Municipal yields edged higher Friday as selling pressure emerged early and buyers greeted it by demanding some concessions, though municipals still outperformed taxables by a large degree on the week.

Triple-A benchmark yields rose another two to three basis points, moving the municipal 10-year to 1% on both Refinitiv MMD and ICE Data Services scales. The last time the 10-year was at 1% or above was June 29 at 1.01% and it fell as low as 0.81% in mid-July, according to Refinitiv MMD data.

Secondary trading was choppy but the prints clearly showed a bias toward higher yields. Short-end selling moved the one-year yield to 0.11% and 0.12% on benchmark scales after trading a week ago had it trading as low as 0.06%.

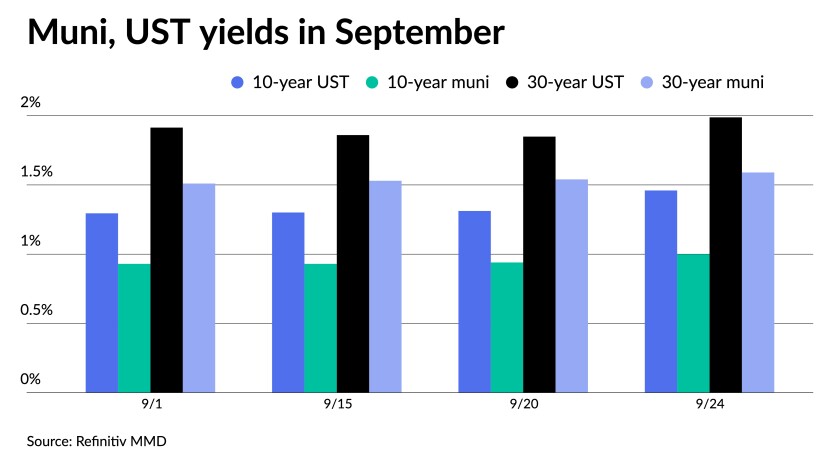

The 10- and 30-year UST yields rose 15 and 14 basis points, respectively, since Monday while municipals have risen less than half of that.

The 30-year UST was approaching 2% near the close at 1.987%. The last time it hit 2% was August 11.

Ratios fell with the week’s moves, with the 10-year municipal to UST ratio at 69% and the 30-year at 80%, according to Refinitiv MMD. The 10-year ratio was at 69% while the 30-year was at 78%, according to ICE Data Services.

“After the post-Fed rate selloff, tax-exempts were able to hold their ground relatively well — bending but not breaking — with muni-UST ratios collapsing in a hurry,” according to a weekly report from Barclays. “However, if rates remain under pressure, at some point tax-exempts will have to follow. We expected September’s muni performance to be relatively subdued, and it is definitely turning out to be this way thus far, with both [investment-grade] and [high-yield] returns close to zero for the month.”

Month-to-date returns for municipals are in the red with the Bloomberg Fixed Income Indices municipal index returning -0.12%, high-yield at -0.15% and taxables at -0.32%. Municipals in those sectors are still in the black for the year at 1.40%, 7.08% and 1.44%, respectively.

“Going into October, we are getting somewhat concerned about the near-term market outlook, as historical muni performances have been much more challenging around this time of the year, especially for high-grade tax-exempts,” Barclays strategists Mikhail Foux, Clare Pickering and Mayur Patel wrote in the report. “Moreover, supply is typically quite heavy in October, and this year will likely not be an exception.”

They also noted that policy-related concerns related to tax reform and the debt ceiling will add to uncertainties and pressure. On top of that, “possible rate volatility, which could have a negative effect on fund flows and investor appetite in general; and lack of dealer appetite for risk in early Q4 after a profitable year all point to possible challenges for municipals ahead.”

In general, they said they are “not overly concerned, as we see this as a temporary dislocation; if the muni market does sell off in the next 4-6 weeks, we would view it as an attractive medium-term buying opportunity.”

Supply is growing leading into the final week of September and the quarter end. Thirty-day visible supply is $15.31 billion.

The total potential volume for the final week of the quarter is estimated at $11.398 billion with $9.434 billion of negotiated deals and $1.964 billion of competitive loans.

Tax-exempt issuance drops to $5.65 billion of that as Hawaii comes with $1.9 billion of taxables and the Golden State Tobacco Securitization Corp. also brings $1.8 billion of taxables.

Secondary trading and scales

Hawaii 4s of 2022 at 0.10%. New York State 5s of 2022 at 0.10%. Maryland Department of Transportation 5s of 2022 at 0.11%. Massachusetts 5s of 2022 at 0.11%. Mecklenburg County, North Carolina, 5s of 2022 at 0.10%. Tennessee 5s of 2022 at 0.13%. North Carolina 5s of 2022 at 0.10%. New York EFC 5s of 2022 at 0.12%. Virginia College Building Authority 5s of 2022 at 0.10%.

New York City TFA 5s of 2026 at 0.53%. Wisconsin 5s of 2026 at 0.44%. Minnesota 5s of 2027 at 0.64%. Frederick County, Maryland, 5s of 2028 at 0.80% (0.70% on 9/15). Los Angeles MTA 5s of 2028 at 0.64%. New York City TFA 5s of 2030 at 1.11%.

California 5s of 2032 at 1.18%. Michigan Trunkline 5s of 2034 at 1.38%. Texas water 5s of 2037 at 1.57%-1.56% (9/9 1.54%).

New York City 5s of 2047 at 1.92%.

Refinitiv MMD saw the one-year rise one basis points to 0.11% in 2022 and up one to 0.14% in 2023. The yield on the 10-year rose three to 1.00% while the yield on the 30-year rose three to 1.59%.

The ICE municipal yield curve showed bonds rise three basis points in 2022 to 0.12% and three to 0.16% in 2023. The 10-year maturity rose two to 1.00% and the 30-year yield was steady at 1.55%.

The IHS Markit municipal analytics curve showed the one-year rise three to 0.11% and three to 0.16% in 2023. The 10-year rose three to 0.99% and the 30-year was also up three to 1.58%.

The Bloomberg BVAL curve showed short yields rise two to 0.11% and 0.11% in 2022 and 2023. The 10-year yield rose two to 0.99% and the 30-year yield rose two to 1.57%.

The 10-year Treasury was yielding 1.455% and the 30-year Treasury was yielding 1.987% in late trading. The Dow Jones Industrial Average rose 39 points or 0.11%, the S&P 500 gained 0.15% while the Nasdaq lost 0.03% near the close.

Debt ceiling near

With the debt ceiling limit near, analysts expect a brief government shutdown, but the municipal bond market could benefit, and a closure would be done before the Federal Reserve announces its taper plans, so those would not be impacted.

It appears the Democrats will have to raise the debt limit on their own, said Wilmington Trust Chief Investment Officer Tony Roth. “There is a good chance for a government shutdown at the end of the month” with no bipartisan agreement to increase the debt limit, he said.

Scott Ruesterholz, a portfolio manager at Insight Investment, agrees. “Unless Democrats agree to separate government funding from the debt ceiling, there could be a partial government shutdown at the start of October.”

But the muni market is not concerned about a shutdown or default, Wilmington’s Roth said. “I don’t think the market is pricing in a chance of default.”

A shutdown, he suggested, could lead to an increase in muni purchases in a flight to safety.

The lack of bipartisan agreement on the debt ceiling could hurt business and consumer confidence, said Dec Mullarkey, managing director, investment strategic research & initiatives at SLC Management, which could “spill over to the labor market.”

Not raising the debt limit before it’s reached “could significantly tighten financial conditions, particularly with tapering in the queue,” he said. In 2011, a default was days away, Mullarkey said, “and financial markets tightened significantly as risk premiums jumped.”

Should the limit not be raised by November, he added, “that materially changes the tapering calculus for the Fed. It will likely be forced to delay until an agreement is in place. Stable financial conditions are critical to the Fed and anything that amplifies broad market uncertainty, makes it cautious.”

And while a shutdown is possible, Insight’s Ruesterholz said, “Our central case is narrowly for no shutdown, but the risk of a brief one is significant and rising.” He said a debt limit hike is unlikely before mid-October. “As such, market nerves could well be frayed for almost another month. The potential for increased market volatility will rise as this timeframe narrows.”

But, previous shutdowns, he said, had “limited market impacts.”

Should the stalemate be prolonged, with the debt ceiling “not raised before the Treasury’s cash holdings run out, potentially toward the end October, Ruesterholz said, “It could cause a technical default and lead to severe market disruption.”

While it “will likely go down to the wire,” Edward Moya, senior market analyst for the Americas at OANDA, said, “expectations are still optimistic that Republicans won’t want to take the blame for sending the economy immediately into a recession and as that could trigger millions of jobs lost and wipe out $15 trillion in wealth.”

Interactive Brokers’ Chief Strategist Steve Sosnick said, “As of now I am not confident that Congress can get any of the spending and debt bills across the finish line ahead of their deadlines.” He sees a 50%-75% chance “of a government shutdown once the debt ceiling is reached,” but, “I can’t imagine that even the most recalcitrant senators will allow the government to default. That would indeed be the nuclear option, and it was never triggered even during prior shutdowns.”

And investors, he said, agree, “which is why the short end of the curve and equities have barely budged.”

Sosnick foresees a shutdown of a week or two. “I think there will be some short-term angst, and there may be some resulting spillover effects that have a temporary but meaningful impact upon the economy, but ultimately things will get back to normal (whatever that means).”

The prospects for the infrastructure deal, he said, are not good, “at least not in its current form.” So there could be “some potential hiccups in markets — including munis,” Sosnick said, “but little lasting damage.”

On Friday, two Federal Reserve Bank presidents, who will be Federal Open Market Committee voters next year, pushed for tapering.

Cleveland Fed President Loretta Mester said, in her opinion the economy has made the substantial further progress needed “and I support starting to dial back our purchases in November and concluding them over the first half of next year.”

But, she added, “The start of asset-purchase tapering should not be taken as a signal that the FOMC plans to raise the fed funds rate any time soon.”

However, she sees “conditions for liftoff of the fed funds rate will be met by the end of next year,” although accommodative policy will be needed for some time.

Still, predictions can be wrong, Mester noted. “If we have learned anything over the past 18 months, it is that things can evolve very differently than anticipated. In these unprecedented times, the uncertainty around any economic forecast — including my own — is particularly high. Uncertainty will remain very high until the path of the economy can be decoupled from the virus.”

Meanwhile, Kansas City Fed President Esther George said, “In my view, the criteria for substantial further progress have been met, with inflation running well above our target and the unemployment rate at 5.2%, down 1½ percentage points relative to December. Under these conditions, the rationale for continuing to add to our asset holdings each month has waned and signaling that we will soon consider bringing our asset purchases to an end is appropriate.”

While “the economy has not returned to normal,” George said she’s not sure “what normal will end up looking like.”

And with the Delta variant raging, the return to normal may take longer she said, “rather than upend the process altogether.”

Also, George said, unemployment rates may not “be the best guidepost in the current expansion,” if COVID proves to have “resulted in a number of structural changes in the labor market. These changes could affect the assessment of maximum employment in ways that are not yet clear.”

In data released Friday, new home sales jumped 1.5% in August to a seasonally adjusted annual rate of 740,000 from a revised 729,000 in July, first reported as 708,000. The 740,000 was the fastest pace since April.

Economists polled by IFR Markets expected a 713,000 pace.

The median sales price rose to $390,900 from $390,500. These prices are up 20.1% year-over-year. Inventory was up 3.3% in the month to 378,000 units.

Primary to come

Hawaii (Aa2/AA+/AA//) is set to price Wednesday $1.9 billion of taxable generation obligation bonds and taxable general obligation refunding bonds, consisting of: $600 million of Series GD, $200 million of Series GE, $27.4 million of Series GF, $86.6 million of Series GG, $141.8 million of Series GH, $108 million of Series GI and $736.225 of Series GJ. BofA Securities.

The Golden State Tobacco Securitization Corp. (Aa3/A+/AA-//) is set to price Thursday $1.843 billion enhanced tobacco settlement asset-backed bonds, Series 2021B (federally taxable), serials 2022-2030, terms 2034, 2042 and 2046. Jefferies LLC.

The California Housing Finance Agency (/AA+///) is set to price $497.548 million of municipal certificates, Series 2021-2 Class X certificates (social certificates), evidencing beneficial interests in credit enhanced custody receipts, serial 2035. Citigroup Global Markets Inc.

The California Housing Finance Agency (/AA+///) is also set to price $497.548 million of municipal certificates, Series 2021-2 Class A Certificates (social certificates), evidencing beneficial interests in credit enhanced custody receipts, serial 2035. Citigroup Global Markets Inc.

Riverside County Infrastructure Financing Authority (/AA-//) is set to price Tuesday $452.42 million of taxable lease revenue refunding bonds, Series 2021B, serials 2022-2036, terms 2041 and 2045. Loop Capital Markets.

Texas Water Development Board (/AAA/AAA/) is set to price Thursday $430.36 million of state water implementation revenue fund revenue bonds, Series 2021 (Master Trust), serials 2022-2056. Wells Fargo Corporate & Investment Banking.

Municipal Electric Authority of Georgia (A2/A-/BBB+/) is set to price Thursday $196.04 million, consisting of $137.52 million of project one subordinated bonds, Series 2021A, serials 2023 and 2029-2041, terms 2046 and 2051 and $58.52 million of general resolution projects subordinated bonds, Series 2021A, serials 2023-2036. Barclays Capital Inc.

Municipal Electric Authority of Georgia (A2/A-/BBB+/) is set to price Thursday $132.575 million, Taxable Series 2021B, consisting of $104.58 million of project one subordinated bonds, taxable series 2021B, serials 2023-2036 and $27.995 million of general resolution projects subordinated bonds, Series 2021B, serials 2023-2031. Barclays Capital Inc.

Corona, California, (/AA+//) is set to price Wednesday $276.84 million of 2021 taxable pension obligation bonds, serials 2022-2034. Stifel, Nicolaus & Company, Inc.

Philadelphia (A1/A+/A+/) is set to price Wednesday $229.275 million of water and wastewater revenue bonds, Series 2021C, serials 2023-2027 and 2029-2041 and terms 2046 and 2051. Ramirez & Co., Inc.

Maryland Health and Higher Educational Facilities Authority (Baa3////) is set to price $213.36 million of revenue bonds, Adventist HealthCare Issue Series 2021B & C, consisting of $143.285 million of Series B and $70.075 million of Series C. Ziegler.

Department of Transportation of Maryland (Aa1/AAA/AA+/) is set to price Thursday $196.32 million of forward delivery consolidated transportation bonds, refunding series 2022A and refunding series 2022B (forward delivery), consisting of $52.565 million of Series 2022A and $143.755 million of Series 2022B. J.P. Morgan Securities LLC.

Piedmont Municipal Power Agency (A3/A-/A-/) is set to price Thursday $183.26 million of electric revenue bonds, refunding series 2021B and 2021C, consisting of $93.05 million, Series 21B, serials 2027-2034 and $90.21 million, Series 21C, serials 2027-2034. Wells Fargo Corporate & Investment Banking.

Ohio (A2/A//) is set to price Wednesday $154.85 million of hospital revenue bonds, Series 2021A (University Hospitals Health System). BofA Securities.

CSCDA Community Improvement Authority (non-rated) is set to price Wednesday $135.555 million of essential housing revenue bonds, consisting of $95.315 million, Series 2021A, serial 2056 and $40.24 million, Series 2021B, serial 2046. Citigroup Global Markets Inc.

The Museum of Fine Arts in Houston (Aa1/AAA///) is set to price Tuesday $100 million of taxable bonds, Series A, due 9/1/2051. J.P. Morgan Securities LLC.

Mather Foundation (/A+///) is set to price Tuesday $100 million of taxable bonds, Series 2021 (Green Bonds). J.P. Morgan Securities LLC.

Competitive:

The Washington Suburban Sanitary District is set to sell $350 million of consolidated public improvement bonds of 2021 and consolidated public improvement bonds of 2021 green bonds at 10:30 a.m. eastern Tuesday.

The Maryland Department of Transportation (Aa1/AAA/AA+) is set to sell $138.415 million of consolidated transportation bonds, refunding series 2021B at 11 a.m. Wednesday.

The Maryland Department of Transportation (Aa1/AAA/AA+) is set to sell $295 million of consolidated transportation bonds, Series 2021A at 10:30 a.m. Wednesday.

New Castle County, Delaware, (Aaa/AAA/AAA) is set to sell $87.305 million of general obligation bonds, Series 2021A at 10:45 a.m. Thursday and $206.7 million of general obligation bonds, Series 2021B (federally taxable) at 11:15 a.m. Thursday.

Greenville County (/A-1+//) is set to sell $152.43 million of general obligation bonds, Series 2021B at 11 a.m. Thursday.