Municipals were little changed ahead of the Labor Day weekend and a larger new-issue calendar led by California, while U.S. Treasuries were weaker after the August jobs report showed a slowing labor market. Equities ended mixed.

Friday’s jobs report reinforced some market participants’ belief the Fed will opt to skip a rate hike at the September FOMC meeting.

“The latest jobs and inflation data takes some pressure off the Fed, as it supports a data-dependent ‘on hold’ at the upcoming September FOMC meeting,” said Christian Scherrmann, U.S. economist at DWS.

The August jobs report is “sufficient for Fed moderates to successfully negotiate another pause at September’s FOMC meeting, but it will not assuage the hawks who are still inclined to follow through with a bit more tightening thereafter,” said BNP Paribas chief U.S. economist Carl Riccadonna, senior U.S. economist Yelena Shulyatyeva and head of U.S. Rates Strategy Yelena Shulyatyeva.

They expect “cooler macro-economic conditions by November’s meeting to justify an extended pause.”

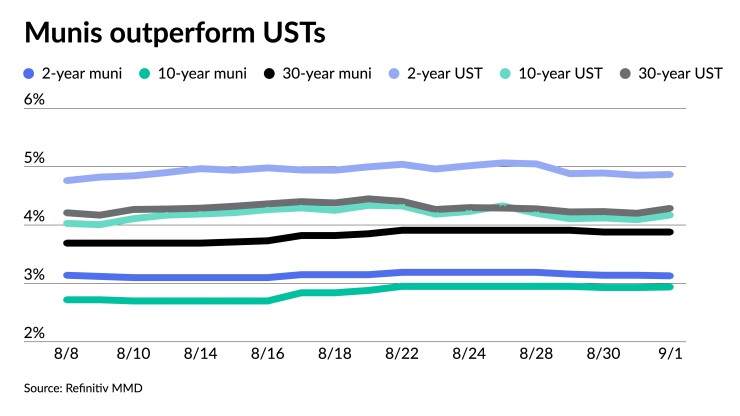

Triple-A yields were little changed to weaker by a basis point or two in spots, outperforming UST, which saw losses out longer to start September.

After a volatile month led by swings in U.S. Treasuries, municipals ended in the red for the month of August at negative 1.44% leaving year-to-date returns at positive 1.59%.

“The U.S. macro debate surrounding longer-term growth, term premium, and U.S. Treasury issuance hit interest rates hard in August,” said James Pruskowski, chief investment officer at 16Rock Asset Management. In August, USTs “jumped across the curve, testing key support levels, and interest rate volatility spiked,” Pruskowski said.

Unlike USTs, munis had a “more pronounced reaction” in August, Pruskowski said.

The Bloomberg Municipal Index posted 1.44% losses, high-yield was at negative 1.52% while taxables lost 0.40%.

Despite favorable municipal seasonal factors, he said “this is the second worst August in over a decade.”

Some notable events include “municipals starting at tight Treasury yield ratios; higher-than-normal new-issue supply; modest demand for fund products; and several credit events including the fire in Maui, more bad news out of the [Puerto Rico Electric Power Authority] restructuring, and a sports complex default in Arizona,” he said.

“Most all major fixed-income asset classes posted negative total returns in August with the longer-duration segments of the market posting worse returns due to rising Treasury yields,” said Cooper Howard, a fixed-income strategist at Charles Schwab.

But in September, total returns should be better, he said.

Howard believes USTs “are near a peak and should therefore be less of a headwind to total returns in the near-term.”

Treasury yields have been rising in part because the “market is shifting the view on Fed policy that it will be tighter for longer,” he said.

While munis barely followed an initial UST rally earlier in the week, if the UST rally “continues and establishes a bullish trend, munis should follow better,” noted a Friday BofA Global Research report.

Muni-UST ratios rose “significantly across the curve over the past several days, easing the tight ratios that held much of the last four months,” BofA strategists said.

The two-year muni-to-Treasury ratio Friday was at 64%, the three-year at 66%, the five-year at 67%, the 10-year at 70% and the 30-year at 91%, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the two-year at 65%, the three-year at 67%, the five-year at 67%, the 10-year at 70% and the 30-year at 92% at 3 p.m.

Higher ratios “should correct much of the richness and make munis more appealing on a relative value basis,” they said.

Although Fed Chairman Jerome Powell’s speech at the Jackson Hole meeting last week may have sounded somewhat hawkish, BofA strategists said “that does not change the overall underlying consensus that, at most, one more Fed rate hike remains in the current tightening cycle.”

Whether there will be a rate hike at the November Federal Open Market Committee meeting will depend on economic data, they noted.

As such, they said, “positioning in the Fed Funds futures market is expected to swing across a wide range amid important economic and inflation data.”

This was also underlined by the large Treasury market rally earlier in the week on the heels of a lower-than-expected August JOLTs report from Tuesday, they said.

While this data does not get paid much attention by the market, BofA strategists said “the August reading points to a large crack in the hot labor market, which could lead to meaningful softening of inflation and thus reduced the prospect of an additional Fed hike.”

“If inflation surprises to the upside or the labor market remains tight, that could tip the scales to another hike,” Howard said.

New-issue calendar

The calendar will rebound with an estimated $7.141 billion next week with $6.323 billion of negotiated deals on tap and $817.6 million on the competitive calendar.

California leads the negotiated calendar with $2.6 billion of GOs, followed by $1.1 billion of consolidated bonds from the Port Authority of New York and New Jersey.

The competitive calendar is led by Dane County, Wisconsin, with $255 million of GO debt in four deals, followed by $150 million of GOs from Burlington, Vermont.

Secondary trading

North Carolina 5s of 2024 at 3.23% versus 3.28% on 8/17. California 5s of 2024 at 3.00% versus 3.10% on 8/25. Ohio 5s of 2025 at 3.21% versus 3.21% on 8/18.

DC 5s of 2027 at 2.97%. DASNY 5s of 2029 at 2.84%. Triborough Bridge and Tunnel Authority 5s of 2029 at 3.03% versus 3.01% on 8/24.

Washington 5s of 2032 at 3.02% versus 3.07% Tuesday and 3.09% on 8/22. Virginia College Building Authority 5s of 2034 at 3.02%-3.01%.

NYC 5s of 2046 at 4.17%-4.16% versus 4.19% Wednesday. Massachusetts 5s of 2048 at 4.05% versus 4.08%-4.06% Wednesday and 4.05%-4.06% on 8/18. Contra Costa Water District, California, 5s of 2053 at 3.87% versus 3.97%-3.94% Thursday and 4.08%-4.05% original on 8/24.

AAA scales

Refinitiv MMD’s scale was little changed: The one-year was at 3.25% (unch, no roll) and 3.13% (unch, -1bp Sept. roll) in two years. The five-year was at 2.88% (unch, no roll), the 10-year at 2.94% (unch, +1bp Sept. roll) and the 30-year at 3.88% (unch) at 3 p.m.

The ICE AAA yield curve was cut up to two basis points: 3.24% (unch) in 2024 and 3.18% (+1) in 2025. The five-year was at 2.86% (+2), the 10-year was at 2.84% (+1) and the 30-year was at 3.85% (unch) at 3 p.m.

The S&P Global Market Intelligence (formerly IHS Markit) municipal curve was unchanged: 3.26% in 2024 and 3.14% in 2025. The five-year was at 2.89%, the 10-year was at 2.94% and the 30-year yield was at 3.87%, according to a 3 p.m. read.

Bloomberg BVAL was cut up to one basis point: 3.23% (unch) in 2024 and 3.14% (unch) in 2025. The five-year at 2.85% (unch), the 10-year at 2.85% (unch) and the 30-year at 3.84% (unch) at 3 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.865% (+1), the three-year was at 4.571% (+3), the five-year at 4.286% (+5), the 10-year at 4.172% (+8), the 20-year at 4.476% (+8) and the 30-year Treasury was yielding 4.286% (+9) at 3 p.m.

Friday’s jobs report

As nonfarm payrolls rose to 187,000 in August from 157,000 the month prior, Brian Coulton, Fitch Ratings chief economist, said “there is clearer evidence now of slowing labor demand.”

Over the last three months, the average monthly payroll gain has decreased to 150,000 after downward revisions to June and July, he said.

“This is consistent with other indicators of labor demand such as hours and job openings,” Coulton said

The August jobs report “shows modest jobs growth, benign wage pressures and a large jump in the unemployment rate as the labor market slackens,” said ING Chief International Economist James Knightley.

However, the jump in the participation rate to 62.8% and a 740,000 increase in the labor force in August shows evidence of labor supply picking up, Coulton said.

“This jump in the share of adults actively participating in the labor market has helped pushed up the unemployment rate to 3.8%,” he said.

“The Fed will take some comfort that supply-demand imbalances in the labor market are easing, although they will still view wage growth — at 4.8% annualized over the last three months — as too high,” he said.

The August jobs report also “offered the latest piece of evidence that the Fed’s ‘soft landing’ prospects remain alive,” said Wells Fargo Securities senior economist Sarah House, economist Michael Pugliese and economic analyst Aubrey George.

“However, with consumers increasingly reliant on income rather than excess savings to finance consumption, we remain cautious,” Scherrmann said, noting further headwinds are on the horizon.

“Increased use of credit at higher interest rates, upcoming student loan repayments, combined with a further decline in wage growth and a further softening of labor market conditions could imply that consumers will rethink their spending plans in the future more than recent strong numbers on personal consumption suggest,” he said.

Scherrmann believes the Fed will not hike rates further this year if this outlook comes to fruition.

“With the labor market more clearly moving back into balance, further Fed rate hikes seem unlikely in our view,” House, Pugliese and George said. “However, with the labor market still tight and wage growth elevated, we expect rate cuts remains a ways off.”

The next discussion then becomes how much rates will be cut next year, once inflation is close to 2%, Scherrmann said.

Primary to come:

California (Aa2/AA-/AA/) is set to price $2.648 billion of various purpose general obligation bonds Thursday consisting of $1.048 billion of GOs, serials 2026, 2033-2038, 2053 and $1.6 billion of refunding GOs, serials 2024-2032, 2043. Citigroup Global Markets Inc.

The Port Authority of New York and New Jersey (Aa3/AA-/AA-/) is set to price Thursday $1.082 billion of consolidated bonds consisting of $535.09 million of Series 242, serials 2025-2028, 2030-2043, terms 2048, 2053, and $546.975 million of Series 243, serials 2025-2043. BofA Securities.

The City of Jacksonville, Florida (/AA/AA-/AA) is set to price Wednesday $290.345 million of special revenue and refunding bonds consisting of $259.495 million of Series 2023A, serials 2024-2043, term 2048, 2053, and $30.85 million of Series 2023B, refunding bonds, serials 2024-2026. Raymond James & Associates, Inc.

The Michigan State Housing Development Authority (Aa2/AA+//) is set to price $286.015 million of single-family mortgage revenue social bonds, Series 2023 B, non-AMT, serials 2024-2034, term 2038, 2043, 2048, 2054, 2054 (PAC). Retail Wednesday, institutions Thursday. Barclays Capital Inc.

The authority is also set to price Thurday $107.425 million of taxable single-family mortgage revenue social bonds, serials 2024-2034, term 2038, 2043, 2048, 2053. Barclays Capital Inc.

The Arizona Transportation Board (Aa1/AA+//) is set to price $273.96 million of highway revenue and refunding bonds, Series 2023. Wells Fargo Bank, N.A. Municipal Finance Group.

The Public Finance Authority is set to price Thursday $171.31 million of student housing revenue bonds (CHF-Manoa, LLC UH Residences for Graduate Students), Senior Series 2023A and Subordinate Series 2023B, consisting of $158.265 million of Series 2023A (/BBB-//), serials 2027-2033, terms 2038, 2043, 2053, 2063, and $13.045 Series 2023B (non-rated), term 2063.Raymond James & Associates, Inc.

The Pasadena Independent School District, Texas is set to price Thursday $166.84 million of unlimited tax school building bonds, Series 2023. Piper Sandler & Co.

The Canadian County Educational Facilities Authority, Oklahoma (/A+//), is set to price Thursday $125.235 million of educational facilities lease revenue bonds (Mustang Public Schools Project) Series 2023A & 2023B. D.A. Davidson & Co.

The Alaska Housing Finance Corporation (Aa2/AA+//) is set to price $99.995 million of State Capital Project Bonds II, 2023 Series A, refunding, serials 2027-2036, term 2037, 2038, 2039, 2040, 2041. Jefferies LLC.

The South Dakota Housing Development Authority (Aaa/AAA//) is set to price Wednesday $99 million of Homeownership Mortgage Bonds 2023 Series D (Non-AMT), serials 2024-2035, term 2038, 2043, 2048, 2054. Citigroup Global Markets Inc.

The Kentucky Housing Corp. (Aaa///) is set to price $98.82 million of single-family mortgage revenue bonds, Series A (non-AMT), serials 2025-2035, term 2038, 2043, 2048, 2054, 2054. Citigroup Global Markets Inc.

Competitive:

Dane County, Wisconsin, is set to sell Thursday $255 million of GO debt in four deals consisting of $156.48 million of GO corporate purpose bonds, Series 2023B, at 11 a.m. eastern, $65.09 million of GO promissory notes, Series 2023A, at 11 a.m., $22.46 million of GO airport project promissory notes, Series 2023D, subject to AMT, at 11:30 a.m. and $10.55 million of taxable GO promissory notes, Series 2023C, at 11:30 a.m.

Burlington, Vermont (Aa3///), is set to sell $150 million of general obligation public improvement bonds, Series 2023A, at 11 a.m. eastern Thursday.