Triple-A benchmarks were little changed on Friday while U.S. Treasuries ended the week stronger amid mixed economic data. Muni participants await a new month with growing issuance, but perhaps not quite enough as issuers are hesitant to add more debt before final word from Washington on infrastructure.

The net negative supply likely will keep interest rates low for issuers as investor demand simply outweighs supply.

Investors can expect $8.59 billion the first week of August, with $6.794 billion of negotiated deals led by more than $1 billion of highly rated New York City Transitional Finance Authority debt and $1.797 billion of competitive loans. Taxables make up $1.7 billion.

July issuance came in down year-over-year but about 13% above its 10-year monthly average at $31.9 billion. Issuance still lags demand by a large amount — $60-plus billion by many accounts for August — as redemptions and coupon payments amass.

Adding to that, BofA Securities also expects continued fund inflows to be a strong demand component. BofA strategists expect roughly $10 billion for the month, meaning there will be nearly $70 billion of total investable cash available in August, greatly exceeding the month’s possible new issuance. Thirty-day visible supply totals $11.65 billion, per Bond Buyer data.

“What have portfolio managers been doing with all the funds they receive since demand has been substantially larger than net supply? Empirical evidence suggests that some funds managers have been allocating slightly higher percentages of their portfolios to corporates, taxable munis, Treasuries and other instruments,” BofA Securities said in a weekly report. “In some cases, these percentages are quite close to 10% of their portfolios. Yet, many mutual funds still invest almost exclusively in munis. As we believe muni/Treasury ratios will remain consistently low, that diversification into taxables may become more pervasive.”

BofA Securities strategists noted that while their $43 billion volume expectations were not met in July, refunding volumes as a percentage of the total, particularly taxable advance refunding volumes versus tax-exempt volumes in July, “rose quite a bit compared to the past few months, despite low muni/Treasury ratios.”

“This suggests to us that Treasury rates levels, not ratio levels, are the critical factor in taxable advance refunding deals,” they said.

Municipal-to-UST ratios rose with the 10-year at 66% and the 30-year at 73%, according to Refinitiv MMD. ICE Data Services had the 10-year at 68% and the 30 at 72%.

At this point, the pool of existing tax-exempt refunding bonds which could be advance refunded by taxable bonds is greater than $100 billion, they said.

If a rising volatility environment results in persistent low Treasury rates in the coming months, “we see scope for more taxable advance refunding deals to come to the market.”

Given that the infrastructure package being debated in Washington lacks tax-exempt advance refundings and direct-pay bond provisions, some issuers may choose to advance refund existing new-money deals as well instead of waiting for the potential reinstatement of the traditional refunding option, BofA said.

“In what really is a perfect technical opportunity for issuers to sell debt, they just aren’t to the degree that investors would like, but I’m not sure I can blame them. You’ve got mixed messages (to put it nicely) coming out of Washington on a near daily basis, and they’re still sitting on bundles of federal aid,” a New York strategist said. “In the very near-term, even if investors are screaming for more paper, rates are insanely low and play to their favor, the issuers are not biting.”

Going into August, BofA’s original expected total issuance for the month is $40 billion.

“If taxable bond issuance indeed rises, then the total volume will likely be higher,” the strategists said.

Secondary trading and scales

Secondary trading was light. Texas 5s of 2022 traded at 0.06%. Los Angeles Department of Water and Power 5s of 2022 at 0.05%. Virginia 5s of 2022 at 0.06%.

Massachusetts clean water 5s of 2031 at 0.81%-0.80%. Washington 5s of 2031 at 0.91%, one basis point higher than original. California 5s of 2032 at 0.98%. Washington 5s of 2033 at 1.01%.

Baltimore 5s of 2037 at 1.22%-1.21%. University of North Carolina Chapel Hill 5s of 2038 at 1.15%-1.14%, the same as Thursday. Washington 5s of 2039 at 1.24%.

Texas water 4s of 2051 at 1.63%-1.62%.

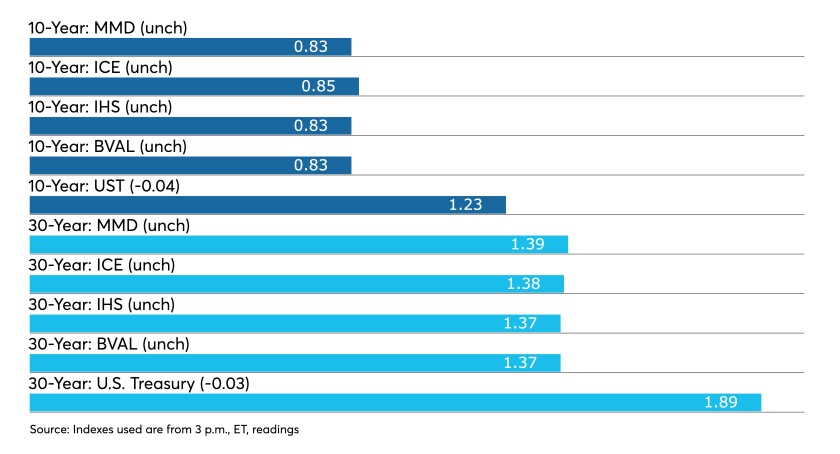

According to Refinitiv MMD, yields were steady at 0.05% in 2022 and at 0.06% in 2023. The yield on the 10-year sat at 0.82% while the yield on the 30-year stayed at 1.39%.

ICE municipal yield curve saw the one-year steady at 0.05% in 2022 and at 0.06% in 2023. The 10-year maturity at 0.85% and the 30-year yield at 1.38%.

The IHS Markit municipal analytics curve saw the one-year steady at 0.05% and the two-year at 0.06%, with the 10-year steady at 0.83%, and the 30-year yield at 1.37%.

Bloomberg BVAL saw levels 0.04% in 2022 and at 0.04% in 2023, both steady, while the 10-year sat at 0.83% and the 30-year at 1.37%.

Treasuries fell while equities were mixed. The 10-year Treasury was yielding 1.23% and the 30-year Treasury was yielding 1.39% in late trading. The Dow Jones Industrial Average lost 152 points or 0.43%, the S&P 500 fell 0.56% while the Nasdaq gained 0.86%.

Primary market to come

The New York City Transitional Finance Authority (Aa1/AAA/AAA/) is set to price $934.435 million of future tax-secured subordinate refunding bonds on Wednesday. Serials 2022-2023, 2025-2038. Siebert Williams Shank & Co., LLC.

The TFA will also sell $119 million of taxables at 10:45 a.m. eastern on Wednesday.

Mt. San Antonio Community College District, California, (Aa1/AA//) is set to price on Thursday $227.975 million of general obligation bonds. RBC Capital Markets.

Baptist Health South Florida Obligated Group (A1/AA-//) Is set to price $300 million of taxable notes on Tuesday. BofA Securities.

The Port of Beaumont Navigation District of Jefferson County, Texas, (nonrated) is set to price $225 million of dock and wharf facility Jefferson Gulf Coast Energy Project revenue bonds. Morgan Stanley & Co. LLC.

The Port of Beaumont Industrial Development Authority (nonrated) is set to price $200 million of taxable facility revenue bonds (Jefferson Gulf Coast Energy Project). Morgan Stanley & Co. LLC.

The California Municipal Finance Authority Special Finance Agency VII is set to price on Wednesday $219.925 million of essential housing revenue bonds (The Breakwater Apartments). Jefferies LLC, New York

The Illinois Finance Authority (Aa2/AA+//) is set to price on Tuesday $211.64 million of Northwestern Memorial Healthcare revenue refunding bonds (fixed period bonds), serials 2022-2024, 2026-2029, 2032-2041, term 2043. Barclays Capital Inc.

The University of Wyoming (/AA//) is set to sell $205.24 million of facilities revenue bonds at 10:45 a.m. eastern on Wednesday.

Prosper Independent School District, Texas, (Aaa//AAA/) (PSF guarantee) is set to price on Wednesday $200 million of unlimited tax school building bonds. FHN Financial Capital Markets.

Williamson County, Texas, (/AAA/AAA/) is set to sell $200 million of limited tax notes at 10 a.m. Tuesday.

The Industrial Development Authority of Pima County, Arizona, (/A//) is set to price on Wednesday $197.250 million of Tucson Medical Center revenue refunding bonds, $174.275 million, serials 2031-2051, $22.975 million, 2025-2030. Barclays Capital Inc.

Meade County, Kentucky, (Baa1/A-//) is set to price on Wednesday $196.99 million of Nucor Steel Brandenburg Project green industrial building revenue bonds. BofA Securities.

Eagle Mountain-Saginaw Independent School District, Texas, (Aaa//AAA/) (PSF guarantee) is set to price $177.18 million of unlimited tax school building bonds, serials 2022-2041, term 2046, 2051. HilltopSecurities.

Chapman University (A2///) is set to price $175 million of taxable bonds, serials 2026-2036, terms 2041, 2051 on Thursday. Wells Fargo Corporate & Investment Banking.

Clifton, New Jersey, Board of Education is set to sell $168.282 million of general obligation unlimited tax school bonds at 11 a.m. eastern Thursday.

The South Carolina State Housing Finance and Development Authority (Aaa///) is set to price on Thursday $166 million of non-AMT mortgage revenue bonds, serials 2022-2033, terms 2036, 2041, 2046, 2052. Citigroup Global Markets Inc.

The Arizona Industrial Development Authority (A1/A//A+) is set to price on Thursday $151.995 million of Phoenix Children’s Hospital forward delivery bonds. BofA Securities.

The Louisiana Local Government Environmental Facilities and Community Development Authority (/AA//) is set to price on Wednesday $150.925 million of taxable revenue refunding bonds (LCTCS ACT 360 Project) insured by Assured Guaranty Municipal Corp., serials 2022-2039. Raymond James & Associates, Inc.

Whittier, California, (/AA//) is set to price on Wednesday $144 million of taxable pension obligation bonds, serials 2022-2036, terms 2041, 2046. Stifel, Nicolaus & Company, Inc.

West Rankin Utility Authority, Mississippi, (/AA//) is set to price on Tuesday $143.615 million of taxable revenue refunding bonds, serials 2022-2048. Insured by Assured Guaranty Municipal Corp. Raymond James & Associates, Inc.

The Glendale Unified School District, California, (Aa1///) is set to price on Wednesday $143.140 million of taxable general obligation refunding bonds. RBC Capital Markets.

The Santa Monica-Malibu Unified School District, California, is set to price on Tuesday $122 million of taxable refunding general obligation bonds. Raymond James & Associates, Inc.

The Temple College District, Texas, (/AA-//) is set to price $110.33 million of limited tax bonds. Piper Sandler & Co.

The city of Little Rock, Arkansas, (Aa3///) is set to price $108.895 million of taxable Water Reclamation System refunding revenue bonds, serials 2024-2035, term 2037. Crews & Associates, Inc.

The Department of Veterans Affairs of the state of California (Aa3/AA/AA-/) is set to price $108.565 million of taxable home purchase revenue refunding bonds, serials 2022-2026, 2034-2036, term 2040. Academy Securities.

Tamer inflation

Although inflation remains high, some measures in Friday’s indicators were below expectations, while consumers continue to propel the economy.

“Today’s batch of economic releases were right down the middle, [with] strong consumer spending, but inflation, while elevated, was tamer than expected,” said Matt Peron, director of research at Janus Henderson Investors. Friday’s numbers “should calm some of the worst-case inflation fears, at least for now.”

Personal income ticked up 0.1% in June after decreasing by a revised 2.2% in May, first reported as a 2.0% decline, while spending gained 1.0% after dropping a revised 0.1% in May, originally reported as an unchanged level.

The PCE price index rose 0.5% in June after a revised 0.5% gain in May, first reported as a 0.4% increase. The core PCE rose 0.4% after an unrevised 0.5% climb in May.

Compared to a year ago, the PCE price index jumped 4.0%, after a 4.0% rise year-over-year in May, while the core gained 3.5%, after a 3.4% annual gain a month earlier

Economists polled by IFR Markets expected a 0.3% drop in income, a 0.7% increase in consumption, a 0.6% climb in core PCE for the month and 3.7% growth in core PCE on an annual basis.

The data are “clear evidence that persistently high inflation is cutting into real disposable income and consumption,” said Berenberg chief economist for the U.S., Americas and Asia Mickey Levy. “Clearly, inflation has risen higher than earlier forecasts and has persisted longer.”

Levy sees employment and wage gains ahead, which “will contribute to rises in personal income and consumption, but that inflation will remain elevated.”

Noting Friday’s numbers following a gross domestic product reading that wasn’t up to expectations, Diane Swonk, chief economist at Grant Thornton, said, “Consumers were not the problem.”

However, she noted, the Delta variant could “put a damper on spending gains in August,” although “consumers defiantly kept spending, even during a surge in outbreaks.”

Of concern to Swonk, “The saving rate was drawn down much faster than expected and could pose more of a headwind.”

Also released Friday, the University of Michigan’s final July consumer sentiment index rose to 81.2 from the preliminary read of 80.8 but lower than June’s final 85.5 read.

The final current conditions was unchanged at 84.5 from the preliminary reading, lower than June’s final read of 88.6 and the final expectations index ticked up to 79.0 from the preliminary reading of 78.4 but down from June’s 83.5 reading.

Economists estimated a reading of 80.8 for sentiment.

“While most consumers still expect inflation to be transitory, there is growing evidence that an inflation storm is likely to develop on the not-too-distant horizon,” said Richard Curtin the chief economist for the survey. “The improved finances of consumers have greatly reduced consumers’ resistance to price increases.”

Also released Friday, the employment cost index climbed 0.7% in the second quarter after a 0.9% jump the prior quarter, wages and salaries rose 0.9% after a 1.0% increase a quarter before, and benefits costs gained 0.4% after rising 0.6% in the prior three-month period.

Economists predicted the index would gain 0.9%.

“The employment costs rise was slower than expected amid a weakening in benefits growth and lackluster private wage growth relative to the recent readings on average hourly earnings,” said Sarah House, senior economist at Wells Fargo Securities. “Nevertheless, labor costs are up 2.9% over the past year and match the high watermark of the past cycle, as inflation pressures have broadened out.”

Separately, the Chicago Business Barometer increased to 73.4 in July from 66.1 in June.

Economists anticipated a 63.5 read.

Of the five main categories production and new orders saw the largest gains in the month.

The price indexes “remained at historically high levels,” according to the report. “Higher prices for materials and freight were again a major concern for survey respondents.”