Municipals were little changed on the day while other markets continued to react to the Fed rate hike as U.S. Treasuries were stronger and equities sold off.

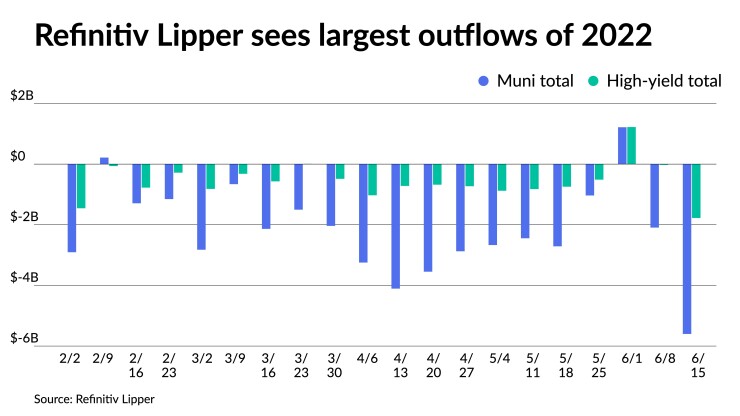

Refinitiv Lipper reported $5.6 billion of outflows, the highest figure of outflows in 2022, as Monday’s massive selloff contributed to more losses for municipals.

That figure is up significantly from $2.094 billion of outflows the week prior and brings the total to $28.7 billion year-to-date.

High-yield saw $1.777 billion of outflows after $25.861 million of outflows the week prior. Exchange-traded funds saw outflows to the tune of $1.002 billion.

Selling pressure has continued since Monday with bids wanteds touching $1.6 billion on Wednesday and $1.96 billion Tuesday following Monday’s $2.2 billion.

The uptick in outflows could be just the beginning, participants say. The hotter-than-expected inflation data and the Fed hiking rates three-quarters has led Jason Appleson, head of municipal bonds at PGIM Fixed Income, to believe outflows will most likely continue for the foreseeable future.

“As long as retail believes rates are going to go higher, then they’re going to continue to pull money from fixed income,” he said in an interview. “That’s just how it is.”

Appleson said there was a “dead cat bouncing relief rally” at the end of May during which participants were overly optimistic, believing that a 50-basis-point drop in yields meant the worst was behind.

The relief rally, he said, was spurred by crossover buyers leading up to it. “People came in and they said, ‘Look at the relative value in the municipal bond space. It is cheap. We have 30-year ratios at 110%, 10-year ratios at 100%,” he said.

The cheapness prompted institutional investors to come in and start buying munis, which eventually kicked off the rally. Following the recent selloff, though, ratios have risen again.

On Thursday, muni-to-UST ratios were at 70% in five years, 88% in 10 years and 100% in 30, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the five at 71%, the 10 at 87% and the 30 at 99% at a 4 p.m. read.

Additionally, during the relief rally toward the end of May, ETFs had inflows week-after-week despite outflows from mutual funds. However, now ETFs are experiencing outflows.

“If you have everyone who’s selling in the same direction, that’s not beneficial for the market,” he said.

Now, though, the muni market can return its focus to market fundamentals after the Fed’s decision to raise interest rates 75 basis points solidified the summer outlook for the market, said Kim Olsan, senior vice president at FHN Financial.

Trading stalled in anticipation of the Federal Open Market Committee meeting, she said, causing benchmarks to “trade sideways but with a modest positive bias in certain structures (short high grades and beaten-down long 4s).”

Bidside reference points were forced to secondary flows by a minimal new-issue calendar, while Municipal Securities Rulemaking Board data indicated longer-term bonds were preferable in secondary flows, she noted.

Bonds due past 12 years captured 56% of volume Wednesday, exceeding the 47% threshold it reached last week, according to Olsan.

“Structures such as Aa2/AA- Energy NW WA Electric Revenue 5s due 2036 (call 2029) that are trading in the 3.50% carry a two-fold benefit—ratios work out to above 100% to USTs and durations are manageable in a period of rate volatility,” she said.

“Further out the curve, 4% coupons continue to offer interesting concession: Aa1/NR New York Dorm Personal Income Tax 4s due 2047 have widened out to +130/AAA and behind 4.50% yields — about 15 basis points wider and more than 60 basis points higher than trading early in June,” she added.

Olsan said UST volatility will spark prioritization of relative value and finding the best spots on the curve.

“Since volatility increased in early May, 5-year AAA/UST ratios have traded up to 82% and as low as 64%, currently settling around 70%,” she said.

“Intermediate ratios have gone as rich as 81% and as wide as 104%, now settling around 88%. Long-dated 5% AAA to UST values reached 110% in mid-May and got as tight as 80% the first week of June, having moved above 100% in recent sessions,” she noted.

Multiple large-scale negotiated deals, including roughly $1.2 billion of tax-exempt GOs from Georgia, headline an expected uptick in market supply for the latter half of June and the end of the second quarter, according to Olsan.

She said initial preliminary official statement postings indicate an upcoming imminent period of active borrowing and investing.

“Given the seasonality attached to the summer timeframe, supply vs. demand moves to the forefront,” Olsan said.

June, from a historical perspective, has had the worst performance of the summer months since 2012, she said, posting a near-flat return rate in that timespan.

So far this month, the Bloomberg Municipal Index has seen losses of 2.81%, high-yield at 4.54% in the red, taxable losses total 2.62% and Bloomberg’s impact index has seen 3.73% losses.

Conversely, June’s median supply over the past decade tops the other summer months, totaling $36 billion, per Olsan.

Currently, the 10-year triple-A MMD rate is higher than any summer period in the past 10 years. The 10-year sits at 2.91% Thursday.

Returns in July for the last decade have averaged 0.55%, she said, reaching upward of 1.5% during that time span. The month’s higher returns is attributed to its average supply of $29 billion, the lowest of the summer months.

“In both July 2020 and July 2021, the 10-year AAA traded below 1% for a sustained period, creating a yield reach out the curve and gains in intermediate and long bonds of 2% (2020) and 1% (2021),” Olsan said.

The monthly supply average for August since 2012 is $32 billion, contributing to higher average gains of 0.55% in the last decade, according to Olsan.

“This August will bring a unique scenario with two FOMC meetings straddling the month on either side, potentially creating greater uncertainty,” she said.

In the primary Thursday, Mesirow Financial priced for the Public Finance Authority, Wisconsin, $275 million of taxable federal lease revenue bonds, Series 2022, with 6.145s of 8/2028, callable in 8/1/2025.

Secondary trading

Georgia 5s of 2023 at 1.77%-1.74%. District of Columbia 5s of 2025 at 2.29%-2.25%. New York City 5s of 2025 at 2.49%. California 5s of 2025 at 2.25%.

Washington 5s of 2026 at 2.39%. Anne Arundel County, Maryland, 5s of 2026 at 2.26%. North CArolina 5s of 2028 at 2.57%, the same as Wednesday.

Guilford County, North Carolina, 5s of 2033 at 3.09%-3.08%. Washington 5s of 2036 at 3.48%-3.47%. California 5s of 2042 at 3.65%-3.56% versus 3.74%-3.56% Wednesday.

Los Angeles DWP 5s of 2051 at 3.78%. NYU University 5s of 2051 at 4.02% versus 4.03% Wednesday. New York City TFA 5s of 2051 at 4.02% versus 4.13%-4.10% Wednesday.

AAA scales

Refinitiv MMD’s scale was unchanged at the 3 p.m. read: the one-year at 1.72% and 2.06% in two years. The five-year at 2.36%, the 10-year at 2.91% and the 30-year at 3.38%.

The ICE municipal yield curve saw small cuts: 1.79% (+2) in 2023 and 2.09% (+1) in 2024. The five-year at 2.41% (+1), the 10-year was at 2.86% (+2) and the 30-year yield was at 3.37% (unch) at a 4 p.m. read.

The IHS Markit municipal curve was unchanged: 1.75% in 2023 and 2.09% in 2024. The five-year at 2.36%, the 10-year was at 2.92% and the 30-year yield was at 3.38% at 4 p.m.

Bloomberg BVAL saw was little changed: 1.75% (+1) in 2023 and 2.03% (unch) in 2024. The five-year at 2.37% (unch), the 10-year at 2.89% (unch) and the 30-year at 3.37% (+1) at a 4 p.m. read.

Treasuries ended stronger.

The two-year UST was yielding 3.104% (-10), the three-year was at 3.296% (-5), the five-year at 3.308% (-6), the seven-year 3.312% (-6), the 10-year yielding 3.229% (-6), the 20-year at 3.535% (-5) and the 30-year Treasury was yielding 3.281 (-5) at the close.

FOMC redux

Analysts expect unsettled markets and a growing likelihood of recession as the Federal Reserve ramps up its efforts to tame inflation.

Until price pressures abate, “markets are set to remain challenged,” said Mark Dowding, chief investment officer, of BlueBay Asset Management (part of RBC Global Asset Management). “In the short term, a mix of elevated inflation, slowing economic growth and rising interest rates create a challenging backdrop for financial markets. Until inflation can turn lower and Treasury yields stabilize, other risk assets are set to remain on shaky ground.”

Continued “aggressive” Fed moves will create a “serious risk” of recession, said Center for Economic and Policy Research Senior Economist Dean Baker. “Understandably, the Fed would want to raise rates to demonstrate its determination to keep inflation under control. It is also hard to justify a near zero federal funds rate when the unemployment rate is close to 50-year lows. However, there is a serious risk that the Fed will overshoot if it continues on this path.”

“The chances for a recession have clearly risen now even further,” said DWS Group U.S. Economist Christian Scherrmann. It’s apparent the Fed wants to “regain its inflation credibility,” as it pushes ahead “with much tighter monetary policy in order to get back ahead of the curve.”

With inflation, as measured by the consumer price index, “at an embarrassingly high 8.6% and in danger of going still higher,” he said, “the Fed probably feels it has no alternative. Its reputation has been tarnished. It therefore also has no alternative now but to follow through on its hawkish guidance — even if a recession is the ultimate outcome.”

And while the Summary of Economic Projections (SEP) offers an optimistic view on inflation and unemployment, Jeffrey Cleveland, principal and chief economist at Payden & Rygel noted, “Fed officials have made it clear that they are more afraid of doing too little to tame inflation than they are of doing too much. As a result, the economy may be in for an uncomfortable reality check.”

Having waited too long to act and now trying to catch up, he said, “policymakers are poised to ‘overcorrect.’”

Of interest, the SEP suggests a fed funds rate at yearend of 3.4%, “well above the Fed’s implied neutral rate (2.4%),” and up from a 1.9% estimate three months ago.

“How realistic is it to expect GDP growth to slow somewhat and inflation to tumble back toward 2% while the unemployment rate rises only slightly?” Cleveland asked. “We’re becoming more and more skeptical.”

Among troubling signs in the economy: fewer mortgage applications and home sales; more layoffs in the technology sector; and negative real disposable personal income growth, he said.

“That said, it will likely be a few more months before we get clear and compelling evidence that inflation is ebbing,” Cleveland said. “Further, there’s no guarantee that consumer inflation expectations will back off given the trajectory in food, energy prices, and rents.”

The Fed, he predicts, will raise rates 75 bps in July, 50 bps each in September and November and 25 bps in December, which would put the fed funds rate target at 3.50%-3.75%.

“We fear that, even if policymakers acknowledge the risks of oversteering, they would ultimately conclude that a little economic pain in pursuit of price stability (getting inflation back to 2%) is desirable,” Cleveland said. “Most FOMC members agree that there could be more economic pain, with 13 out of 18 members seeing an upside risk to their unemployment forecasts.”

And many believe the SEP projections, which cut real GDP estimates and lifted unemployment projections, are too optimistic.

“Based on the magnitude of the downward revision in the FOMC’s real GDP projections, its projections of a gradual rise in the unemployment rate may prove too optimistic,” said Mickey Levy, Berenberg Capital Markets’ chief economist for the U.S. Americas and Asia, and a member of the Shadow Open Market Committee.

Ed Al-Hussainy, senior interest rate strategist at Columbia Threadneedle Investments, was blunter. “Ignore the precise median forecasts,” he said, “they are likely still too optimistic — and instead focus on the direction of travel in 2022/23.”

After Wednesday’s statement, Al-Hussainy said his belief is “the Fed is more likely to overshoot and tighten too much, sacrificing growth/employment in the process, than to undershoot and allow inflation to surprise them to the upside again next year.”

The Fed, he noted, recognizes “that an un-anchoring of inflation expectations would be a disproportionately costly policy error for the Fed relative to a shallow recession. The front end of the rate curve remains vulnerable to sharp repricing when data surprises nullify the Fed’s already weak forward guidance. I think this mix continues to favor staying long duration and in curve flatteners.”

Still, the threats to the economy are not all controllable by the Fed, said Alex Strekel, director of investment management solutions at Clearwater Analytics. “While the Fed can take action to stabilize the U.S., it cannot as effectively impact these other risks, heightening the probability that stagflation impact will occur even if not expressly coupled with a recession.”

Mutual fund details

In the week ended June 15, Refinitiv Lipper reported $5.602 billion of outflows Thursday, following an outflow of $2.094 billion the previous week.

Exchange-traded muni funds reported outflows of $1.002 billion after outflows of $362.452 million in the previous week. Ex-ETFs, muni funds saw outflows of $4.599 billion after $1.729 billion of outflows in the prior week.

The four-week moving average widened to negative $1.879 billion from negative $1.156 in the previous week.

Long-term muni bond funds had outflows of $4.986 billion in the last week after outflows of $1.466 billion in the previous week. Intermediate-term funds had outflows of $286.249 million after $289.927 million of outflows in the prior week.

National funds had outflows of $5.108 billion after $2.034 billion of outflows the previous week while high-yield muni funds reported $1.777 billion of outflows after $25.861 million of outflows the week prior.

Informa: Money market muni assets rise again

Tax-exempt municipal money market funds continued an eight-week inflow streak as $408.2 million was added the week ending June 14, bringing the total assets to $102.17 billion, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for all tax-free and municipal money-market funds fell to 0.30%.

Taxable money-fund assets gained $35.58 billion to end the reporting week at $4.400 trillion of total net assets. The average seven-day simple yield for all taxable reporting funds rose to 0.51%.

Gabriel Rivera contributed to this story.