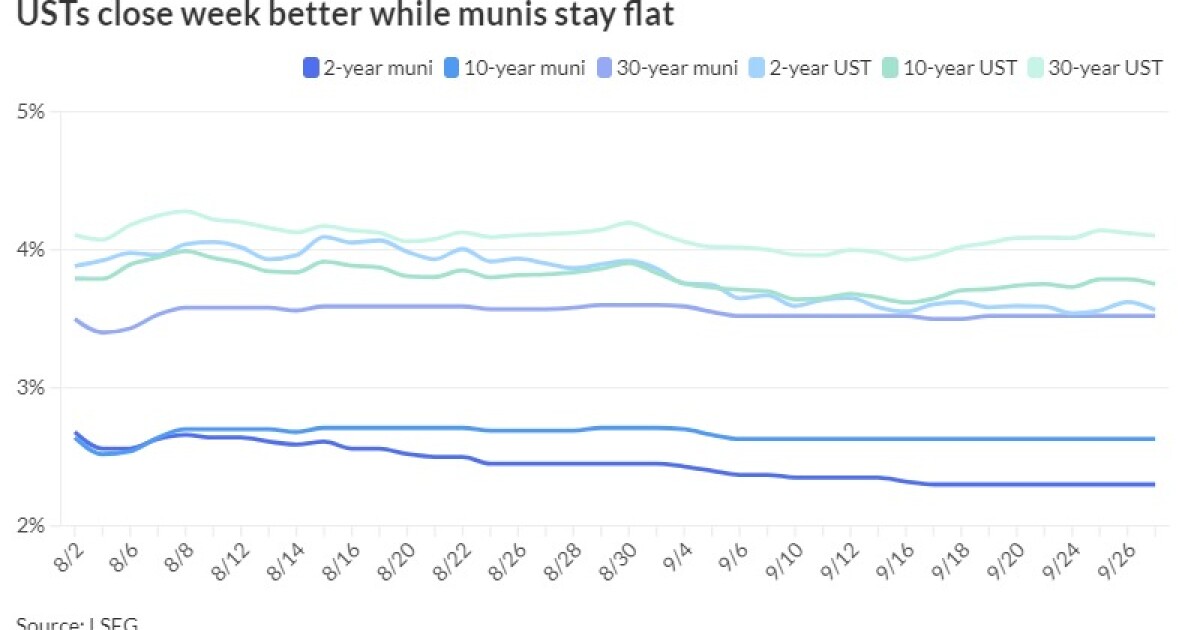

The municipal market muscled through this week by holding yields mostly steady as investors digested a large new-issue slate, heavy on tax-exempt paper, even as U.S. Treasuries were weaker until Friday’s session.

Municipal triple-A yield curves closed out the week with few changes, valuations were little changed — though at attractive levels — and the forward calendar climbs to more than $10 billion to open the fourth quarter.

“Munis have continued proving their underlying strength in the past week, in the face of one of the heaviest supply weeks in recent history and somewhat higher Treasury rates,” said Mikhail Foux, managing director and head municipal research and strategy at Barclays. ”All deals are getting heavily oversubscribed, and MMD-UST ratios actually declined slightly this week.”

The two-year muni-to-Treasury ratio Friday was at 65%, the three-year at 66%, the five-year at 66%, the 10-year at 70% and the 30-year at 86%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 63%, the three-year at 64%, the five-year at 64%, the 10-year at 69% and the 30-year at 85% at 4 p.m.

“On the one hand, with four or five heavy supply weeks ahead of us, it would be hard not to expect tax-exempts to underperform Treasuries, at least to a degree,” Foux said. “On the other hand, many market participants are expecting to buy the dip, and, as we know, the market typically does not do what investors foresee, and we would not be surprised if munis do not underperform much.”

Municipal volume is estimated at $10.14 billion for the week of Sept. 30. There are $7.769 billion of negotiated deals on tap and $2.372 billion of competitive loans.

The negotiated calendar is led by a $1 billion-plus Northwell Healthcare deal via the Dormitory Authority of the State of New York while the competitive calendar is led by the New York Metropolitan Transportation Authority, which is set to sell Tuesday nearly $872 million of dedicated tax fund green Climate Bond Certified bonds in two sales, $399.74 million of which are refunding bonds.

Bond Buyer 30-day visible supply sits at $15.83 billion.

“These levels of supply are not particularly surprising as issuers pull forward deals ahead of November, consistent with prior election years,” said Peter DeGroot in a Friday market comment. “The central assumption underpinning our belief that ratios will cheapen leading up to the election is this expectation of accelerated supply as we approach November.”

Municipals are returning 0.89% in September and 2.20% year-to-date per the Bloomberg Municipal Index. The high-yield index is at 0.80% so far this month and at 7.38% in 2024 while taxable munis are returning 1.41% in September and 5.28% year-to-date.

Treasuries have seen 1.53% returns in September and 2.29% in 2024 while corporates are at 1.67% in the black this month and 5.22% in 2024.

The front end of the tax-exempt curve has been the best performer since the summer, Foux noted. “It has already become relatively steep, but we think it could steepen further,” he said. The 5s10s index curve is just about 5 basis points away from its average in 2021; the 3s5s curve is about 10 basis points away from that average, Foux said.

“Although the IG yield curve could steepen a bit more, we think a better trade would be to invest in the parts of the market that have underperformed this move, such as pre-pay bonds with 4-7-year puts; alternatively, investors could extend a bit,” Foux said.

Despite week-to-date outperformance

AAA scales

Refinitiv MMD’s scale was little changed: The one-year was at 2.50% and 2.30% in two years. The five-year was at 2.31%, the 10-year at 2.63% and the 30-year at 3.52% at 3 p.m.

The ICE AAA yield curve was better in spots: 2.53% (unch) in 2025 and 2.31% (-1) in 2026. The five-year was at 2.31% (-2), the 10-year was at 2.60% (-2) and the 30-year was at 3.49% (-2) at 4 p.m.

The S&P Global Market Intelligence municipal curve was little changed: The one-year was at 2.52% (unch) in 2025 and 2.32% (unch) in 2026. The five-year was at 2.32% (unch), the 10-year was at 2.61% (unch) and the 30-year yield was at 3.50% (unch) at 4 p.m.

Bloomberg BVAL was little changed: 2.49% (unch) in 2025 and 2.37% (-1) in 2026. The five-year at 2.35% (-2), the 10-year at 2.61% (unch) and the 30-year at 3.49% (unch) at 4 p.m.

Treasuries improved.

The two-year UST was yielding 3.565% (-6), the three-year was at 3.484% (-6), the five-year at 3.509% (-5), the 10-year at 3.752% (-4), the 20-year at 4.151% (-3) and the 30-year at 4.103% (-2) at the close.

Primary to come:

The Dormitory Authority of the State of New York (A3/A-/A-/) is set to price Wednesday $1.027 billion of Northwell Health Obligated Group revenue bonds, consisting of $664.135 million of Series 2024A refunding bonds and $362.87 million of Series 2025A forward delivery bonds. Morgan Stanley & Co. LLC.

The California Community Choice Financing Authority (A2///) is set to price next week $995 million of clean energy project revenue bonds Series 2024C. Goldman Sachs & Co. LLC.

The Commonwealth of Kentucky State Property and Buildings Commission (Aa3//AA-/) is set to price Wednesday $600 million of Project No. 131 revenue bonds, serials 2025-2044. BofA Securities.

Massachusetts (Aa1/AAA//AAA) is set to price Wednesday $490.7 million of transportation revenue bonds, consisting of $150 million of revenue bonds, Series 2024A, serials 2044, 2047-2053, $125 million of Series 2024B revenue bonds, term 2054, and $215.7 million of revenue refunding bonds, serials 2025-2037, term 2044. BofA Securities.

The Ohio Water Development Authority (Aaa/AAA//) is set to price Tuesday $400 million of water pollution control loan fund green revenue bonds. RBC Capital Markets.

The Trustees of Columbia University (Aaa/AAA//) is set to price Wednesday $350 million of taxable corporate CUSIP bonds. Goldman Sachs & Co. LLC.

The Michigan State Housing Development Authority (Aa2/AA+//) is set to price Wednesday $300.2 million of single-family non-AMT mortgage social revenue bonds, serials 2025-2036, terms 2039, 2044, 2049, 2055, 2055. RBC Capital Markets.

The Michigan State Housing Development Authority (Aa2/AA+//) is also set to price Wednesday $144.705 million of taxable single-family mortgage revenue social bonds, serials 2025-2034, terms 2039, 2044, 2049, 2055. RBC Capital Markets.

San Antonio, Texas, (Aa1/AA+/AA/) is set to price Thursday $268.59 million of water system junior lien revenue bonds, Series 2024B. J.P. Morgan Securities LLC.

Colorado (Aa2/AA-//) is set to price Tuesday $262.335 million of Higher Education Health Sciences Facilities certificates of participation, serials 2027-2044, terms 2049, 2054. BofA Securities.

The Pennsylvania Turnpike Commission (A2/A+/A/A+) is set to price Tuesday $236.985 million of turnpike subordinate revenue refunding bonds, serials 2025-2044. Wells Fargo Bank, N.A. Municipal Finance Group.

The Timpanogos Special Service District, Utah, (/AA/AA+/) is set to price $218.1 million of sewer revenue and refunding bonds, serials 2025-2044, terms 2049, 2054. BofA Securities.

The

The New York City Transitional Finance Authority (Aa1/AAA/AAA/) is set to price $200 million of future tax-secured tax-exempt subordinate adjustable-rate bonds, Fiscal 2025 Subseries C-3. Morgan Stanley & Co. LLC.

The National Finance Authority (/A//) is set to price Wednesday $179.065 million of affordable housing social certificates, Series 2024-1 Class A. Wells Fargo Bank, N.A. Municipal Finance Group.

The IPS Multi-School Building Corp., Indianapolis, Indiana, (Aa2/AA+//) is set to price Wednesday $167.76 million of ad valorem property tax first mortgage refunding and improvement social bonds, serials 2025-2044, term 2046, Indiana State Aid Intercept Program. Stifel, Nicolaus & Company, Inc., St. Louis

The Northeast Ohio Regional Sewer District (Aa1/AA+//) is set to price Wednesday $163.105 million of wastewater improvement refunding revenue bonds, Series 2024, serials 2025-2044, term 2046. Jefferies LLC.

The Dormitory Authority of the State of New York is set to price Wednesday $150 million of Columbia University revenue bonds, Series 2024A. BofA Securities.

Santa Clara, California, (/AA-/AA-/) is set to price Wednesday $113.56 million of Silicon Valley Power electric revenue bonds. J.P. Morgan Securities LLC.

Competitive:

The New York Metropolitan Transportation Authority is set to sell $472.19 million of dedicated tax fund green Climate Bond Certified bonds at 10:45 a.m. eastern Tuesday.

The New York Metropolitan Transportation Authority is also set to sell $399.74 million of dedicated tax fund refunding green Climate Bond Certified bonds at 11:15 a.m. eastern Tuesday.

California is set to sell $150 million of veterans general obligation bonds at 11:30 a.m. eastern Tuesday.

The Virginia Transportation Board is set to sell $121 million of federal transportation grant anticipation revenue notes at 10:30 a.m. eastern Tuesday.

Alexandria, Virginia, is set to sell $114.92 million of general obligation capital improvement bonds at 10:30 a.m. eastern Thursday.