Municipals were better Wednesday as the smaller primary kicked into gear, while U.S. Treasuries sold off on the front end of the curve and equities ended in the red.

Pressure on UST and volatility in equities hit after stronger economic data and continued hawkish Fed speak.

“Stocks turned negative as expectations grew that the Fed won’t be easing up on its rate-hiking campaign after both solid U.S. economic data and aggressive rate hiking talk by the Bank of Canada,” said Ed Moya, at OANDA. “The U.S. economy is still looking pretty good and that means the Fed may need to stick with the half-point rate hike pace beyond the summer. Everyone expects economic activity to soften over the next couple of months, especially since inflation risks remain elevated and now that the Fed has begun shrinking its $8.9 trillion dollar balance sheet.”

Municipals ignored other markets and triple-A yield curves saw two to four basis point bumps in constructive secondary trading. Muni-to-UST ratios fell again and were at 70% in five years, 83% in 10 years and 90% in 30, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the five at 70%, the 10 at 83% and the 30 at 92% at a 4 p.m. read.

Municipal to UST ratios have become richer across the curve since the rally began. While valuations are not as cheap as earlier in May, many participants say they are at compelling levels, particularly looking at taxable equivalent yields.

Municipals posted gains for the first time in 2022 in May. The Bloomberg Muni Index posted a 1.49% return in May bringing losses down to 7.47% year to date.

High-yield gained 1.10% for the month, moving losses to 8.86% for 2022 while Bloomberg’s Impact Index saw 1.68% gains for May and losses of 9.76% year-to-date.

Taxables lost 0.70% in May, bringing total losses to 9.76% in 2022 so far.

Municipals outperformed the U.S, Treasury Index, which returned 0.2% in May.

“Municipal bonds rallied into what may well be sustainable gains last week, bolstered by buying ahead of the massive June reinvestment, a record surge into muni exchange-traded funds and stronger Treasuries,” said Matt Fabian, partner at Municipal Market Analytics.

The power of June’s nearly $50 billion of reinvestment demand, which includes $16 billion of principal payoffs for California and New York investors alone, “mitigated around another $3 billion outflows from the traditional funds,” he said.

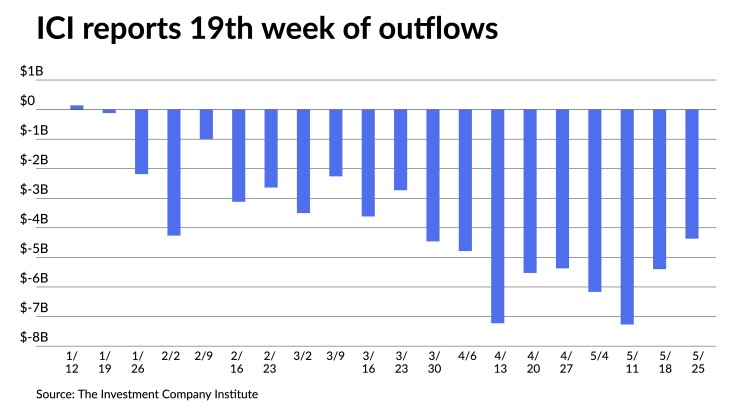

The Investment Company Institute reported investors pulled $4.367 billion from muni bond mutual funds in the week ending May 25, down from $5.398 billion of outflows in the previous week. It was the 19th consecutive week bringing ICI’s 2022 total figure to $74.4 billion. Refinitiv Lipper, which reports Thursday, has the total outflows for the year at $37.6 billion.

Exchange-traded funds saw another round of inflows at $2.150 million versus $901 million of inflows the week prior, per ICI data. This is the largest amount since March 2020.

While the high-yield sector faces materially more challenges ahead, muni high-yield fund NAVs “were near vertical last week, boosted in part by Nuveen’s reopening of its main fund to new investors and the related market action that implies,” according to Fabian.

This week, he said, “June properly starts and reinvestment demand should continue: a material driver of momentum in a space (tax-exempts) that is still fundamentally marked by product scarcity.”

The Bond Buyer 30-day visible supply sits at $13.44 billion.

“In particular, once mutual fund inflows turn positive, any secondary supply still available after last week will disappear, and long 3s and 2s will find more support, boosting evaluations of 4s and 5s,” he said.

While ratios have fallen, they are still cheap, Fabian noted, adding that “together these suggest a continued rally is more likely than the opposite.” In the past, June has tended to be a negative month for munis, “presenting one more challenge in 2022,” he said.

In the primary Wednesday, BofA Securities priced for Tampa, Florida, (Aaa/AAA/AAA/) $298.250 million of water and wastewater revenue bonds. The first tranche, $282.345 million of green bonds, Series 2022A, saw 5s of 10/2034 at 2.60%, 5s of 2037 at 2.72%, 5s of 2042 at 2.90%, 5s of 2047 at 3.04%, 5s of 2052 at 3.11% and 5s of 2057 at 3.24%, callable 10/1/2032. The second tranche, $15.905 million, Series 2022B, saw 5s of 10/2032 at 2.51%, and 5s of 2033 at 2.58%, callable 10/1/2032.

Barclays Capital priced for the Michigan State Housing Development Authority (Aa2/AA+//) $197.120 million of non-AMT social single-family mortgage revenue bonds, with 1.5s of 12/2022 at par, 2.95s of 6/2027 at par, 3.05s of 12/2027 at par, 3.7s of 6/2032 at par, 3.7s of 12/2032 at 3.73%, 4s of 12/2037 at 3.97%, 4.1s of 6/2043 at par and 5s of 6/2052 at 3.35%, callable 12/1/2031.

In the competitive market, the Iowa Board of Regents sold $130.695 million of University of Iowa Hospitals and Clinics hospital revenue refunding bonds, Series S.U.I. 2022C, to Mesirow Financial, with 5s of 9/2023 at 1.67%, 5s of 2027 at 2.25%, 5s of 2032 at 2.73%, 4s of 2037 at 3.44% and 5s of 2038 at 3.00%, callable in 9/1/2031.

Jersey City (Aa3///) sold $98.430 million of general improvement bonds, Series 2022A, to Jefferies, with 5s of 2/2023 at 1.49%, 5s of 2027 at 2.21%, 5s of 2032 at 2.73%, 3s of 2037 at 3.50% and 3s of 2038 at 3.55%, callable in 2/15/2029.

The city also sold $27.440 million of taxable general improvement bonds, Series 2022B, to TD Securities, with 2.5s of 2/2023 at par, 3.6s of 2027 at 3.57%, 4.25s of 2032 at 4.22% and 4.75s of 2038 at 4.57%, callable 2/15/2032.

Informa: Money market muni assets rise again

Tax-exempt municipal money market funds continued a six-week inflow streak as $938.5 million was added the week ending May 30, bringing the total assets to $99.24 billion, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for all tax-free and municipal money-market funds stayed at 0.42%.

Taxable money-fund assets gained $1.23 billion to end the reporting week at $4.363 trillion in total net assets. The average seven-day simple yield for all taxable reporting funds rose 0.02% to 0.45%.

Secondary trading

Texas 5s of 2023 at 1.54%. Oregon 5s of 2024 at 1.85%-1.84%. California 5s of 2024 at 1.77%-1.70%.

Henrico County, Virginia, waters 5s of 2026 at 2.00%-1.99%. Loudoun County 5s of 2028 at 2.21%.

New York City 5s of 2031 at 2.66%. New York Dorm PITs 5s of 2031 at 2.64%-2.62%. Maryland 5s of 2031 at 2.42%-2.40%. Baltimore County 5s of 2031 at 2.42% versus 2.43% Tuesday.

Princeton 5s of 2032 at 2.48%-2.47% versus 2.54%-2.49% Tuesday and 3.09% original.

Loudoun County 5s of 2033 at 2.52% versus 2.82% original. Energy Northwest 5s of 2036 at 2.78%. NYC waters 5s of 2039 at 2.95%. Tennessee 4s of 2041 at 3.07% NYC TFA 3s of 2048 at 3.75%.

AAA scales

Refinitiv MMD’s scale was bumped up to four basis points at the 3 p.m. read: the one-year at 1.51% (-3, +3 June roll) and 1.79% (-4, no roll) in two years. The five-year at 2.05% (-4, no roll), the 10-year at 2.43% (-4, no roll) and the 30-year at 2.78% (-3).

The ICE municipal yield curve saw one to four basis point bumps across the curve: 1.49% (-4) in 2023 and 1.82% (-3) in 2024. The five-year at 2.07% (-2), the 10-year was at 2.41% (-2) and the 30-year yield was at 2.85% (-1) at a 4 p.m. read.

The IHS Markit municipal curve saw three basis point bumps: 1.48% (-3) in 2023 and 1.78% (-3) in 2024. The five-year at 2.05% (-3), the 10-year was at 2.45% (-3) and the 30-year yield was at 2.79% (-3) at 4 p.m.

Bloomberg BVAL saw two to four basis point bumps: 1.53% (-3) in 2023 and 1.81% (-3) in 2024. The five-year at 2.12% (-4), the 10-year at 2.45% (-3) and the 30-year at 2.80% (-2) at a 4 p.m. read.

Treasuries sold off on the front end.

The two-year UST was yielding 2.641% (+8), the three-year was at 2.818% (+9), the five-year at 2.910% (+9), the seven-year 2.950% (+8), the 10-year yielding 2.909% (+5), the 20-year at 3.287% (+3) and the 30-year Treasury was yielding 3.062 (+1) at the close.

Primary to come:

Atlanta, Georgia, (Aa3//AA-/) is set to bring a total of $578 million of AMT and non-AMT airport general revenue bonds consisting of $179.51 million of exempts, $118.145 million of exempts, $218.765 million and $61.95 million of AMT bonds. Goldman Sachs & Co.

The Utah Board of Higher Education (Aa1/AA+//) is set to price Thursday $505.450 million of green University of Utah general revenue bonds, Series 2022B, serials 2024-2042, term 2047. Barclays Capital.

The Massachusetts Educational Financing Authority is set to price Thursday $394.700 million of education loan revenue bonds, Issue M, consisting of: $143.350 million of taxable senior bonds (/AA//), Series 2022A, serials 2024-2031, term 2038; $52.370 million of AMT senior bonds (/AA//), Series 2022B, serials 2024-2031, term 2038; and $28.500 million of AMT subordinate bonds (/BBB//), Series 2022C, serial 2052. RBC Capital Markets.

The New York State Housing Finance Agency (Aa2///) is set to price Thursday $394.210 million of affordable housing revenue bonds, consisting of: $68.660 million of climate bond certified/sustainability bonds, 2022 Series D-1; $209.985 million of climate bond certified/sustainability bonds, 2022 Series D-2; $24.785 million of sustainability bonds, 2022 Series E-1; and $90.780 million of sustainability bonds, 2022 Series E-2. Morgan Stanley & Co.

The Department of Water and Power of the City of Los Angeles (Aa2//AA/AA+/) is set to price Thursday $346.685 million of water system revenue bonds, 2022 Series C, serials 2023-2025 and 2034-2043, terms 2047 and 2052. Siebert Williams Shank & Co.

Competitive:

Beaufort County School District, South Carolina, (Aa1/AA//) is set to sell $139.610 million of general obligation bonds, Series 2022C at 11 a.m. eastern Thursday.