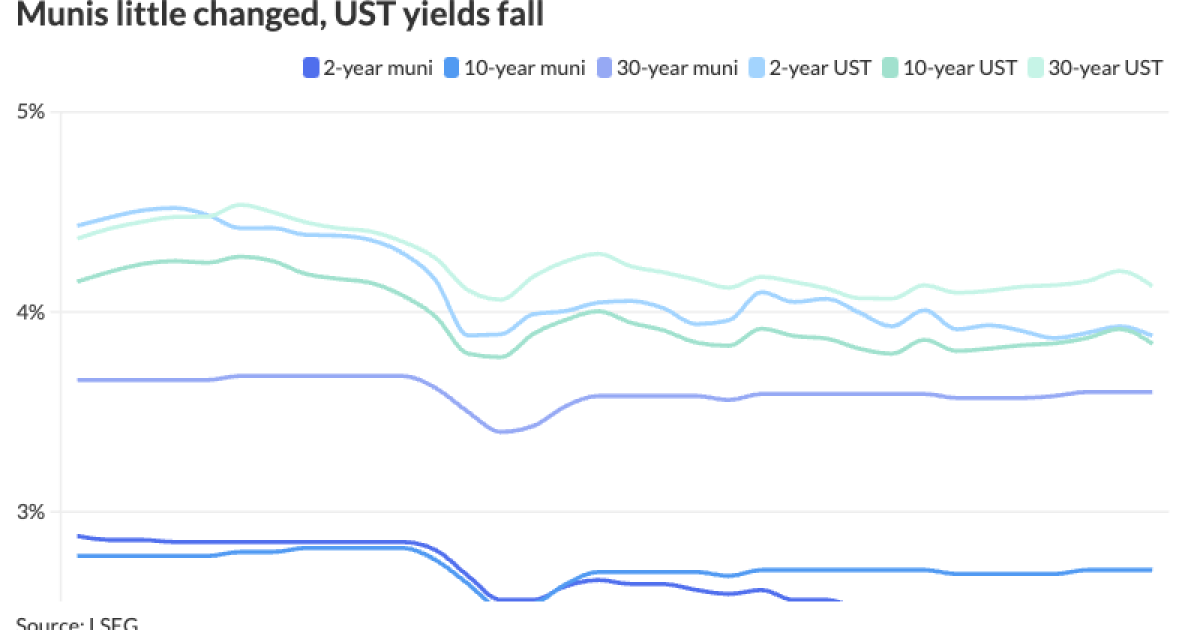

Municipals were little changed to firmer in spots Tuesday as U.S. Treasury yields fell while equities sold off to start September.

“With August now behind us, munis continued the summer rally with [the month] returning 0.79%, pushing year-to-date gains to 1.30%,” said Jason Wong, vice president of municipals at AmeriVet Securities. This marked the first August since 2019 that the market closed August in the black.

Municipals saw gains of 0.79% for August, pushing year-to-date returns to 1.30%. High-yield saw returns of 1.18% month-to-date and 6.52% year-to-date, while taxables returned 1.27% month-to-date and 3.82% year-to-date.

Returns averaged negative 1.1% of the last four August cycles, noted Kim Olsan, senior fixed income portfolio manager at NewSquare Capital. “The year-to-date gain stands at 1.3%, lagging UST (+2.6%) and U.S. Corporate (+3.4%) gains — primarily influenced by supply conditions.”

While munis had a “strong” rally this summer, the asset class underperformed USTs across the curve as muni-UST ratios have risen in the past two months, Wong said.

The 10-year ratio was at 64.74% at the start of July, but “with Treasures rallying, fueled by an anticipated Fed-rate cut this month, we saw 10-year ratio rise above 70% for the first time since November 2023 when the month closed at 69.10%,” Wong said.

This underperformance can be seen across the curve, he said.

The front-end saw ratios rise by 2.5 percentage points for the two-year and 0.05 percentage points for the five-year, but the underperformance was most “prevalent” seen out long as the 30-year ratio rose five percentage points, Wong said.

The two-year muni-to-Treasury ratio Monday was at 63%, the three-year at 65%, the five-year at 66%, the 10-year at 70% and the 30-year at 87%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 62%, the three-year at 64%, the five-year at 65%, the 10-year at 69% and the 30-year at 86% at 3:30 p.m.

Summer redemption season has ended, and “without the huge amounts of maturing and called bond principal flowing back to investors, demand in the last months of the year will be more reliant on new money coming into the market than it was in June, July and August,” said Pat Luby, head of municipal strategy at CreditSights.

The total amount to be paid out by issuers in September is $22.8 billion, less than half of August’s total and 21% lower than this year’s monthly average, he said.

Interest payable in September is at $8.4 billion, the second lowest total in 2024 after March, he said.

Five states will see September redemptions top $1 billion: California ($4.7 billion), Texas ($2.5 billion), New York ($1.4 billion), Kansas ($1.1 billion) and Pennsylvania ($1.1 billion), he said.

On the first day of the month, $13.2 billion of the principal for September will be paid out, or 58%, according to Luby. Additionally, issuers will also be paid out $6.3 billion of interest.

Due to the “slowdown in redemptions and the increased pace of new-issue supply, we expect that net supply will be positive for the rest of the year and that this year’s total net supply will be the most since at least 2017,” he said.

With an estimated supply of $483 billion for the year and $346 billion in redemptions, net supply for 2024 will be $137 billion, Luby said.

Bond Buyer 30-day visible supply sits at $15.84 billion.

With the Fed planning to cut rates at its September meeting, investors should continue to “lock in higher rates,” Wong said.

This will help “boost performance this month and bring higher returns for 2024, bucking the trend of weak performance for September which has had negative returns in seven of the past 10 years,” he added.

In the primary market Tuesday, Truist Securities priced for the East County AWP Joint Powers Authority (//AA/) $433.235 million of green tax-exempt interim notes, Series 2024A. The first tranche, $369.595 million of Subseries A-1, saw 3s of 9/2026 at par, callable 6/1/2024.

The second tranche, $63.64 million of Subseries A-2, saw 4s of 9/2026 at 2.60%, callable 6/1/2026.

AAA scales

Refinitiv MMD’s scale was little changed: The one-year was at 2.53% (unch, no Sept. roll) and 2.45% (unch, no Sept. roll) in two years. The five-year was at 2.42% (unch, no Sept. roll), the 10-year at 2.71% (unch, no Sept. roll) and the 30-year at 3.60% (unch) at 3 p.m.

The ICE AAA yield curve was narrowly mixed: 2.52% (unch) in 2025 and 2.46% (unch) in 2026. The five-year was at 2.45% (+2), the 10-year was at 2.67% (-1) and the 30-year was at 3.60% (-1) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was bumped up to three basis points: The one-year was at 2.54% (-3) in 2025 and 2.48% (-3) in 2026. The five-year was at 2.44% (unch), the 10-year was at 2.68% (unch) and the 30-year yield was at 3.59% (unch) at 3 p.m.

Bloomberg BVAL was bumped up to two basis points: 2.51% (unch) in 2025 and 2.46% (unch) in 2026. The five-year at 2.44% (unch), the 10-year at 2.67% (-1) and the 30-year at 3.58% (-2) at 3:30 p.m.

Treasuries were firmer.

The two-year UST was yielding 3.881% (-5), the three-year was at 3.740% (-5), the five-year at 3.652% (-4), the 10-year at 3.841% (-7), the 20-year at 4.210% (-9) and the 30-year at 4.127% (-8) at 3:40 p.m.

Primary to come:

The North Texas Tollway Authority is set to price

The San Diego Unified School District (Aa2//AAA/AAA) is set to price Thursday $670 million of dedicated unlimited ad valorem property tax general obligation bonds, consisting of $21.535 million of taxable green bonds, Series H-1; $328.465 million of green bonds, Series H-2; $12.45 million of taxable sustainability bonds, Series B-1; $177.55 million of taxable sustainability bonds, Series B-2; and $190 million of sustainability bonds, Series B-3. Goldman Sachs.

The Michigan State Housing Development Authority (/AA+//) is set to price $426.12 million of non-AMT rental housing revenue bonds, Series A, serials 2026-2036, terms 2039, 2044, 2049, 2054, 2059, 2064, 2067. BofA Securities.

The Municipal Electric Authority of Georgia (A2/A-/A-/) is set to price Thursday $372.645 million of subordinated bonds, consisting of $350.62 million of Project 1 bonds, serials 2026-2044, terms 2049, 2054, and $22.025 million of general resolution projects bonds, serials 2026-2034. BofA Securities.

The Curators of the University of Missouri (Aa1/AA+//) is set to price Wednesday $364.785 million of system facilities revenue bonds. Goldman Sachs.

The Metropolitan Water District of Southern California (Aa1/AAA//) is set to price Thursday (retail Tuesday) $215.71 million of water and revenue refunding bonds, serials 2025-2046, term 2049. Barclays Capital Inc.

Mt. San Antonio Community College District, California, (Aa1/AA//) is set to price Wednesday $189.6 million of election of 2018 general obligation bonds, Series 2024D, serials 2025-2044, terms 2046, 2049. RBC Capital Markets.

Barbers Hill Independent School District, Texas, is set to price Thursday $189.19 million of unlimited tax school building bonds, Series 2024, Piper Sandler.

The Louisiana Local Government Environmental Facilities and Community Development Authority (A1/A+//) is set to price Thursday $151.435 million of East Baton Rouge Sewerage Commission Projects subordinate lien revenue refunding bonds, Series 2024. J.P. Morgan.

The Florida Housing Finance Corp. (Aaa///) is set to price Wednesday $150 million of Homeowner Mortgage Revenue Bonds, consisting of $110 million of non-AMT 2024 Series 5, serials 2025-2036, terms 2039, 2044, 2049 2054, 2055, and $40 million of taxable refunding bonds 2024 Series 6, serials 2025-2035, terms 2039, 2044, 2049, 2054, 2055. Raymond James.

The Mississippi Development Bank (Aa3/AA-//) is set to price Wednesday $148.66 million of Desoto County, Mississippi Highway Refunding Project special obligation refunding bonds, Series 2024A, serials 2025-2032. Wells Fargo.

27J Schools, Colorado, (Aa2/AA//) is set to price $128.5 million of general obligation bonds, insured by the Colorado State Intercept Program. RBC Capital Markets.

The Rhode Island Health and Educational Building Corp. (/AA//) is set to price Wednesday $125 million of public schools revenue bond financing program revenue bonds, Series 2024 G (City of Providence Issue), Insured by Build America Mutual Assurance Co., serials 2028-2044. Siebert Williams Shank & Co., LLC.

Lake County, Ohio, (Aa1///) is set to price Thursday $120 million of County Correctional Facilities Series 2024, consisting of $70 million of bonds, serials 2025-2044, terms 2046, 2050, 2052, and $50 million of notes, serials 2025. Stifel, Nicolaus & Company, Inc.

Competitive:

Massachusetts (Aa1/AA+/AA+/) is set to sell $850 million of tax-exempt and taxable general obligation consolidated loan of 2024 bonds in four series Thursday, consisting of $130 million of series C exempts at 10 a.m. eastern, $220 million of Series D exempts at 10:30 a.m., $400 million of Series E exempts at 11 a.m. and $100 million of Series F taxables at 11:30 a.m.

Dane County, Wisconsin, is set to sell $144.61 million of general obligation promissory notes, Series A and $22.085 taxable general obligation promissory notes, Series B, at 11 a.m. eastern Thursday.