Munis sold off, playing catch-up Thursday’s U.S. Treasury selloff, while taxables pared back some of those losses in a flight-to-quality bid Friday as equities were hit hard on U.S.-Russia tensions.

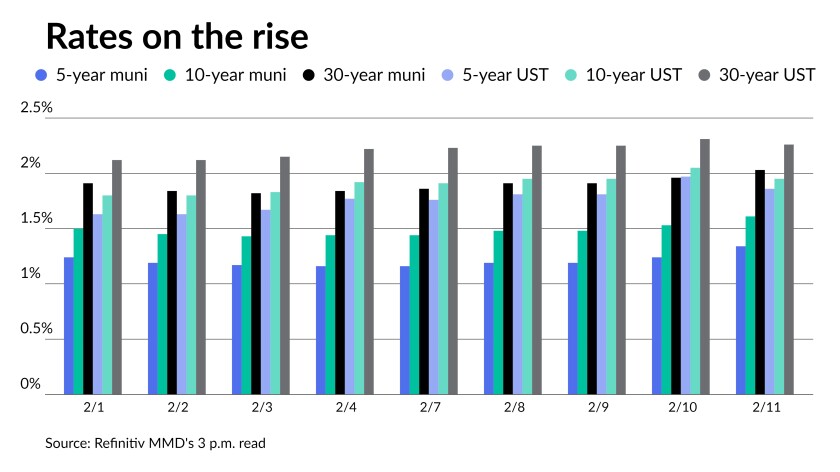

Triple-A muni benchmark yields were cut by up to 10 basis points on the short end but the pain was felt across the curve with cuts of up to seven seen out long. Govies fell eight to 11 basis points on the day. Muni to UST ratios rose.

The municipal to UST ratio five-year was at 72%, 82% in 10 and 90% in 30, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the five at 64%, the 10 at 78% and the 30 at 85% at a 4 p.m. read.

JB Golden, portfolio manager at Advisors Asset Management, said Friday’s weakness was no shock.

“This is not surprising given the significant outperformance versus Treasuries yesterday with the largest single-day move in the two-year Treasury since 2009,” he said Friday.

The municipal market continues to grapple with the prospects of higher inflation and, in turn, higher interest rates, according to Golden. “While it is understandable that valuations/ratios would widen out on the heels of the Treasury selloff yesterday, the silver lining for municipals remains their resiliency in the face of volatility,” he said.

“We would expect the relative outperformance versus corporates and Treasuries to continue,” Golden added.

In addition, valuations “remain attractive, in our opinion, and sit well north of post-pandemic averages,” Golden added.

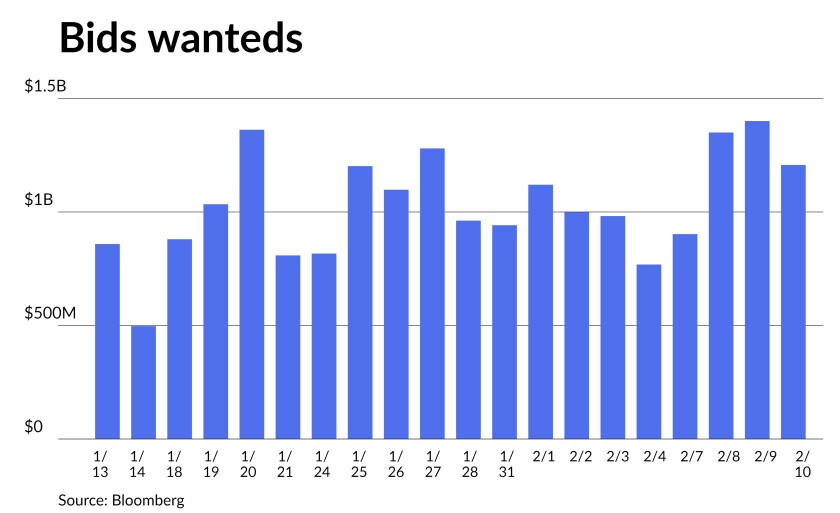

A little more than a month into the new year, elevated bid-wanted flows have allowed for a shift to more of a buyer’s market.

“Buyers now have the freedom to be more selective in adding both credit and duration risk,” Golden said.

Golden said a flattening yield curve must have the Fed’s attention “and they will be walking a tightrope, balancing and trying to combat inflation with not tightening financial conditions too much.”

“With inflation running hotter than we have seen in decades and action by the Fed seeming imminent, we believe municipal investors must be cautious here,” Golden said.

The volatility of Treasury rates will inevitably be more significant for munis until they settle into more stable levels, BofA Global Research strategists said.

“The Fed’s rhetoric and aggressive market pricing of short-end Treasuries have kept long-term Treasury yields in check and resulted in a significantly flatter Treasury curve,” Yingchen Li and Ian Rogow, BofA Securities strategists said. “At this point, the market has assigned a 50% probability that in March the Fed may hike 50 basis points instead of 25 basis points.”

The flatness of the Treasury curve has historically dictated how far the Fed will go, and it is likely to do so again this cycle.

With Treasury yields already much higher this year, Barclays strategists believe it’s difficult to expect strong performance from fixed-income assets, which have suffered losses across classes. Municipals, particularly the muni high-yield index, have been more defensive and have somewhat outperformed thus far, but they are far from out of the woods, said Barclays strategists Mikhail Foux, Clare Pickering and Mayur Patel in a weekly report.

Fund inflows reported this week were an aberration, they said.

Mutual funds have lost $5 billion in the last six weeks, the highest level of outflows since the COVID-19 pandemic began in March/April 2020. They said while there were 20 months of inflows in the subsequent rebound beginning in May 2020. A new outflow cycle began this year, spurred by a steep sell-off in rates amid inflation fears and a hawkish Fed.

Barclays strategists expect fund flows to remain anemic for some time, and similar to previous years, there could be more outflows next month, as investors generate cash to pay their tax bills in April and harvest tax losses for the upcoming year.

The new-issue calendar is about $5.19 billion with $3.622 billion of negotiated deals and $1.571 billion of competitive loans. The lower supply is being credited with keeping munis from seeing yields rise further.

Larger high-grade deals greet investors next week from gilt-edged Wake County, North Carolina, and Waco, Texas and Delaware lead the competitive calendar.

Secondary trading

District of Columbia 5s of 2023 at 0.87%. Prince Georges County, Maryland, 5s of 2023 at 1.02%-0.97%. Wisconsin 5s of 2024 at 1.15%-1.14%.

Harvard 5s of 2027 at 1.41% and 5s of 2028 at 1.48%-1.47%. Georgia 5s of 2028 at 1.47%-1.43% versus 1.32% on Tuesday. Maryland 5s of 2028 at 1.45%-1.43%. New York City TFA 5s of 2029 at 1.66% versus 1.59%. Delaware 5s of 2031 at 1.54% versus 1.48%-1.46% Thursday and 1.45%-1.43% Wednesday. California 5s of 2031 at 1.72% versus 1.54% Wednesday. Washington 5s of 2032 at 1.70% versus 1.54% original.

Georgia 5s of 2035 at 1.86%-1.85%. Ohio State Water Development Authority 5s of 2038 at 1.87%-1.86% New York City 5s of 2039 at 2.19%-2.17%

LA DPW 5s of 2040 at 2.10%-2.06% versus 1.98% Thursday. California 5s of 2041 at 2.04%-2.03% versus 2.00% Thursday and 1.93%-1.91% on Wednesday.

AAA scales

Refinitiv MMD’s scale saw were cut seven to 10 basis points across the curve at the 3 p.m. read: the one-year at 0.78% (+10) and 1.05% (+10) in two years. The five-year at 1.34% (+10), the 10-year at 1.61% (+8) and the 30-year at 2.03% (+7).

The ICE municipal yield curve saw cuts of three to six basis points: 0.78% (+6) in 2023 and 1.06% (+4) in 2024. The five-year at 1.32% (+5), the 10-year was at 1.65% (+4) and the 30-year yield was at 2.05% (+5) in a 4 p.m. read.

The IHS Markit municipal curve was cut: 0.68% (+4) in 2023 and 0.92% (+5) in 2024. The five-year at 1.26% (+5), the 10-year at 1.53% (+6) and the 30-year at 1.96% (+5) at a 4 p.m. read.

Bloomberg BVAL was cut three to five basis points: 0.80% (+10) in 2023 and 1.03% (+10) in 2024. The five-year at 1.37% (+10), the 10-year at 1.62% (+8) and the 30-year at 2.02% (+7) at a 4 p.m. read.

Treasuries were better while equities ended in the red.

The two-year UST was yielding 1.487% (-9), the five-year was yielding 1.827% (-12), the 10-year yielding 1.918% (-11), the 20-year at 2.298% (-8) and the 30-year Treasury was yielding 2.237% (-8) at the close. The Dow Jones Industrial Average lost 526 points or 1.47%, the S&P was down 1.81% while the Nasdaq lost 2.10% near the close.

Inflation on everyone’s mind

While the Federal Reserve ponders how to rein in inflation, consumers’ weariness about rising prices becomes more evident.

The University of Michigan’s consumer sentiment index sank to its lowest level in a decade in February, 61.7 after posting a 67.2 read in January. Economists polled by IFR Markets expected a bump to 67.5 in the month.

The current conditions index fell to 68.5 from 72.0 and the expectations index declined to 57.4 from 64.1.

The survey’s chief economist Richard Curtin said, “The recent declines have been driven by weakening personal financial prospects, largely due to rising inflation, less confidence in the government’s economic policies, and the least favorable long term economic outlook in a decade.”

And, he noted, the drop in sentiment was fueled by households earning more than $100,000.

Higher prices weighed on “income and buying prospects,” said Wells Fargo Securities Senior Economist Tim Quinlan, Economist Shannon Seery and Economic Analyst Sara Cotsakis.

“The details of the report suggest weaker expectations around consumers’ financial situation was the main culprit behind the decline,” they said. “Consumers’ views of their finances versus a year ago fell to the lowest level since 2013. This shouldn’t come as a surprise when considering the massive amount of fiscal support reaching households at the onset of the pandemic has now ended, and households continue to contend with higher prices.”

While inflation should wane, they said, it won’t be for a “few months.”

Indeed, Morgan Stanley researchers, led by Chief U.S. Economist Ellen Zentner, said they raised their inflation forecasts, and expect Federal Reserve officials will do the same in their dot plot at the March 16-16 meeting. They said three factors led to their revisions, “a mark-to-market for higher inflation at the start of the year, updated component weights reflected in the latest CPI data, as well as a firmer path for shelter inflation resulting from continued pressures in rental markets.”

They see inflation, as measured by the consumer price index, peaking next month at a 7.9% annual rate and core also at its worst (6.4%) in February. “Early evidence is starting to appear, in both high frequency data on auto prices and our broader global supply chain index, which continue to point toward a turn in the goods inflationary impulse,” the Morgan Stanley researchers said. “As a consequence, we continue to see sequential declines in goods prices helping to bring down the sequential trend in overall inflation.”

But that doesn’t mean inflation won’t remain “elevated” on an annual basis most of the year. They expect in the fourth quarter, the annualized core personal consumption expenditures index will show a 3.2% gain, a half point higher than the Fed’s December expectations. “We expect a material upward revision of inflation in the upcoming March projections, which should be accompanied by a similar revision in the policy path from a median of 0.875% to as high as 1.625% — front-loaded inflation to be met with the intention to front-load hikes,” Zentner’s group said.

With inflation at its highest level in four decades, and “accelerating faster than most continue to anticipate,” Craig Erlam, senior market analyst, UK & EMEA, at OANDA, suggested the Fed may follow the Bank of England’s approach, with a number of hikes before summer, “then hope inflation peaks late in Q1/early Q2, as they anticipate, and falls significantly enough after to considerably ease the pressure.”

But markets are taking a pessimistic view, he said, “pricing in plenty more hikes in the second half of the year on the belief that the central banks will once again prove too optimistic.” While that may cause short-term stock market instability, he said, “it could become a useful tailwind in the second half of the year if inflation does fall considerably after peaking and allow for some of the interest rate positioning to be unwound.”

But Roosevelt Institute Chief Economist Joseph Stiglitz, said, “Although it is anyone’s guess what will happen next with inflation, the data show that there is no reason to react rashly with large across-the-board interest-rate hikes. The economy is working through an unprecedented transition that could ultimately be a boon for workers; but only if policymakers let the process play out.”

The biggest risk, he said, “is that central banks will overreact, raising interest rates excessively and hampering the nascent recovery.”

Since the pandemic poses unique challenges, “we can’t be sure of how things will evolve,” he said. “Nor can we be sure what to make of the Great Resignation.”

But raising rates is not the answer in Stiglitz’s opinion. “We should not attack a supply-side problem by lowering demand and increasing unemployment.” Instead, he suggested, “targeted structural and fiscal policies aimed at unblocking supply bottlenecks.”

Primary to come:

University of Washington (Aaa/AA+//) is set to price Tuesday $400.855 million of general revenue bonds, consisting of $75 million, Series 2022A, serials 2023-2035 and 2037; $225.845 million of taxable refunding bonds, Series 2022B, serials 2022-2034, term 2041; and $100.01 million of term-rate refunding bonds, Series 2022C, serial 2048. Citigroup Global Markets.

Mount Nittany Medical Center, Pennsylvania, (/A+/AA-/) is set to price Tuesday $300 million of corporate CUSIP taxable revenue bonds, Series 2022. J.P. Morgan Securities.

Pennsylvania Housing Finance Agency (Aa1/AA+//) is set to price Wednesday $255.495 million of non-alternative minimum tax social single-family mortgage revenue bonds, Series 2022-138, serials 2022-2032, terms 2037, 2042, 2047 and 2052. Wells Fargo Bank.

Wisconsin (Aa1/AA+//AAA/) is set to price daily $236.975 million of taxable general obligation refunding bonds of 2022, Series 2, serials 2023-3032 and 2037. UBS Financial Services.

Waco Independent School District, Texas, is set to price Thursday $185 million of unlimited tax school building bonds, Series 2022. Oppenheimer & Co.

Peninsula Corridor Joint Powers Board, California, (/AA+//AAA) is set to price Tuesday $140 million of green climate-certified Measure RR sales tax revenue bonds, 2022 Series A. J.P. Morgan Securities.

Sanger Unified School District, California, is set to price Wednesday $105 million of 2022 certificate of participation. Stifel, Nicolaus & Co.

Georgetown Independent School District, Texas, (Aaa/AAA//) is set to price daily $103.88 million of taxable unlimited tax refunding bonds, Series 2022-A, insured by Permanent School Fund Guarantee Program. FHN Financial Capital Markets.

Northside Independent School District, Texas, (Aaa//AAA//) is set to price Tuesday $100.42 million of unlimited tax school building bonds, Series 2022A, insured by Permanent School Fund Guarantee Program. Morgan Stanley & Co.

Competitive:

Wake County, North Carolina, (Aaa/AAA/AAA/) is set to sell $42.215 million of general obligation parks, greenways, recreation and open space bonds, Series 2022C at 11:30 a.m. eastern Tuesday.

Wake County, North Carolina, (Aaa/AAA/AAA/) is set to sell $202.45 million of general obligation public improvement bonds, Series 2022A at 11 a.m. Tuesday.

Waco, Texas, (Aa1/AA+//) is set to sell $25.295 million of general obligation refunding bonds, Series 2022 at 11 a.m. Tuesday.

Waco, Texas, (Aa1/AA+//) is set to sell $103.22 million of combination tax and revenue certificates of obligation, Series 2022A at 11:30 a.m. Tuesday.

Delaware is set to sell $251.55 million of general obligation bonds, Series 2022 at 11 a.m. eastern Wednesday.

Lynne Funk contributed to this report.