 10-year muni/UST ratio at 71% and the 30-year at 74%. Refinitiv MMD had ratios at 70% in 10 years and 75% in 30.

While the first half of 2021 had municipal returns outperforming most other fixed-income asset classes, Barclays strategists see the road ahead to be more challenging.

“A lot will depend on rates and policy, while the emergence of new strains of coronavirus may negatively affect some sectors,” Barclays strategists Mikhail Foux, Clare Pickering and Mayur Patel said in a July performance summary. “We see subdued 2H21 returns, hampered by somewhat higher muni-Treasury ratios and possibly rates.”

Investment-grade total returns “will likely end up being subdued, although muni high-yield should have a solid year,” they said.

They upgraded their supply forecast to $470 billion from $450 billion with $120 billion of net supply. “We expect demand to remain strong; demand might weaken to a degree if tax rates are not increased or the SALT caps are changed,” they wrote. For August, they expect issuance of $30 billion to $35 billion, with negative net issuance of up to $5 billion, not including $12 billion in coupon payments.

They also expect redemptions to increase in August and forecast about $40 billion to $45 billion of bond redemptions and about $12 billion in coupon payments, in line with many other forecasts of about $60 billion to $70 billion of available cash. The states with the lowest expected net supply in August are California, Texas, and New York, they noted.

While credit quality continues to improve, with upgrades outpacing downgrades, and an implied default rate of about 1%, “we still see some risks ahead that could negatively affect some sectors.”

“Taxable muni spreads have already tightened significantly, we see marginal upside for high-quality names, driven by demand from life insurers, spurred into action by risk weighting changes implemented by the NAIC,” according to the report. “We update our sector outlooks, and provide a number of credit recommendations across all sectors. However, for most names we see only marginal spread compression, and mostly focus on carry.”

In the competitive market Tuesday, the Florida Department of Transportation (Aa2/AA/AA/) sold $229.835 million of turnpike revenue bonds to Citigroup Global Markets Inc. with 5s of 2022 at 0.06%, 5s of 2026 at 0.42%, 5s of 2031 at 0.92%, 1.875s of 2036 at 1.92%, 2s of 2041 at 2.11%, 2.125s of 2046 at 2.26% and 2.25s of 2051 at 2.35%.

Williamson County, Texas, (/AAA/AAA/) sold $175.5 million of limited tax notes to J.P. Morgan Securities. Bonds in 2022 with a 5% coupon yield 0.04%, 4s of 2026 at 0.31% and 4s of 2028 at 0.57%.

In the negotiated market, Morgan Stanley & Co. LLC priced for the Port of Beaumont Navigation District of Jefferson County, Texas, (nonrated) $225 million of dock and wharf facility Jefferson Gulf Coast Energy Project revenue AMT bonds. Bonds priced at par: 2026 at 1.875%, 2031 at 2.625%, 2036 at 2.75%, 2041 at 2.875% and 2050 at 3%. Morgan Stanley & Co. LLC also priced for the issuer $200 million of taxable facility revenue bonds (Jefferson Gulf Coast Energy Project), 2028 priced at 4.10% par.

Barclays Capital Inc. priced for the Illinois Finance Authority (Aa2/AA+//) $214.235 million of Northwestern Memorial Healthcare revenue refunding bonds (fixed period bonds), with 5s of 2022 at 0.07%, 5s of 2026 at 0.42%, 5s of 2032 at 1.09%, 4s of 2036 at 1.43% and 2.25s of 2043 at 2.27%, callable July 15, 2031.

The New York City Transitional Finance Authority (Aa1/AAA/AAA/) is set to price for institutions $934.435 million of future tax-secured subordinate refunding bonds on Wednesday and sell $119 million of taxables at 10:45 a.m. eastern. Retail offerings had yields in line with recent trading of the credit.

Secondary trading and scales

Trading showed firmer prints on the short end. California 5s of 2022 at 0.07%. Washington 5s of 2023 at 0.07%. NYC 5s of 2024 at 0.17%. Utah 5s of 2025 at 0.17%-0.13%. Ohio 5s of 2025 at 0.22%. Maryland 5s of 2025 at 0.22%-0.20%. Delaware 5s of 2026 at 0.26%.

Fairfax County, Virginia, 4s of 2027 at 0.50% versus 0.51% Monday. Florida BOE PECO 5s of 2028 at 0.57% versus 0.58% Monday. California 5s of 2028 at 0.59%-0.60% versus 0.61% Monday. California 5s of 2029 at 0.70% versus 0.75% Monday.

Howard County, Maryland, 5s of 2033 at 1.08%. Maryland 5s of 2033 at 0.94%. New York Dorm PIT 5s of 2034 at 1.21% Los Angeles Department of Water and Power 5s of 2035 at 1.03%-1.02%.

Hawaii 5s of 2037 at 1.25%. University of North Carolina-Chapel Hill 5s of 2038 at 1.14%. West Virginia 5s of 2039 at 1.29%.

According to Refinitiv MMD, yields sat at 0.05% in 2022 and at 0.06% in 2023. The yield on the 10-year sat at 0.82% while the yield on the 30-year stayed at 1.39%.

ICE municipal yield curve saw the one-year fall one basis point to 0.04% in 2022 and to 0.05% in 2023. The 10-year maturity was steady at 0.85% and the 30-year yield at 1.38%.

The IHS Markit municipal analytics curve saw the one-year steady at 0.05% and the two-year at 0.06%, with the 10-year steady at 0.83%, and the 30-year yield at 1.37%.

Bloomberg BVAL saw levels at 0.04% in 2022 and 0.04% in 2023, both steady, while the 10-year sat at 0.82% and the 30-year at 1.36%.

Treasuries were steady while equities made gains. The 10-year Treasury was yielding 1.175% and the 30-year Treasury was yielding 1.849% in late trading. The Dow Jones Industrial Average gained 262 points or 0.75%, the S&P 500 rose 0.76% while the Nasdaq gained 0.48%.

Easing supply chain woes?

While supply-chain problems persist, Tuesday’s economic indicator “hints that some supply chain issuers are improving,” according to one analyst.

“U.S. factory order data shows how strong business spending remains and hints that some supply chain issues are improving,” according to Ed Moya, senior market analyst for the Americas at OANDA.

Factory orders gained 1.5% in June after a revised 2.3% gain in May, first reported as a 1.7% increase.

Excluding transportation, orders rose 1.4% following a 1.0% gain in May, originally reported as an 0.7% increase.

Economists polled by IFR Markets expected a 1.0% increase in the headline number.

“Manufacturing activity will remain strong given the surge in new orders, shipments, unfilled orders and inventories,” Moya said. “This broad increase in factory goods suggests manufacturers are getting their hands on supplies, which could support Fed Chair Powell’s argument that inflation is transitory.”

Primary market to come

Mt. San Antonio Community College District, California, (Aa1/AA//) is set to price on Thursday $227.975 million of general obligation bonds. RBC Capital Markets.

The California Municipal Finance Authority Special Finance Agency VII is set to price on Wednesday $219.925 million of essential housing revenue bonds (The Breakwater Apartments). Jefferies LLC, New York.

The University of Wyoming (/AA//) is set to sell $205.24 million of facilities revenue bonds at 10:45 a.m. eastern on Wednesday.

Prosper Independent School District, Texas, (Aaa//AAA/) (PSF guarantee) is set to price on Wednesday $200 million of unlimited tax school building bonds. FHN Financial Capital Markets.

The Industrial Development Authority of Pima County, Arizona, (/A//) is set to price on Wednesday $197.250 million of Tucson Medical Center revenue refunding bonds, $174.275 million, serials 2031-2051, $22.975 million, 2025-2030. Barclays Capital Inc.

Meade County, Kentucky, (Baa1/A-//) is set to price on Wednesday $196.99 million of Nucor Steel Brandenburg Project green industrial building revenue bonds. BofA Securities.

Eagle Mountain-Saginaw Independent School District, Texas, (Aaa//AAA/) (PSF guarantee) is set to price $177.18 million of unlimited tax school building bonds, serials 2022-2041, term 2046, 2051. HilltopSecurities.

Chapman University (A2///) is set to price $175 million of taxable bonds, serials 2026-2036, terms 2041, 2051 on Thursday. Wells Fargo Corporate & Investment Banking.

Clifton, New Jersey, Board of Education is set to sell $168.282 million of general obligation unlimited tax school bonds at 11 a.m. eastern Thursday.

The South Carolina State Housing Finance and Development Authority (Aaa///) is set to price on Thursday $166 million of non-AMT mortgage revenue bonds, serials 2022-2033, terms 2036, 2041, 2046, 2052. Citigroup Global Markets Inc.

The Arizona Industrial Development Authority (A1/A//A+) is set to price on Thursday $151.995 million of Phoenix Children’s Hospital forward delivery bonds. BofA Securities.

The Louisiana Local Government Environmental Facilities and Community Development Authority (/AA//) is set to price on Wednesday $150.925 million of taxable revenue refunding bonds (LCTCS ACT 360 Project) insured by Assured Guaranty Municipal Corp., serials 2022-2039. Raymond James & Associates, Inc.

Whittier, California, (/AA//) is set to price on Wednesday $144 million of taxable pension obligation bonds, serials 2022-2036, terms 2041, 2046. Stifel, Nicolaus & Company, Inc.

The Glendale Unified School District, California, (Aa1///) is set to price on Wednesday $143.140 million of taxable general obligation refunding bonds. RBC Capital Markets.

The Temple College District, Texas, (/AA-//) is set to price $110.33 million of limited tax bonds. Piper Sandler & Co.

The city of Little Rock, Arkansas, (Aa3///) is set to price $108.895 million of taxable Water Reclamation System refunding revenue bonds, serials 2024-2035, term 2037. Crews & Associates, Inc.

The Department of Veterans Affairs of the state of California (Aa3/AA/AA-/) is set to price $108.565 million of taxable home purchase revenue refunding bonds, serials 2022-2026, 2034-2036, term 2040. Academy Securities.

Aaron Weitzman contributed to this article.