Municipals were a touch softer Friday as U.S. Treasuries rose and equities sold off as global concerns over China and COVID were heightened and participants prepared for the FOMC meeting and potential for tapering next week.

Triple-A benchmark yields rose a basis point beginning in 2028 while UST were off another three to four on the 10- and 30-year. The 10-year UST has risen 9 basis points since Tuesday while the 30-year climbed five since its low on Tuesday.

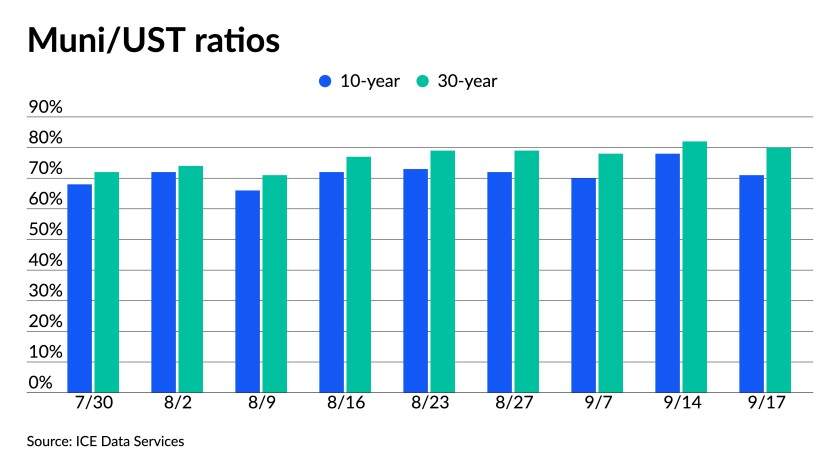

Ratios fell on Friday as municipals continued to outperform taxables with the 10-year municipal to UST ratio at 68% and the 30-year at 80%, according to Refinitiv MMD. The 10-year ratio was at 71% while the 30-year was at 81%, according to ICE Data Services.

Municipals have been distracted by the robust primary market and that trend will continue next week when another large new-issue calendar greets investors content to put money to work there, making the secondary market secondary.

The total potential volume is estimated at $9.924 billion with $7.51 billion of negotiated deals and $2.41 billion of competitive loans. Total 30-day visible supply is at $13.22 billion.

The calendar is led by the Triborough Bridge and Tunnel Authority’s $880.54 million MTA Bridge/Tunnels payroll mobility tax senior lien bonds in the negotiated market and nearly $1 billion of general obligation bonds from Massachusetts and $546 million from the New York Thruway Authority in the competitive space.

Rates remain historically favorable from the issuer side, noted Kim Olsan, senior vice president at FHN Financial. She said the low rates set up another $100 billion of new issues between now and the end of the year.

“Since 2016, the low end of Q4 volume has been $83 billion and as high as $155 billion (2017 and preceding tax changes in 2018),” she noted.

“Consistent fund flows this year have created a cycle of demand that won’t fade, but merely adjust to changing rate scenarios,” she said. “It would likely take a heavy period of supply to force rates over their 2021 highs, which are about 20 basis points away from current levels.”

Despite single-and low-double digit yields, “the FOMC/Tax/Financing Package storyline will hold reluctant interest in short munis — meaning the push for any concession (leading to a strong credit spread collapse) and demand for short calls will remain in play,” she added.

If issuers do pull back on issuance as a result of waiting on the potential for a massive new influx of tools from the $3.5 trillion package being debated in Washington, participants still see an active investor base.

“We expect the next several weeks to be relatively active in the muni space, but, in our view, the asset class is well positioned, especially if supply turns out to be lighter than expected,” Barclays said in a weekly report. “There is a lot of cash on the sidelines, with investors looking to buy the dip. Consequently, even if there is some market volatility, we would view this less as a concern and more as a possible buying opportunity.”

Secondary trading and scales

Trading showed some weakness. New York Dorm PITs 5s of 2022 traded at 0.10%.

Texas 5s of 2025 traded at 0.35%-0.34%. New York City TFA 5s of 2026 at 0.41%-0.39%. Wisconsin 5s of 2026 at 0.41% and 5s of 2027 at 0.54%.

North Carolina 5s of 2028 at 0.67%. Maryland 5s of 20228 at 0.71%-0.70%. Minnesota 5s of 2031 at 0.96%. Ohio mental health 5s of 2031 at 1.04%.

Maryland 5s of 2032 at 1.06% versus 1.03% Monday. Maryland 5s of 2034 at 1.15%-1.14% the same as Thursday.

Arlington 5s of 2038 at 1.29%-1.28%. California 5s of 2041 at 1.47%.

Refinitiv MMD’s scale showed the one-year steady at 0.07% in 2022 and steady at 0.11% in 2023. The yield on the 10-year rose one basis point to 0.94% while the yield on the 30-year rose one to 1.54%.

The ICE municipal yield curve showed bonds in 2022 at 0.08% and at 0.12% in 2023. The 10-year maturity sat at 0.95% and the 30-year yield was up one to 1.53%.

The IHS Markit municipal analytics curve showed the one-year steady 0.08% and steady at 0.11% in 2023. The 10-year rose one to 0.94% and the 30-year rose one to 1.53%.

The Bloomberg BVAL curve showed short yields steady at 0.07% and 0.07% in 2022 and 2023. The 10-year yield rose one to 0.94% and the 30-year yield also rose one to 1.53%.

The 10-year Treasury was yielding 1.375% and the 30-year Treasury was yielding 1.908% in late trading. The Dow Jones Industrial Average fell 168 points or 0.48%, the S&P 500 lost 0.92% while the Nasdaq fell 0.91% near the close.

Economic indicators

The University of Michigan’s consumer sentiment index rose 1% to 71.0 in September from 70.3 in August, according to its survey of consumers.

Economists surveyed by IFR Markets had expected the index to increase to 72.0 for the month.

The index, which stood at 80.4 in September of 2020, is down 11.7% on the year.

“The steep August falloff in consumer sentiment ended in early September, but the small gain still meant that consumers expected the least favorable economic prospects in more than a decade,” according to Richard Curtin, the survey of consumers’ chief economist.

The current economic conditions index fell 1.8% to 77.1 in September from 78.5 in August. On the year, the index is down 12.2% from September 2020’s level of 87.8.

The index of consumer expectations rose 3.1% to 67.1 in September from 65.1 in August. On the year, the index is down 11.2% from September 2020’s level of 75.6. Looking ahead, consumers could have several potential reactions to inflation, Curtin wrote in a commentary on the report.

“Consumers have initially reacted by viewing the rise in inflation as transitory, believing that prices will stabilize or could even fall in the future. As a result, postponing purchases is seen as a viable strategy. This implies a slowdown of spending in the months ahead and a more robust rebound later in 2022,” he said.

“The main alternative is that inflation will not be transient, but will rise further due to an unprecedented expansion in fiscal and monetary policies,” Curtin said. “The resulting rise in inflationary psychology will lessen resistance to rising prices and stiffen demands for increased wage gains. This reaction takes a long time to fully develop, and is contingent on significant increases in long-term inflation expectations, which have yet to be observed.”

Primary to come

Triborough Bridge and Tunnel Authority (/AA+/AA+/AA+/) is set to price on Tuesday $880.54 million of payroll mobility tax senior lien bonds, Series 2021C, consisting of $380.65 million, Series C-1, $184.115 million, Series C-2 and $315.775 million, Series C-3. Goldman Sachs & Co.

The Department of Airports of Los Angeles, California, (Aa3/A+/AA-//) is set to price $750.215 million of subordinate revenue bonds, 2021 Series D (Private Activity/AMT), serials 2026-2041, terms 2046 and 2051. Jefferies LLC.

The New Jersey Health Care Facilities Financing Authority (Aa3/AA-//) is set to price on Tuesday $746.27 million of revenue bonds, RWJ Barnabas Health Obligated Group Issue, Series 2021A, serials 2022-2041 and 2045, term 2051. Citigroup Global Markets Inc.

Orange County Transportation Authority (Aa3/AA//) is set to price on Tuesday $663.12 million of bond anticipation notes I-405 Improvement Project, Series 2021. BofA Securities.

Ohio State University (Aa1/AA/AA/) is set to price on Tuesday $600 million of general receipts bonds (Multiyear Debt Issuance Program II), Series 2021 A (Green Bonds), serials 2022-2041, terms 2046 and 2051. Barclays Capital Inc.

The California Housing Finance Agency (/AA+///) is set to price on Thursday $497.547 million of municipal certificates, Series 2021-2 Class A Certificates (social certificates), evidencing beneficial interests in credit enhance custody receipts, serial 2035. Citigroup Global Markets Inc.

The California Housing Finance Agency (/AA+///) is set to price on Thursday $497.547 million of municipal certificates, Series 2021-2 Class X Certificates (social certificates), evidencing beneficial interests in credit enhance custody receipts. Citigroup Global Markets Inc.

Southeast Alaska Regional Health Consortium (/A-/A-//) is set to price on Tuesday $300 million of taxable corporate CUSIP fixed rate bonds, Series 2021. BofA Securities.

The Maryland Health and Higher Education Facilities Authority (Ba3////) is set to price on Tuesday $213.36 million of revenue bonds, Adventist HealthCare Issue Series 2021B & C, consisting of $143.285 million, Series B and $70.075 million, Series C. Ziegler.

The Suffolk Tobacco Asset Securitization Corporation (non-rated) is set to price on Wednesday $179.125 million of tobacco settlement asset-backed bonds, Series 2021A-2 Senior Bonds and Series 2021B-1 Subordinate Bonds, consisting of $122.425 million, Series 21A2, serials 2024-2041, term 2050 and $56.7 million, Series 21B1, terms 2031 and 2050. Jefferies LLC.

The New York State Housing Finance Authority (Aa2////) is set to price on Tuesday $165.185 million of affordable housing revenue bonds, 2021 Series G (sustainability bonds) and 2021 Series H Refunding Bonds (social bonds), consisting of, $109.965 million; Series G; serials 2022-2033; terms 2036, 2041, 2047, 2051 and 2056 and $55.22 million; Series H, serials 2022-2033; terms 2036, 2041 and 2047. Wells Fargo Corporate & Investment Banking.

The Turnpike Authority of Kentucky (Aa3///AA-/) is set to price on Tuesday $157.285 million of economic development road revenue refunding bond (Revitalization Projects), 2021 Series A, 2021 Series B (federally taxable), 2022 Series A (forward delivery). J.P. Morgan Securities LLC.

The Residential Care Facilities for the Elderly Authority of Fulton County, Georgia (non-rated) is set to price on Wednesday $131.775 million of Series 2021A & Series 2021B (Canterbury Court Project), consisting of $120.775 million, Series A and $11 million, Series B. Ziegler.

The Hospital Service District No. 1 of the Parish of Tangipahoa, Louisiana (/A-/BBB+//) is set to price on Tuesday $129.795 million of hospital revenue refunding bonds (North Oaks Health System Project), Series 2021. BofA Securities.

The Department of Airports of Los Angeles, California, at the Los Angeles International Airport (Aa3/A+/AA-//) is set to price $125.535 million of subordinate refunding revenue bonds, 2021 Series E (federally taxable), serials 2023-2036, terms 2041 and 2051. Jefferies LLC.

Palomar Community College District in San Diego County, California (/AA//) is set to price on Tuesday $122.470 million of 2021 general obligation refunding bonds. Piper Sandler & Co., Minneapolis.

The Rampart Range Metropolitan District No. 5 in Douglas County, Colorado (non-rated) is set to price on Thursday $117.700 million of limited tax supported and special revenue bonds, Series 2021, terms 2036, 2041 and 2051. Jefferies LLC.

The California Community Housing Agency (non-rated) is set to price on Thursday $117.505 million of essential housing revenue bonds, Series 2021A-1 Senior Bonds and Series 2021A-2 Junior Bonds (K Street Flats), consisting of $70 million, Series 21A1, term 2057 and $47.505 million, Series 21A2, term 2050. Jefferies LLC.

The Board of Regents of Higher Education at Montana State University (Aa3/A+//) is set to price on Tuesday $116.9 million of general revenue bonds, Series G 2021 and Series H 2021 (taxable), consisting of $45 million, Series G 21, serials 2022-2041, term 2046 and $71.900 million, Series H2, serials 2022-2036, terms 2041 and 2043. Wells Fargo Corporate & Investment Banking.

The Cypress-Fairbanks Independent School District (Aaa/AAA//) is set to price on Tuesday $91.96 million of unlimited tax refunding bonds, Taxable Series 2021B, insured by Permanent School Fund Guarantee Program. Morgan Stanley & Co. LLC.

The Suffolk Tobacco Asset Securitization Corporation (non-rated) is set to price on Wednesday $84.26653 million of tobacco settlement asset-backed bonds, Series 2021B-2 Subordinate Bonds, term 2066. Jefferies LLC.

Competitive:

Massachusetts (Aa1/-/AA+) is set to sell $226.215 million of general obligation refunding bonds, 2021 Series A at 11 a.m. eastern on Tuesday.

Massachusetts (non-rated) is set to sell $350 million of general obligation bonds consolidated loan of 2021 Series D at 10:30 a.m. on Tuesday.

Massachusetts (Aa1/-/AA+) is set to sell $385 million of general obligation bonds consolidated loan of 2021 Series C at 10 a.m. on Tuesday.

Miami-Dade County School District is set to sell $450 million of tax anticipation notes, Series 2021 at 10 a.m. on Wednesday.

New York State Thruway Authority (A1/A/-) is set to sell $259.49 million of general revenue bonds Series O Bonds Maturity Group 1 at 10:15 a.m. on Thursday.

New York State Thruway Authority (A1/A/-) is set to sell $287.455 million of general revenue bonds Series O Bonds Maturity Group 2 at 10:45 a.m. on Thursday.