Just recently, Terra founder Do Kwon hinted at purchasing $3 billion in bitcoin to bolster the protocol’s reserves and according to a number of reports and blockchain analysis, Terra purchased $125 million worth of bitcoin on March 21. The following day, bitcoin’s fiat value jumped to a high of $43,079 per unit and there’s been lots of discussions concerning Terra’s reported bitcoin buy.

Reports and Blockchain Analysis Suggests $125 Million Bitcoin Purchase Executed by Terra

On March 21, 2022, Bitcoin.com News reported on the Terra founder Do Kwon and his hints about purchasing billions in bitcoin (BTC). After being asked why the project was eying BTC reserves, Do Kwon said: “Bitcoin is the only hard reserve asset that’s been proven out of the digital currencies… It is very difficult for somebody in crypto to question bitcoin.”

Following the report, the digital currency influencer Lark Davis tweeted that the Terra (LUNA) project had made its first purchase. “Luna makes its first purchase of bitcoin worth 125 million dollars,” Davis said. The crypto influencer’s tweet has been retweeted over 450 times and has close to 4K likes on Twitter at the time of writing.

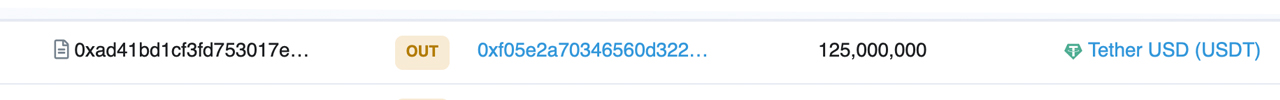

On Tuesday, the purported $125 million in BTC purchase has been trending a great deal on social media. While there has been no official mention of the bitcoin (BTC) purchase by Terra, a Gnosis safe address reportedly owned by Terra transferred $125 million worth of USDT to Binance.

The same day, BTC advocate and the director of growth marketing at Kraken, Dan Held, welcomed the Terra community. “I welcome all projects and protocols that want to build on Bitcoin/use Bitcoin,” Held tweeted. “Excited to see what [Do Kwon] and the Terra community will do.”

Do Kwon responded to Held’s commentary and replied: “Looking forward to building together.” The co-founder of Stacks, an open-source smart contract platform for Bitcoin, Muneeb Ali also responded to Held’s Twitter thread. “This is the way,” Muneeb Ali tweeted. “[The] Bitcoin community was welcoming to developers pre-2016. We can do the same now. Developers can use Bitcoin however they want, it only makes BTC stronger.”

Terra Founder Do Kwon Insists Project Has $3 Billion in Funds Ready to Seed Reserves

Both terra (LUNA) and the network’s stablecoin UST have seen significant growth over the last 12 months. Year-to-date, LUNA is up 323% against the U.S. dollar and the stablecoin UST is the fourth-largest USD stablecoin by market valuation with $15.6 billion.

On Tuesday, the co-founder and CEO of Blockstream, Adam Back, asked Do Kwon about where the billions of dollars were coming from. Terra’s founder responded by telling the Blockstream executive that the organization has $3 billion in “funds ready to seed this reserve,” but he added that “technical infrastructure (bridges etc) is still not ready yet.”

Furthermore, Terra’s founder also explained how the funds were raised by the Terra ecosystem and Luna Foundation Guard (LFG). “It’s BTC or tether,” Do Kwon told Back on Tuesday. “1B was raised recently and 1.2B LFG raised by selling UST against tether, 0.8B or so left to go,” Terra’s founder added.

What do you think about the reported $125 million bitcoin purchase by Terra and the statements made by Do Kwon? Tell us what you think in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer