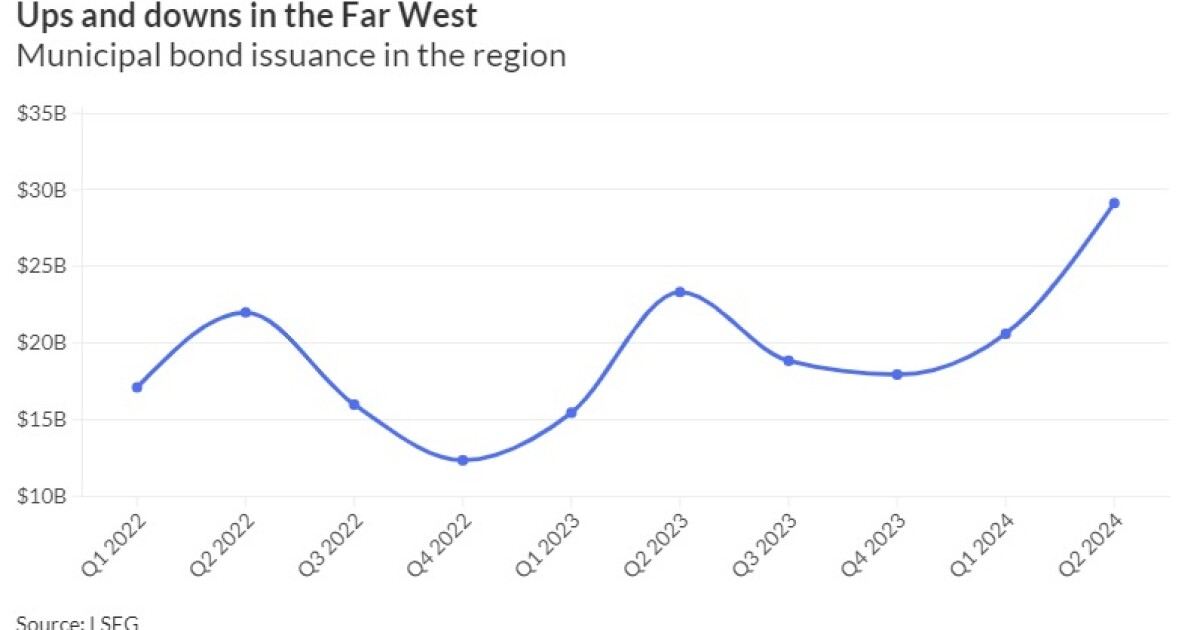

Mirroring national trends, most states in the Far West enjoyed a double-digit jump in municipal bond issuance in the first half of the year as market conditions for borrowers improved.

Issuance across the nine-state region totaled $49.7 billion, up 28.3% from $38.7 billion over the same period last year, according to LSEG Data & Analytics. The number of deals rose to 507 from 458, including nine megadeals of more than $1 billion.

Refunding transactions drove the increase, more than doubling to $16.2 billion, while new-money deals declined by 3%. Financings that included both refunding and new money rose by 69%, data showed.

The trends were uneven among the states. Five of the states saw a bump, led by Alaska’s 122% increase to $353 million.

A surge in issuance from the region’s bellwether state of California pushed the Far West to its year-over-year gain.

Four states — Hawaii, Montana, Oregon, and Wyoming — saw a dip in issuance, led by Hawaii, which saw a 53% decline.

Nationwide, bond sales also rose above previous mid-year levels, up more than 32% to $242 billion from $183 billion the same period in 2023.

Borrowing was up as cities and states took advantage of favorable market conditions compared to the lackluster issuance and volatile markets of the last few years. Some issuers who had delayed projects finally brought them to market. The winding down of pandemic aid may also have played a role. Many issuers also did “election forwards,” eager to close deals ahead of November to avoid any uncertainty tied to the election.

“The bond business is going gangbusters,” said Justin Cooper, who leads the finance section at Orrick, Herrington & Sutcliffe LLP. The market has started to recover from the abrupt end to a decade of low interest rates, he said.

“Now everyone is regrouped with new baselines,” Cooper said. “We understand that money now costs money — and bond money costs less than other money so everyone is back in business.”

Bonds LSEG classifies for education were the top sector in the Far West, at $13.8 billion, a 32% increase over the same period last year. Healthcare issuance leapt a whopping 1,333% to total $3.8 billion with 25 transactions compared to $272 million in 11 deals a year earlier. The California Health Facilities Financing Authority was the fifth-largest borrower for the period, with $2.1 billion.

Volume in the transportation space doubled to $7.3 billion.

As usual, California towered over the region, with issuers there selling $36.1 billion in the first six months of 2024, up 32% year-over-year and the most of any state in the first half.

California issuers made up eight of the region’s top 10 borrowers, led by the state government, which floated $4 billion of debt the first half of the year. The Los Angeles United School District was the region’s third-largest issuer in the first half of the year, on the heels

LAUSD was one of a handful of top issuers that took advantage of the market to refund their BABs through extraordinary redemption provisions, a move that was not without controversy among investors unhappy at giving up the paper.

The third-largest issuer in the region, the Regents of the University of California, in early March refunded $1.09 billion of BABs, prompted

The state of

Looking forward, the Golden State is expected to continue its borrowing trend. The state will kick off the second half of the year with a

In November, voters will consider statewide borrowing proposals, including $10 billion for schools and $10 billion for climate and environmental projects, as well as dozens of local initiatives.

Another measure, Proposition 5, could indirectly raise future local government issuance by reducing the number of votes — from two-thirds to 55% — needed to approve housing and infrastructure bonds.

Last week,

California spreads have widened slightly over the year, said Cooper Howard, director, and fixed income strategist at Schwab.

“Part of that is due to the fiscal issues they’re going through,” he said. The state is struggling to close a deficit

Schwab’s general view nationally is that credit quality has peaked but is not significantly deteriorating, Howard said.

“California is one of the outliers,” he said. “Obviously there are budget deficits and declines in rainy-day funds and things aren’t that great, so our expectation is that the pace of upgrades will start to slow a little bit from here.”

Issuers in Washington sold $7.59 billion of bonds, making it the region’s second largest source of bonds during the first half of the year, with its volume jumping by 70% over the same period last year. But the jump was mostly due to the state’s decision to head to market with its annual summer sale in June instead of July, said Aaron Sherman, communications director for State Treasurer Mike Pellicciotti.

Taking out that deal, the state’s total bond and certificate of participation volume is up about 8%, Sherman said.

“This is made up from somewhat higher capital and transportation budget borrowing, and slightly lower issuance for refinancings,” he said.

On the underwriting front, negotiated deals saw a strong 41% increase over the same period last year, for a par amount of $41.7 billion and 413 deals. Competitive deals dipped by 2.4% to total $7.3 billion with 70 deals. Private placements plummeted by 57%, totaling $726 million.

BofA Securities ranked first among book-running senior managers in the region, credited by LSEG with $9.2 billion par amount, followed by JP Morgan Securities with 6.1 billion. Morgan Stanley came in third with $5.3 billion, followed by Wells Fargo with $4.6 billion. Jefferies was fifth with $4.17 billion followed closely by RBC Capital Markets with $4.14 billion.

Among financial advisors, PFM Financial Advisors ranked first, credited with $12 billion of par amount, followed by Public Resources Advisory Group with $10.6 billion. KNN Public Finance ranked third, followed by Piper Sandler and Montague DeRose & Associates.

Orrick Herrington & Sutcliffe remained comfortably on top of the Far West bond counsel rankings, credited with $15.2 billion of par amount. Coming in second was Stradling Yocca Carlson & Rauth with $5.9 billion. Hawkins Delafield & Wood ranked third.