Low prices made Uber into a global sensation. Now they threaten its future. Cheap fares kept the ride-hailing app on the road through its worst years, despite accusations of aggressive rule-breaking, a belligerent founder and friction with drivers. But as the financial credibility of its disruptive business model is wearing thin, the era of Silicon Valley-backed growth at all costs is at an end.

Uber is a company valued at $91bn that still loses money. For more than a decade, investors have accepted billions of dollars of loss. Not for much longer. Uber is pledging to balance the books. Since the start of the pandemic it has shed its experimental driverless car and vertical lift-off aircraft units, offloaded bikes and scooters and reduced headcount by around 25 per cent.

Prices for customers are rising too. Uber, a company born in the midst of the financial crisis, is trying to deliver profits just as the labour market is in flux. To the dismay of users, ultra cheap services are growing more costly.

So far, the combination of cost cuts, efficiency and higher rates is working. In September, Uber declared that it could soon report a positive adjusted ebitda figure — a self-defined measure of profitability. The market reaction was euphoric. The company’s stock price jumped 11 per cent on the day. Dara Khosrowshahi, Uber chief executive, describes its balance sheet as “great”.

If Uber is about to end a decade of losses and mark the beginning of a profitable future it will be one of the best turnround stories in the tech industry. But adjusted figures can be deceptively optimistic.

Ride sharing in a pandemic

In theory, Uber should be cheap to run. It does not own vehicles or directly employ the drivers who ferry passengers, food and freight around the world. Uber is just a platform — a broker arranging deals between buyers and sellers for a fee.

But the gig economy has proved more expensive than envisaged. The idea was that companies could flood the market with on-demand services like laundry, food delivery, rides and repairs. They would grow their customer base by absorbing some of the cost of services, relying on workers who were not employees and elbowing out rivals.

Silicon Valley venture capital provided the rocket fuel. Uber, which started as a luxury car service app in San Francisco, grew into a global transport business with freight, food and grocery deliveries. More than 100m people use the platform every month.

Unfortunately, competition has proved relentless. In the US alone, Uber is still locked in a fight with Lyft for rides and DoorDash for food deliveries, among others. It cannot risk removing subsidies completely. In April, the company announced that it would need to spend another $250m on incentives to ward off a driver shortage.

Prices are a delicate calculation. Too high and passengers will cancel. Too low and drivers will find other work. Plus Uber has to strike the right balance with the share of fees it takes.

There is a further problem. If drivers obtain the employee status that many are fighting for — and which some countries and states are demanding — future profits could evaporate. Uber claimed prices could double if it was subject to a California bill that sought to reclassify some gig workers as employees. It is still exempt despite a California judge ruling that the law classifying gig workers as independent contractors was unconstitutional. In the UK, a Supreme Court ruling in February guaranteed holiday pay and a minimum wage to the drivers who had brought the case. In the first quarter of the year Uber reported a $600m accrual as a result of that single change.

The business is still recovering from the pandemic, which put a stop to car sharing and blew a hole in revenues. Passengers are returning. But as Uber focuses on profits, prices in some cities are noticeably higher. Five years ago, an Uber ride in London was around a third cheaper than for a traditional black cab. Now the prices are similar, depending on demand. Uber’s cheaper “pool” option, in which several riders share a trip, was suspended during the pandemic and is only slowly returning.

Keeping rivals at bay

Uber’s expanding food delivery business — ranging from fast food to neighbourhood restaurants — cushioned the company from the drop in passenger demand during the pandemic. Last year it overtook rideshare as the company’s largest source of revenue. Khosrowshahi believes that habits formed in lockdown will remain in place long after reopenings.

But food delivery is a drag on profitability. There has been consolidation in some regions — in the US Uber acquired rival companies including alcohol delivery service Drizly and food delivery company Postmates. To break even, Uber must still either take a higher share of each order or group more orders into single trips, lengthening delivery times.

Food retailers, such as Hanson Li, co-founder of Lazy Susan, a delivery-only Chinese restaurant in Hayes Valley, an affluent neighbourhood of San Francisco, have been working with Uber Eats for some time. The dishes he sells are prepared to cope with bumpy rides. “It’s got that crunch, right? It’s not soggy,” he says of his signature garlic and basil chicken wings. “We spent a lot of time designing chicken wings that would withstand travel.”

Lazy Susan makes use of empty kitchen space in a restaurant that closed during the pandemic, but Li says delivery costs are still too high. “The consumer receipt is starting to look like a rental car agreement,” he says, referring to the growing number of line items on a typical Uber food delivery receipt, including regulatory fees, San Francisco-specific tax measures and other charges — not including a tip.

Like every restaurant owner in the city, Li is looking closely at how those charges stack up, and whether delivery companies like Uber might turn the screw in order to make their own services profitable.

In the past, food delivery companies have been known to charge as much as 30 per cent commission to restaurants on each order. In San Francisco they can now charge a maximum of 15 per cent, after city supervisors voted to maintain a pandemic-era cap on commissions. New York City recently passed a bill to make a 23 per cent cap permanent.

Alongside the continued fight over driver employee status, battling commission caps in different markets will be a significant feature of Uber’s activity in 2022.

While Uber is pulling out the stops to compete toe-to-toe with global food delivery companies, there is one area where the company is happy to sit back and let others plough billions of dollars into investments: rapid grocery services. Over the past year, DoorDash has expanded its network of US “DashMart” warehouses, while small but heavily capitalised players like Gopuff have promised all manner of convenience items in 30 minutes or less from purpose-built facilities.

Uber limits its grocery delivery offers to existing stores. “We don’t think we can add a huge amount of value in running a store,” Khosrowshahi says. “That’s not where the magic happens. So we will partner with experts in running a store or restaurant.”

These partnerships include integrating Gopuff into the Uber Eats app, a move both parties say leaves enough margin to make it worthwhile.

“The danger to Uber is that if all they do is partner with experts, it opens the door for DoorDash, Shipt, Instacart or any of the rapid grocery delivery companies to cut a deal with Uber’s grocery, retail and restaurant customers,” says Brittain Ladd, a consultant specialising in the grocery sector. “I am not convinced that Uber won’t open its own automated dark stores to offer ‘fulfilment by Uber’.”

The right direction?

Expansion comes at a price. In spite of cutting costs, Uber recorded a $6.8bn net loss last year.

Although it jettisoned some lossmaking parts of the company, it has held on to its emerging Freight business. In 2020, revenue for the freight division, which matches truckers to cargo by cutting out brokers, exceeded $1bn.

In the tech industry, heavy losses are not necessarily a sign of failure. But Uber’s early investors, the risk takers like VC firm Benchmark Capital that are tolerant of the growth-at-all-costs model, have mostly departed. To warrant its market value, Uber has to prove that its underlying business can make money.

Roger McNamee, a veteran tech investor, is sceptical. “The three values of the post-2010 Silicon Valley — efficiency, speed, and scale — laid the foundation for predatory business models,” he says. “The notion was to raise so much capital and move so fast that your company became a self-fulfilling prophecy.” Some of the companies that adopted this model have become real, profitable businesses. But not all.

Uber’s profitability is a moving target. It managed to report $1.1bn of profit in the last quarter to June 30. But this figure was boosted by high valuations of its investments in other companies, including a $1.4bn unrealised gain from its stake in Chinese ride-hailing company Didi. These paper gains produced no hard cash.

Didi’s share price has since crashed, following China’s decision to investigate its handling of personal data. This will drag on Uber’s profits.

Khosrowshahi is clear that one-off profitability is not what Uber wants. “We’re after sustainable, free cash flow generation — GAAP profitability [numbers that comply with generally accepted accounting principles] with very big top-line growth, over a five- to 10-year period,” he says. “That’s the goal here. And you know, you only get there by building a great company that’s offering incredible services to people all around the world. And that’s where it starts, and that’s where it ends.”

But a look at Uber’s business operations reveals that the losses are stark. In the first six months of the year, free cash flow was minus $1.1bn.

Uber prefers to direct investors towards another number: adjusted ebitda, or adjusted earnings before interest, taxes, depreciation and amortisation. It sees this as a good proxy for the profitability of core services because it excludes non cash expenses and one-off charges. In the last quarter the number was minus $509m. In the next quarter, Uber says it could be positive.

Adjusted numbers are popular with US companies because they allow them to create bespoke metrics. Companies say they can provide a clearer picture of how the business works. Mentions of adjusted ebitda during S&P 500 company earnings calls are up more than 50 per cent since 2015, according to Zion Research Group. Many look better than standard numbers.

Angelo Zino, an analyst at CFRA, an investment research firm in New York, believes Uber’s adjusted ebitda figure demonstrates the company is on the right track. “Positive cash flow and GAAP profitability are more important, but this shows things are moving in the right direction,” he says.

But Uber’s adjusted ebitda figure excludes stock-based remuneration, which was $272m in the last quarter. Dave Zion at Zion Research points out that in a tech company like Uber, stock based compensation is a very real cost of doing business as it forms a significant portion of employee pay. “Take away the stock compensation then see how many employees leave and how the business runs,” he says.

Stability over ambition

Since ousting founder Travis Kalanick in 2017, Uber has successfully shed the worst of its image. Under Khosrowshahi it has morphed from a ruthless start-up with a toxic work culture into a sober, public company. A recent profile described the chief executive as the “dad of Silicon Valley”.

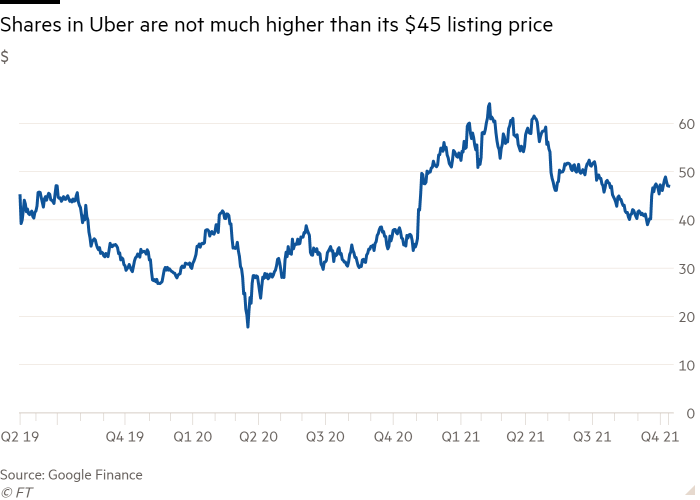

But Khosrowshahi has not been able to erase all of Uber’s problems. The share price hovers close to its 2019 listing of $45. The future of gig workers poses an existential threat. Chief legal officer Tony West, brother-in-law of US vice-president Kamala Harris, led a successful campaign that exempted Uber drivers from California’s gig worker bill. But multiple states and governments remain unhappy that drivers are classed as self-employed, and continue to work on legislative measures designed to close what they see as an employment loophole.

In the US, a labour shortage and rising demand has created an expensive problem. Flexibility, touted by Uber as a key incentive for drivers, is not enough. Drivers want better remuneration.

But so long as they do not become employees, Uber is forecast to report positive ebitda on a non-adjusted basis by next year. This, says Zino at CFRA, could bring about heightened scrutiny from regulators. “My concern is that it might prove too much of a good thing,” he says. “Regulatory issues may increase as it becomes more profitable.”

The wild card remains robot taxis, once seen as the answer to Uber’s labour and wage problems. Failure to offer autonomous vehicles is listed as a risk factor in the company’s most recent annual report — though tests were halted after the death of a pedestrian in 2018.

The cost of developing autonomous vehicles will be vast. So will the cost of buying, renting and insuring them. Uber’s decision to sell its driverless cars unit to Aurora, while taking a 26 per cent stake in the business, is sensible for the company’s cash flow. But it also removes some of the distinctive innovation that supports outsize valuations in tech. Uber has chosen stability over anarchic ambition. Investors are left to decide whether a transportation company that is still a year away from ebitda break-even is worth $91bn.