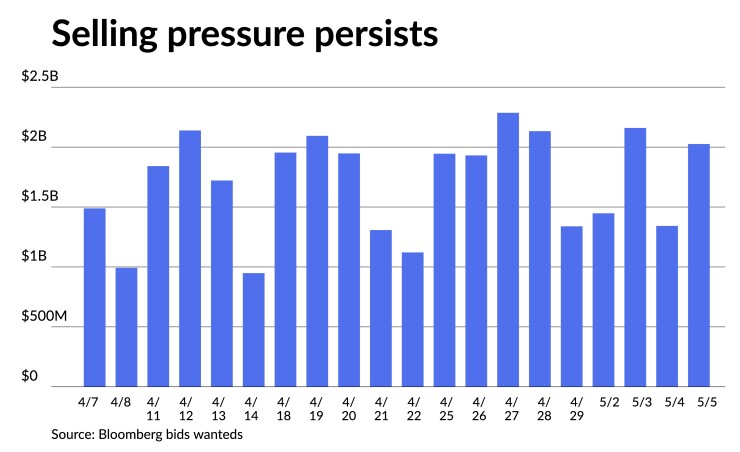

Municipals were weaker amid more selling pressure to close out the week, U.S. Treasury yields rose with the 10-year sitting firmly above 3% and equities ended in the red.

Triple-A muni benchmarks were cut up to four basis points while UST yields rose five to 10 basis points five years and out.

Muni to UST ratios were at 84% in five years, 91% in 10 years and 99% in 30, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the five at 82%, the 10 at 91% and the 30 at 100% at a 3:30 p.m. read.

Ahead of next week’s $6.63 billion issuance, the municipal market continues to be led by the macro effects — overall rising interest rates and massive volatility since the beginning of the year, according to John Farawell, managing director of municipal underwriting at Roosevelt & Cross.

“We continue to have outflows from the funds and that adds to the pressure,” he said, but at the same time, municipal to Treasury ratios and the nominal yield levels are “extremely attractive,” which is generating some renewed interest among the retail crowd.

“We are starting to see some retail come back into the municipal market that we haven’t seen in a while because nominal yields are so attractive,” Farawell said.

The Fed rate increase this week did not surprise participants, but he said investors might be questioning the amount they raised rates.

“They did the 50 as expected, and [Powell] seemed to be saying the right type of things, but then all of sudden when the market started to reevaluate what he said they questioned whether he should have done 75 and not 50, and we sold off big time,” Farawell said.

“I think a lot of people are still questioning the Fed, and the fact that they are late to the game,” he added, noting that the Ukraine crisis continues to add the already troubling supply chain pressure and rates.

“The question is, by raising rates can they control inflation,” he added. “In terms of a soft landing, it seems like the economy definitely has some pressure moving forward after they raise rates.”

Supply ticks up

Investors will be greeted Monday with an uptick in supply, albeit still on the lighter side of historicals. The new-issue calendar reaches $6.631 billion with $5.410 billion of negotiated deals and $1.221 billion of competitive loans.

The primary calendar is led by two large deals from the Dormitory Authority of the State of New York — $751 million of School Districts Revenue Bond Financing Program revenue bonds and $735 million of Northwell Health Obligated Group revenue bonds. Other notable deals include $700 million of GOs from the San Francisco Bay Area Rapid Transit District, California, and $422 million of GOs from the state of Oregon.

Wisconsin is expected to sell $183 million to lead the competitive calendar, along with the Orange Unified School District, California, with $100 million.

“The muni market’s improvement thus far in May has been less than expected, as mutual fund outflows persist and long-term Treasury rates remain volatile,” noted BofA strategists Yingchen Li and Ian Rogow in a weekly report.

Still, they noted, “mutual fund outflows have become smaller, and muni market volatilities are lower than Treasuries.”

“New buyers in tax-exempt munis are more active in the short maturities, including money market and short-call bonds, while long-duration bonds need to price cheap in the primary market,” they said. “Hopefully, the lighter-than-feared Fed quantitative tightening plan will help to stabilize long-term Treasury rates and give muni duration investors some forward clarity.”

For the market to see a much-needed turnaround, rates need to stabilize, according to Barclays PLC.

Barclays strategists Mikhail Foux, Clare Pickering and Mayur Patel said “technicals will improve going forward, as muni investors will receive abundant cash from bond redemptions and coupons over the summer months, which should move net issuance into negative territory.”

They also point to fund outflows as an ongoing still be a problem for the market.

“If we go by what happened in 2013, the market environment that resembles what happens in the muni space this year, fund outflows continued for quite some time even after rates stabilized, although peak outflows occurred only during the months of the largest Treasury yield increases,” they wrote.

While they don’t see “outflows stopping on a dime, if they become smaller, they will start having a smaller negative effect on the municipal market.”

Barclays strategists still “see current weakness as an opportunity to add, but are cautious with longer-duration assets and much rather prefer bonds in the belly of the curve, possibly trading down in coupon.”

They continue to believe “that investors might find good value in taxable munis.” But, with corporates under pressure, “as concerns about a possible recession have intensified,” they said “wider credit spreads have also put pressure on taxable munis.”

After trading well through taxables in April, Barclays strategists said, “corporate spreads are now actually trading wider, which makes them less attractive for crossover investors, while foreign investor appetite for taxable municipals has been negatively affected by higher hedging costs.”

“All of the above makes it harder for taxable muni spreads to perform well in the current market environment, but we are still hopeful longer term,” they said.

Secondary trading

Massachusetts 5s of 2024 at 2.31%-2.25% versus 2.32%-2.30% Thursday. Guilford, North Carolina 5s of 2025 at 2.50%-2.45%. Arlington, Virginia 5s of 2025 at 2.57%-2.53%.

Cornell University 5s of 2026 at 2.58%. Montgomery County, Maryland 5s of 2026 at 2.55%-2.52%. Triborough Bridge and Tunnel Authority 5s of 2026 at 2.68% versus 2.70% Thursday.

Maryland 5s of 2028 at 2.61%-2.58%. NY Dorm PIT 5s of 2029 at 3.03%-3.04%. North Carolina 5s of 2030 at 2.89% versus 2.57% on 4/20. Georgia 5s of 2031 at 2.87%.

NYC Municipal Water Finance Authority 5s of 2039 at 3.57% versus 3.50% Thursday, 3.43% on 4/27 and 3.44%-3.41% on 4/20.

LA DWP 5s of 2042 at 3.50% versus 3.43% Thursday.

AAA scales

Refinitiv MMD’s scale was cut up to four basis points 3 p.m. read: the one-year at 1.97% (unch) and 2.27% (+2) in two years. The five-year at 2.54% (+3), the 10-year at 2.85% (+4) and the 30-year at 3.17% (+3).

The ICE municipal yield curve was cut two to four basis points: 2.03% (+2) in 2023 and 2.35% (+2) in 2024. The five-year at 2.53% (+4), the 10-year was at 2.81% (+4) and the 30-year yield was at 3.24% (+4) at a 4 p.m. read.

The IHS Markit municipal curve was cut two to four: 1.99% in 2023 (unch) and 2.29% (+2) in 2024. The five-year at 2.56% (+3), the 10-year was at 2.83% (+4) and the 30-year yield was at 3.17% (+3) at 4 p.m.

Bloomberg BVAL was cut one to four basis points: 1.99% (+1) in 2023 and 2.26% (+1) in 2024. The five-year at 2.57% (+3), the 10-year at 2.82% (+4) and the 30-year at 3.13% (+3) at a 4 p.m. read.

Treasury yields rose.

The two-year UST was yielding 2.720% (+1), the three-year was at 2.934% (+2), five-year at 3.058% (+5), the seven-year 3.135% (+8), the 10-year yielding 3.124% (+8), the 20-year at 3.448% (+10) and the 30-year Treasury was yielding 3.218% (+9) near the close.

Jobs report

Analysts had no clear consensus on the employment report, which showed 428,000 jobs added, an unemployment rate steady at 3.6%, labor force participation down two-tenths of a point, and average hourly earnings on an annual basis slightly below March’s level.

The data are “consistent with job openings and quits data that point to robust labor demand amid limited supply and largely reaffirms the Fed’s hawkish pivot,” said Mickey Levy, Berenberg Capital Markets’ chief economist for the U.S. Americas and Asia, and a member of the Shadow Open Market Committee.

The wage data, while hinting “the pace of nominal wage growth may have begun to moderate,” he said, “remains elevated at a level inconsistent with the Fed’s 2% inflation target.” But wage growth should “remain elevated but potentially ease in the coming months,” given there are nearly two jobs available for each person seeking work.

And while one month could be a distortion, Levy said, “the moderation in measures of labor market activity in April and the deceleration in nominal wage growth over the last three months are likely to be welcomed by the Fed.”

Should this continue, it “would raise the probability the Fed will be able to tamp down on inflation and inflationary pressures without tipping the economy into a recession.”

But even if the economy were to slip into recession, National Association of Realtors Chief Economist Lawrence Yun said, “it would be unique because of the tight job market.” Labor market tightness “is one of the factors contributing to higher inflation,” he said. As such, expect “many more rate hikes.”

“The ratio of job openings to workers is expected to hit 1.8 in April, matching the second-highest level on record,” said Grant Thornton Chief Economist Diane Swonk. “That is not exactly reassuring to the Federal Reserve, which is looking for that ratio to drop close to one-to-one.”

The strength of the employment sector is “adding to inflationary pressures.” And while Federal Reserve Board Chairman Jerome Powell said he hoped to curb “inflation without a ‘significant’ increase in unemployment,” she said, “hope is not the same as reality.”

The Fed will remain “in a hawkish mood,” said DWS Group U.S. Economist Christian Scherrmann. The only weakness he saw in the report was the 2,000 construction jobs added in April, 20,000 less than the month before.

“But despite the overall surprise in job creation, wage pressures did not accelerate — though they remained at very high levels,” Scherrmann said.

But the question that needs to be answered, he said, “is whether the fading dynamic in wage growth is the first sign of a slight cooling in the labor market.”

Still, it should get harder to add jobs at this point, said Morning Consult Chief Economist John Leer. “First, job growth tends to naturally slow over time toward the end of a strong economic recovery.” Also, the Fed rate hikes will impact employment gains in a few months, he said

Possible hints of slowing job growth, said Scott Anderson, chief economist at Bank of the West, were the unemployment rate holding at 3.6% when economists expected a dip to 3.5%; and a drop in the labor participation rate to 62.2% from 62.4%, when economists predicted a rise.

“If this labor market shrinkage is sustained in the months ahead, it will make it harder for the U.S. labor market to continue to outperform on job creation every month and could even accelerate the decline in the U.S. unemployment rate,” he said. “This could force the Federal Reserve into the uncomfortable position of having to tighten monetary policy even more forcefully in response to a labor market that is so clearly overshooting ‘full employment’ for fear that it could further stoke already elevated inflation expectations or lead to a wage-price spiral.”

While earnings rose 0.3% in the month, David Page, head of macro research at AXA Investment Managers, said, “the monthly pace has been volatile and subject to revision — there is no obvious trend deceleration here yet.” While wage growth doesn’t appear to be accelerating, “there is only tentative evidence that it is receding.”

No matter what the May employment report says, it is unlikely to derail the next 50 basis point rate hike. But there will be two employment reports before the FOMC’s July meeting, Page noted.

“On balance, we see insufficient development to stall that hike either,” he said. “But we will watch to see whether a broader deceleration in activity, evident in Q1 GDP and a wider range of metrics, begins to more obviously show up in labor market data as we go into the summer.”

Should a slowdown occur, “it would not only merit a change of gears from the Fed, to 0.25% hikes from 0.50%, but ultimately we believe will necessitate an outright pause to stop efforts to remove excess demand from the system turning into pushing the economy into a more meaningful slowdown,” Page added.

Primary to come:

The Dormitory Authority of the State of New York is set to price Wednesday $750.790 million of School Districts Revenue Bond Financing Program revenue bonds, consisting of $724.310 million (Aa3//AA-/), Series 2022A, serials 2023-2037, term 2042 and 2051 and $26.480 million (/AA/AA-/), Series 2022B, serials 2023-2037. Roosevelt & Cross.

The Dormitory Authority of the State of New York (A3/A-/A-//) is set to price Tuesday $735 million of Northwell Health Obligated Group revenue bonds, Series 2022A, serials 2033-2041, terms 2045 and 2052. Citigroup Global Markets.

The San Francisco Bay Area Rapid Transit District (Aaa//AAA/) is set to price Wednesday $700 million of Election of 2016 general obligation bonds, consisting of $604.270 million of Series D-1, serials 2024-2042, terms 2047 and 2052 and $95.730 million of Series D-2, serials 2022. Stifel, Nicolaus & Co.

Oregon (Aa1/AA+/AA+/) is set to price Tuesday $422.415 million of general obligation bonds, consisting of $178.085 million of bonds, 2022 Series A; $175.800 million of taxable sustainability bonds, 2022 Series B; and $68.530 million of bonds, 2022 Series C. Morgan Stanley & Co.

The Harris County Cultural Education Facilities Finance Corp., Texas, is set to price Thursday $277 million Memorial Hermann Health System hospital revenue bonds, consisting of $170 million of fixed rate bonds, Series 2022A; $55 million of fixed-rate puttable bond, Series 2022B; and $52 million of fixed-rate notes, Series 2022C. J.P. Morgan Securities.

Georgetown, Texas, (/A+//) is set to price Thursday $223.330 million of utility system revenue bonds, Series 2022. Morgan Stanley & Co.

The Industrial Development Authority of the City of Phoenix, Arizona, is set to price Thursday $199.926 million of All Sports Village Project economic development revenue bonds, consisting of $180.660 million of tax-exempt bonds, Series 2022A, $6 million of taxable bonds, Series 2022B and $13.266 million of tax-exempt, Series 2022C. D.A. Davidson & Co.

Richardson Independent School District, Texas, is set to price Tuesday $189.960 million of unlimited tax school building bonds, Series 2022, insured by the Permanent School Fund Guarantee Program. Piper Sandler & Co.

Pennsylvania State University (Aa1/AA//) is set to price Tuesday $151.080 million, consisting of $124.580 million of tax-exempt bonds, Series A of 2022, serials 2023-2042, terms 2047 and 2052 and $26.500 million of taxable bonds, Series B of 2022, serials 2023-2037, term 2042. Barclays Capital Inc.

The School Board of Broward County, Florida, (Aa3//A+/) is set to price Tuesday $151.020 million of certificates of participation, Series 2022B. Morgan Stanley.

The Minnesota Higher Education Facilities Authority (A2///) is set to price Wednesday $128.125 million of University of St. Thomas revenue bonds, consisting of $59.775 million of green bonds, Series 2022A, serials 2025-2042, terms 2047 and 2052 $68.350 million of Series 2022B, serials 2025-2042, terms 2047 and 2052. RBC Capital Markets.

The Bay Laurel Center Community Development District, Florida, (/AA//) is set to price Thursday $126.770 million of taxable water and sewer revenue bonds series 2022B, serials 2024-2032, terms 2042 and 2052, insured by Assured Guaranty Municipal Corp. Jefferies.

The Indiana Housing And Community Development Authority (Aaa//AAA/) is set to price Wednesday $115.840 million of social single-family mortgage revenue bonds, 2022 Series B, serials 2023-2034, terms 2037, 2042, 2047 and 2052. RBC Capital Markets.

The Houston Independent School District, Texas, (Aaa/AAA//) is set to price Tuesday $109.380 million variable rate limited tax schoolhouse bonds, Series 2014A-2, insured by the Permanent School Fund Guarantee Program. Piper Sandler & Co.

Competitive:

Wisconsin is set to sell $183.375 million of general obligation bonds of 2022, Series A, at 10:45 a.m. eastern Tuesday.

Orange United School District, California, (/AA//) is set to sell $100 million of Election of 2016 general obligation bonds, Series 2022, at noon Tuesday.