Municipals were stronger on the short end, hitting record low levels for the second time this year, in quiet trading while U.S. Treasuries were treading water and equities did much the same as all markets await Wednesday’s Federal Open Market Committee meeting announcement.

Triple-A benchmarks moved one to two basis points lower inside of five years with several high-grade names trading at sub-0.05% levels.

Bellwether Maryland 5s of 2022 traded at 0.04% as did Washington. Ohio 5s of 2022 traded at 0.05%. Wake County, North Carolina, 5s of 2023 exchanged hands at 0.04% and Virginia 5s of 2023 at 0.05%. Washington 5s of 2023 also traded at 0.05%.

All triple-A benchmark curves had the one-year at 0.05%.

Bloomberg BVAL saw its two-year also at 0.05%, a record low for the benchmark.

Refinitiv MMD’s two-year is also now at a fresh all-time low of 0.06%, surpassing its previous record of 0.07% set on April 15.

Municipal-to-UST ratios hovered at recent percentages and were at 65% for the 10-year and the 30-year was at 71%, according to Refinitiv MMD. ICE Data Services had the 10-year muni-to-Treasury ratio at 66% and the 30-year at 70%.

With municipal yields at exceedingly low absolute levels, the spread tightening between credits also continues.

“Short-end yields are fairly homogeneous between AA and AAA credits,” said FHN Financial’s Kim Olsan.

Spreads between the two-year AAA to AA is a mere four basis points, six basis points in five years, nine basis points in 10 and 13 basis points in 30, according to ICE Data Services.

Not until a 2028 maturity does any material difference come into play down in credit, she notes, while implied intermediate AA revenue spreads begin to separate from AAA counterparts.

“Indicative 10-year AA revenue bonds offer a comparable yield to 15-year AAAs and in 15 years, AA revenue yields jump slightly above 20-year AAA GOs,” Olsan said “A generic 10-year noncallable AA revenue bond duration is approximately 8.1 years, while a 15-year (10-year call) AAA GO duration is about 7.8 years. Inquiry can find a balance in this range with a blend of high-grade GOs and mid-AA revenue bonds.”

Out longer, current spreads indicate value of about 25 basis points in 30-year AA revenue bonds over AAA GOs, she said.

“With the Bond Buyer 20 GO index at a near-historic low (2.03% YTM) as an example of the reach for yield, incremental pickup has become more valuable,” Olsan said.

Secondary trading and scales

More short trading: Virginia College Building Authority 5s of 2022 at 0.06%. Baltimore County 5s of 2024 at 0.12%. Fort Worth, Texas, ISD 5s of 2024 at 0.14%-0.13%. Maryland DOT 5s of 2024 at 0.14%. New York City 5s of 2025 at 0.30%.

California 5s of 2027 at 0.53%-0.52%. Virginia 4s of 2028 at 0.61%. Maryland 5s of 2029 at 0.66%. New York City 5s of 2031 at 1.03%-1.01%.

University of North Carolina-Chapel Hill 5s of 2035 at 1.05%-1.04%. New York Dorm PIT 5s of 2036 at 1.28% versus 1.30% Thursday.

Jarrell, Texas, ISD 4s of 2044 at 1.50%-1.45% versus 1.56% original. Los Angeles Department of Water and Power 5s of 2046 at 1.36% versus 1.40% Wednesday. LA DWP 5s of 2049 at 1.36%-1.28%.

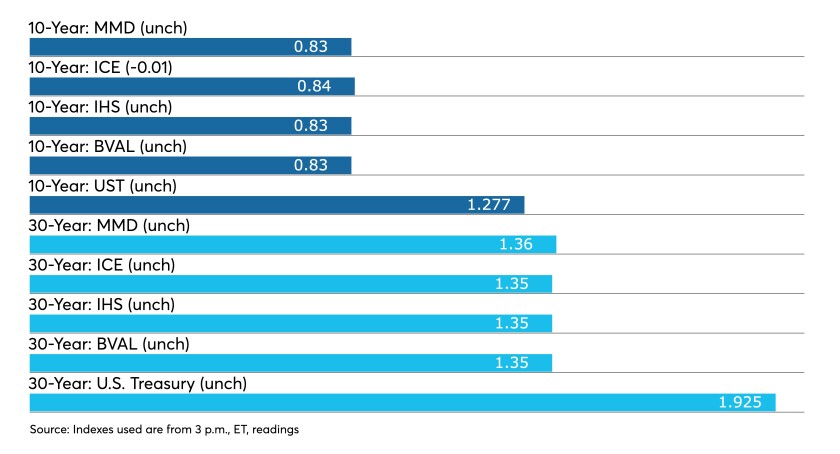

According to Refinitiv MMD, yields were steady at 0.05% in 2022 and fell two basis points to 0.06% in 2023. The yield on the 10-year was steady at 0.83% while the yield on the 30-year was at 1.36%.

ICE municipal yield curve showed yields at 0.045% in 2022 and down two to 0.06% in 2023. The 10-year maturity at 0.84% (-1) and the 30-year yield sat at 1.35%.

The IHS Markit municipal analytics curve saw the one-year steady at 0.05% and the two-year fall two to 0.06%, with the 10-year at 0.83%, and the 30-year yield at 1.35%, both steady.

Bloomberg BVAL saw levels down one basis point to 0.05% in 2022 and down two to 0.05% in 2023 while the 10-year held at 0.83% and the 30-year sat at 1.35%.

Treasuries were little changed while equities were mixed near the close. The 10-year Treasury was yielding 1.277% and the 30-year Treasury was yielding 1.925% in late trading. The Dow Jones Industrial Average gained 65 points or 0.19%, the S&P 500 rose 0.18% while the Nasdaq fell 0.63%.

Housing headwinds

Signs of softness in the housing market, caused by lack of supply, could have another headwind on the horizon, should the Federal Reserve decide to taper its purchases of mortgage-backed securities quicker than expected.

“A period of bidding wars and skyrocketing home prices has left many would-be buyers discouraged,” said Yelena Maleyev, economist at Grant Thornton.

“Builders are racing to keep up with the pace of demand and we are seeing supply-side shortages, not only with materials but also with skilled workers,” said Mike Fratantoni, senior vice president and chief economist of the Mortgage Bankers Association. “And the lack of supplies is limiting their ability to quickly bring new homes.

The Federal Open Market Committee will discuss when to begin tapering its asset purchases at its meeting this week. The minutes of the previous meeting indicated some members targeted MBS purchases as a better fit for curtailing the Fed’s asset-purchases that support the economy, because rising home prices suggest real estate doesn’t need continuing support.

Since the Fed promised to give “plenty of notice” before tapering, he said, it won’t matter for the real estate market if MBS buys are cut before or quicker than Treasuries.

“We forecast the mortgage rate to go up to around 3.5% by the end of the year, it is currently around 3%,” he said. “That level will not harm the housing market and honestly, a little cooling of the market would be welcome.”

The Fed’s MBS purchases are not impacting the supply side, which is where the market has issues.

New home sales fell 6.6% in June to a 676,000 seasonally adjusted annual rate from a downwardly revised 724,000 a month earlier, and 19.4% from 839,000 a year ago, the first time since the pandemic began that sales were lower than a year earlier.

The May figure was originally reported as 769,000.

Economists polled by IFR Markets expected 800,000 sales.

The median sales price dropped to $361,800 in June from an upwardly revised $380,700 in May, first reported as $374,400, while the average price declined to $428,700 from an upwardly revised $434,000, first reported as $430,600.

“Homebuyers, especially first-time buyers, have been sidelined by price rises that have outpaced income growth,” Grant Thornton’s Maleyev said. “Builders, faced with significant supply constraints for everything from land to labor to materials, have been unable to match the pace of demand during the first half of 2021; many have paused projects to wait out shortages.”

Also released Monday, Texas manufacturing activity suggested some moderation in wages and price gains, while the employment situation improved, the Federal Reserve Bank of Dallas’ Texas Manufacturing Outlook Survey suggested.

The general business activity index fell to 27.3 in July from 31.1 in June and the company outlook index decreased to 22.2 from 27.5.

The production index gained to 31.0 in July from 29.4 in June and new orders inched up to 26.8 from 26.7.

The employment index rose to 23.7 from 22.9, wages and benefits dipped to 46.0 from 48.1, while prices paid for raw materials dropped to 73.5 from 80.8 and prices received for finished goods fell to 40.9 from 42.8. The price indexes “eased off the all-time highs reached last month but remained strongly elevated,” according to the Fed.

Primary market to come

King County, Washington, is set to price on Tuesday $333.56 million of taxable limited tax general obligation refunding bonds (payable from sewer revenues), 2021, Series B (Aa1/AA+//) and taxable sewer revenue refunding bonds, 2021, Series A (Aaa/AAA//) Morgan Stanley & Co. LLC.

Philadelphia (A2/A/A-/) is set to price on Tuesday $297.76 million of general obligation bonds. Goldman Sachs & Co. LLC.

The Michigan State Housing Development Authority (Aa2/AA+//) is set to price on Thursday $289.28 million of single-family mortgage revenue social bonds, consisting of $177.77 million of non-AMT and $111.51 million of taxables. Barclays Capital Inc.

The New Mexico Finance Authority (Aa2/AA//AAA) Is set to price on Tuesday $234.6 million of state transportation revenue bonds, serials 2025-2026, 2028-2030. Wells Fargo Corporate & Investment Banking.

Colorado Springs (Aa2/AA+//) is set to price on Tuesday $229.145 million of utilities system refunding revenue bonds. BofA Securities.

The Massachusetts Institute of Technology (Aaa/AAA//) is set to price $225 million of corporate CUSIP bonds on Tuesday. Barclays Capital Inc.

Durham, North Carolina, (Aa1/AAA/AA+/) is set to price on Thursday $217.215 million of utility system revenue refunding bonds, serials 2022-2051. PNC Capital Markets LLC.

The Michigan Finance Authority is set to price on Tuesday $200 million of state aid revenue refunding notes. PNC Capital Markets LLC.

The Eagle Mountain-Saginaw Independent School District, Texas, (PSF guarantee) is set to price on Thursday $177.18 million of unlimited tax school building bonds, serials 2022-2051. HilltopSecurities.

The Texas Department of Housing and Community Affairs (Aaa/AA+//) is set to price on Tuesday (retail Monday) $150 million of single-family mortgage revenue bonds 2021 Series A (Non-AMT) (Social Bonds), serials, 2022-2033, terms 2036, 2041, 2046, 2051, 2052. Barclays Capital Inc.

The A.B. Won Pat International Airport Authority, Guam (Baa2///) is set to price on Tuesday $144.765 million of taxable general revenue bonds. Barclays Capital Inc.

The New Jersey Housing and Mortgage Finance Agency (Aa2/AA//) is set to price on Tuesday $135.8 million of single-family housing revenue social bonds, serials 2022-2033, terms 2036, 2041, 2046, 2052, 2052. Jefferies LLC.

Philadelphia is also set to price on Tuesday $131.525 million of taxable general obligation refunding bonds. Goldman Sachs & Co. LLC.

Rapid City, South Dakota, (Aa2///) is set to price on Tuesday $102.210 million of taxable sales tax revenue refunding bonds, serials 2021-2041, term 2046. Baird.

The El Monte Union High School District, California, (Aa3//AAA/) is set to price on Wednesday $101.140 million of exempt and taxable general obligation bonds. RBC Capital Markets.

The Unified School District No. 500, Wyandotte County, Kansas, (Aa3///) $98.57 million of taxable general obligation refunding bonds. Piper Sandler & Co.

In the competitive market, King County, Washington, will sell $334 million of general obligation bonds at 9 a.m. eastern on Tuesday.

Philadelphia will sell $298 million of general obligation bonds at 9 a.m. eastern.

On Thursday, Washington is set to sell $316 million of general obligation bonds at 10:30 a.m. eastern and $282 million of GOs at 11 a.m. eastern.

The Michigan State Housing Development Authority is set to sell $289 million of revenue bonds at 9 a.m. eastern.