Municipals were little changed ahead of a smaller $6.6 billion new-issue calendar. U.S. Treasuries were firmer and equities rallied.

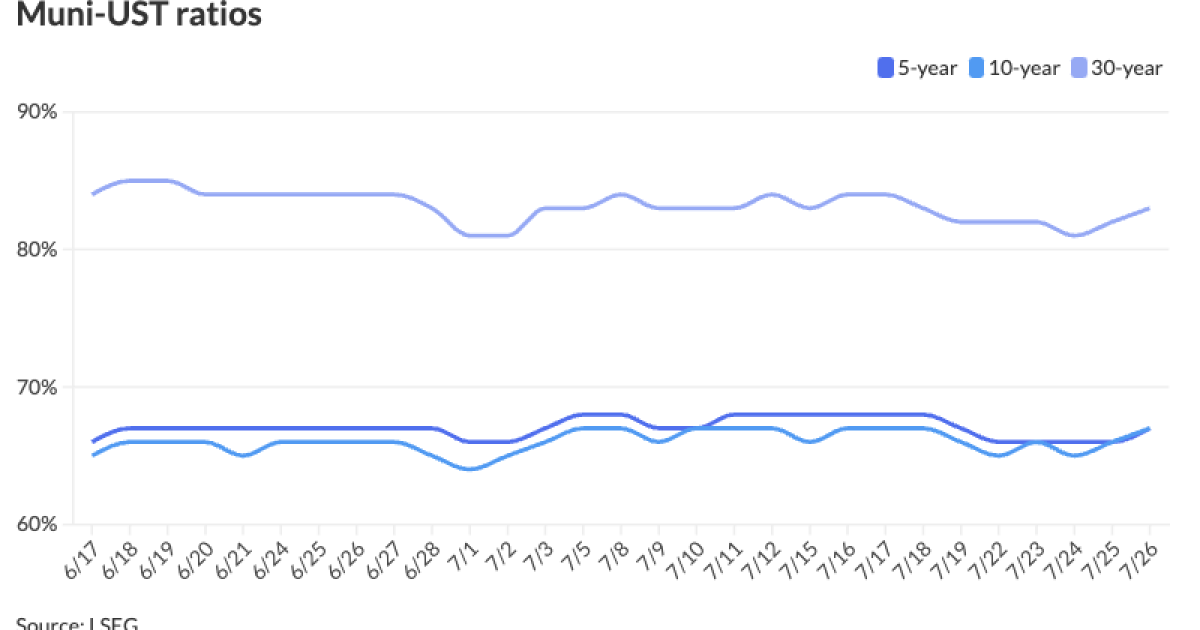

The two-year muni-to-Treasury ratio Friday was at 65%, the three-year at 66%, the five-year at 67%, the 10-year at 67% and the 30-year at 83%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 64%, the three-year at 66%, the five-year at 67%, the 10-year at 66% and the 30-year at 81% at 3:30 p.m.

As the Federal Reserve’s first rate cut approaches — which could be as early as its July meeting — the UST yield curve has started to steepen, with the tax-exempt curve following, said Barclays strategists Mikhail Foux and Clare Pickering.

In July, the 3s5s portion of the tax-exempt curve steepened 5 basis points, and the 5s10s curve steepened 10 basis points, they said, noting both curve slopes, though still flatter than levels seen in the first quarter of 2022, are at their steepest levels in months.

“In our view, the steepening trend of the front end has been firmly entrenched,” Barclays strategists said.

“While the front end of the tax-exempt curve has been performing well, the long end has not really moved much, and the 10s20s and the 10s30s parts of the curve have been relatively stable, with long MMD-UST ratios anchored at current levels,” they noted.

While the expected Fed ratecutting cycle may end up being “much shallower” than investors expect, it should support the front end of the yield curve, according to Barclays strategists.

The yield curve is expected to disinvert by the first half of 2025, providing “additional help for tax-exempts in the 3-7y maturity bucket,” they said.

Meanwhile, the muni market tends to have “remarkable patience” in relation to USTs, said BofA strategists.

Munis usually wait while a UST market trend forms, and then follow USTs after the trend is established, they said.

“The good thing about munis is that once its own trend is established, it generally extends longer in time than Treasuries’,” they said.

This Treasury yields downtrend started in late April, with munis’ downtrend beginning in May, BofA strategists said.

“Treasury yields’ downtrend has been led by the front end, and 10-30yr yields have been somewhat stalled for the last six weeks,” they said.

The muni yields downtrend, which has “merely slowed,” continues, according to BofA strategists.

Ten- to 30-year USTs would need to “break the logjam of its six-week stasis” for an acceleration of the muni rally, they noted.

Catalysts may be provided by next week’s Federal Open Market Committee meeting and July’s jobs report, BofA strategists noted.

If so, they said, “a similarly strong muni market supply/demand imbalance would all add to the possibility of a pleasant August.”

However, Barclays strategists noted, “August has been one of the most difficult months for tax-exempts.”

Next month “will be the final month of

New-issue calendar is at $6.6B

The new-issue calendar is at $6.633 billion the week of July 29, with $5.655 billion of negotiated deals expected to come to market and $977.9 million of competitive deals on tap.

The negotiated calendar is led by New York City with $1.2 billion of GOs, followed by the Port of Seattle with $822 million of intermediate lien revenue bonds and the Port of Portland with $592 million of AMT Portland International Airport revenue bonds.

Miami-Dade County, Florida, tops the competitive calendar, with $234 million of capital asset acquisition special obligation bonds.

AAA scales

Refinitiv MMD’s scale was little changed: The one-year was at 2.88% (unch) and 2.85% (unch) in two years. The five-year was at 2.75% (unch), the 10-year at 2.82% (+2) and the 30-year at 3.68% (unch) at 3 p.m.

The ICE AAA yield curve was narrowly mixed: 2.90% (unch) in 2025 and 2.87% (unch) in 2026. The five-year was at 2.78% (+1), the 10-year was at 2.81% (+1) and the 30-year was at 3.65% (-2) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was bumped up to a basis point: The one-year was at 2.90% (unch) in 2025 and 2.88% (unch) in 2026. The five-year was at 2.77% (unch), the 10-year was at 2.81% (-1) and the 30-year yield was at 3.66% (-1) at 3 p.m.

Bloomberg BVAL was little changed: 2.89% (unch) in 2025 and 2.84% (unch) in 2026. The five-year at 2.75% (unch), the 10-year at 2.77% (unch) and the 30-year at 3.65% (unch) at 3:30 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.386% (-6), the three-year was at 4.200% (-6), the five-year at 4.074% (-7), the 10-year at 4.191% (-6), the 20-year at 4.534% (-6) and the 30-year at 4.449% (-5) at 3:30 p.m.

Primary to come

New York City (Aa1/AA/AA/AA+/) is set to price Tuesday $1.159 billion of GOs, consisting of $1.134 billion of fiscal series 2025 A, and $24.175 million of fiscal series 2025 B. Wells Fargo.

The Port of Seattle (A1/AA-/AA-/) is set to price Thursday $822.225 million of intermediate lien revenue refunding bonds, consisting of $170.825 million of non-AMT bonds, Series 2024A, serials 2025-2044, and $651.4 million of AMT bonds, Series 2024B, serials 2025-2044, term 2049. BofA Securities.

The Port of Portland (/AA-/AA-/) is set to price Tuesday $592.03 million of AMT Portland International Airport revenue bonds, consisting of $520.065 million of green bonds Series 2024A, serials 2025-2054, and $71.965 million of refunding bonds Series 2024B, serial 2025-2044s. BofA Securities.

The Central Florida Expressway Authority (A1/AA-//) is set to price Tuesday $366.515 million of senior lien revenue bonds, consisting of $148.185 million of Series 2024A, serials 2025-2044, terms 2049, 3054, and $218.33 million of Series 2024B, serials 2029-2030, 2032-2035. J.P. Morgan.

The Industrial Development Authority of Fairfax County, Virginia, (Aa2/AA+//) is set to price Tuesday $362.245 million of Inova Health System Project healthcare revenue Series 2024. J.P. Morgan.

The Allegheny County Sanitary Authority, Pennsylvania, (Aa3/AA-//) is set to price Monday $361.595 million of sewer revenue refunding bonds, Series 2024, serials 2024-2044, terms 2049, 2055. PNC Capital Markets.

The Illinois Housing Development Authority (Aaa///) is set to price Tuesday $327.335 million of taxable social revenue bonds, Series 2024F, serials 2025-2036, terms 2039, 2044, 2046, 2054. BofA Securities.

The authority is also set to price $66.665 million of non-AMT social revenue bonds, Series 2024E, serials 2025-2036, terms 2039, 2043, 2055. Raymond James.

Tallahassee, Florida, (Aa3/AA//) is set to price Thursday $201.295 million of energy system refunding revenue bonds, Series 2024, serials 2025-2042. Raymond James.

The Fayette County Development Authority, Georgia, (//BBB/) is set to price Thursday $200 million of United States Soccer Federation revenue bonds, Series 2024. Goldman Sachs.

The Northampton County General Purpose Authority, Pennsylvania, (Aa3/AA-//) is set to price Tuesday $125.785 million of Lehigh University higher education fixed-rate revenue bonds, Series A of 2024, serials 2024-2034. Wells Fargo.

The Minnesota Housing Finance Authority (Aa1/AA+//) is set to price Tuesday $110 million of taxable residential housing finance bonds, 2024 Series P, serials 2025-2035, terms 2039, 2044, 2049, 2051. RBC Capital Markets.

The Detroit Regional Convention Facility Authority (/A+/AA-/) is set to price Thursday $107.98 million of convention facility special tax revenue refunding bonds, Series 2024C. J.P. Morgan.

Competitive

Miami-Dade County, Florida, is set to sell $234.03 million of capital asset acquisition special obligation bonds, Series 2024A, at 10 a.m. Eastern Wednesday.

New Orleans is set to sell $183 million of public improvement bonds, Issue of 2024A, at 10:30 a.m. Eastern Wednesday.

Glendale, California, is set to sell $166.88 million of electric revenue bonds, 2024 Second Series, at 11 a.m. Eastern Thursday.

Layla Kennington contributed to this story.