Municipals were steady in typical summer Friday style ahead of a less-than-robust new-issue calendar to end July.

The U.S. Treasury 10-year ends 10 basis points higher than it started the week, but back to levels of a week ago, while the stock market rallied and earnings pushed them to all-time record highs Friday.

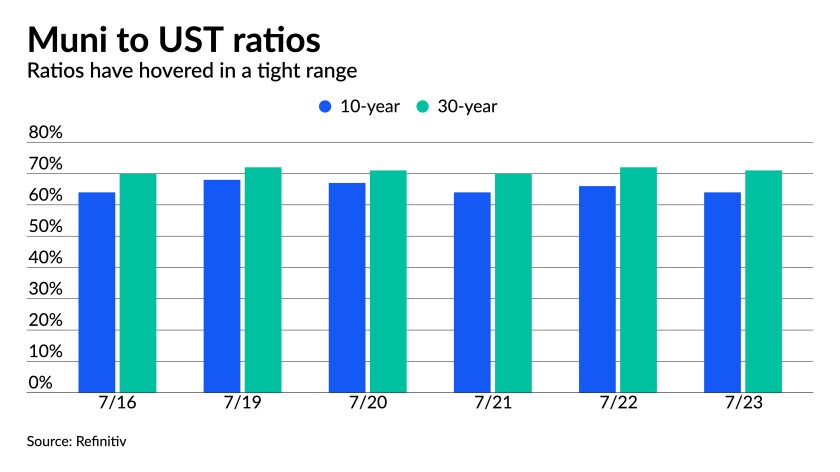

Triple-A benchmarks were little changed. Municipal-to-UST ratios were at 64% for the 10-year and the 30-year was at 71%, according to Refinitiv MMD. ICE Data Services had the 10-year muni-to-Treasury ratio at 65% and the 30-year at 70%.

The total potential volume for next week is estimated at $6.356 billion, down from total sales of $8.653 billion this week while 30-day visible supply is pegged at $9.4 billion.

Washington along with King County, Washington, and Philadelphia lead the slate with various negotiated and competitive exempt and taxable general obligation bonds. The housing and utility sectors also are well represented.

With about $60 billion coming due and it being very unlikely for new issuance to hit that figure, the supply-demand imbalance is severe and keeping municipal performance strong.

And while munis saw pressure out longer this week, participants say it’s likely short-lived. Between mutual funds, the constrained supply and overall credit positives the sector is seeing, it is hard to see any major headwinds in the near-term.

“In our view, this is temporary, and, if rates remain in check, an opportunity to add,” Barclays strategists Mikhail Foux, Clare Pickering and Mayur Patel said in a Friday report. “We believe that the yield curves could continue to flatten in the near term as long-term retail inflows continue to provide support for the market … while mutual funds have sizable cash balances. Supply is a running a bit heavier than expected for this time of the year, but there is ample appetite to absorb the pipeline even though some tightly traded deals saw some investor pushback this week.”

Barclays noted that while corporate spreads have widened somewhat on growth concerns, taxable munis outperformed yet again.

“We still see this muni sub-sector as well supported, despite rather rich valuations,” they wrote. “AAAs and AAs will see strong demand from life insurers, incentivized by changes in the NAIC’s risk weightings, and some BBB credits are still attractive enough versus similarly rated corporates with relatively few credit concerns on the horizon.”

Ratios continue to hold at historically low levels also as a result. Nuveen noted that after reaching historical highs in 2020, the 10-year municipal-to-Treasury yield ratio moved from 64% to 66% during the second quarter, versus a long-term average of 85% while the 30-year ratio dipped into the 60% range during the quarter, but ultimately ended the quarter steady at 70% compared to a long-term average of 93%.

“These low ratios indicate municipal outperformance, driven by both technical and fundamental factors,” Nuveen said.

Any potential weakness could be modest at best given the extremely strong demand from mutual funds and exchange-traded funds, according to JB Golden, executive director and portfolio manager at Advisors Asset Management.

“The unceasing wave of post-pandemic inflows continues and the amount of money entering the market this year has been nothing short of astounding,” Golden said.

While there may be some concern and market pressure over the resurgence of the COVID-19 Delta variant and the potential impact it could have on state and local governments, Golden said, it seems more technical in nature than fundamental.

“There have been a host of supportive tailwinds for the asset class this year, including a healthy political backdrop, a credit backstop in the form of the $1.9 trillion American Rescue Plan Act, concern over higher taxes, and a lack of safe haven alternatives,” he said. “This has supported strong demand that has stretched valuations to the point of eroding the value proposition associated with tax-exempt municipals.”

The 10-year ratio has averaged about 63% to 64% since the mid-February 2021 selloff on the back of higher interest rates, he said.

While Golden and others noted the ratio has dipped below 63% a few times in the last several months, “it tends to bottom and bounce once it has breached that level.”

Somewhere below 63%, the value proposition in municipals erodes and it no longer remains rational to favor municipals over Treasuries, he noted.

Hence the better-performing taxable municipal sector.

“We entered the last Treasury rally sitting at approximately 62% on the 10-year municipal to Treasury ratio and we think it doesn’t make sense for them to go much lower,” Golden said.

Secondary trading and scales

Trading on the short end showed steady prints and the one-year high-grade holding tight at 0.05%.

Maryland 5s of 2022 at 0.05%. Washington 5s of 2022 at 0.05%. South Carolina 5s of 2022 at 0.05%. Montgomery County, Maryland, 5s of 2022 at 0.05%.

Utah 5s of 2023 at 0.08%. New York UDC 5s of 2023 at 0.07%. Maryland 5s of 2023 at 0.07%. Baltimore County 5s of 2024 at 0.12%. Henrico County, Virginia, 5s of 2024 at 0.16%-0.15%. Connecticut 5s of 2024 at 0.18%. Maryland 5s of 2025 at 0.26%.

There were not many prints around the 10- to 15-year to point to.

Princeton 2s of 2038 traded at 1.86%-1.85%. Baltimore County 4s of 2046 at 1.55%-1.51%.

Triborough Bridge and Tunnel 5s of 2051 at 1.50%.

According to Refinitiv MMD, yields were steady at 0.05% in 2022 and 0.08% in 2023. The yield on the 10-year was steady at 0.83% while the yield on the 30-year was at 1.36%.

ICE municipal yield curve showed yields steady at 0.05% in 2022 and down one to 0.08% in 2023. The 10-year maturity at 0.85% and the 30-year yield sat at 1.35%.

The IHS Markit municipal analytics curve saw the one-year and two-year fall two basis points to 0.05% and 0.08% in 2022 and 2023, with the 10-year at 0.83%, and the 30-year yield at 1.35%.

Bloomberg BVAL also saw levels down two basis points to 0.05% in 2022 and 0.07% in 2023 while the 10-year held at 0.83% and the 30-year sat at 1.35%.

Treasuries were little changed while equities hit record highs. The 10-year Treasury was yielding 1.287% and the 30-year Treasury was yielding 1.925% in late trading. The Dow Jones Industrial Average gained 183 points or 0.53%, the S&P 500 rose 0.91% while the Nasdaq gained 0.94%.

FOMC preview

While analysts agree the Federal Open Market Committee’s post-meeting statement next week will likely be little changed from the previous one, they have a laundry list of clarifications they’d like from Chair Jerome Powell’s press conference or the meeting minutes.

Any clues about tapering or rate hikes would get a big reaction from markets.

David Page, head of macro research at AXA Investment Managers, expects the Fed to exit its asset purchases after six months of tapering. “News that the Fed is considering something faster would likely send yields higher sharply,” he said. Such news, he noted, would likely be gleaned from the minutes, rather than a press conference or statement.

Any tapering talk will interest Rhea Thomas, senior economist at Wilmington Trust, be it “at the meeting, in the press conference, or in subsequent speeches by other Fed officials.”

And Ariel Acuna, founder and CEO at LTG Capital, LLC/The Aqueduct Strategy, expects “the Fed to shed some light on when they anticipate beginning to slow their monthly bond purchases.”

Moving to other issues, Sean Simko, managing director and head of fixed income portfolio management at SEI’s Investment Management Unit, wants clarity on the projected path of interest rates.

“At this point, the Fed has projected two rate hikes by year end 2023,” he noted. “This contradicts the messaging that inflationary pressures are transitory. We are looking for clarity on this topic.”

Some, like Wilmington’s Thomas, expect more “concrete information” about defining “substantial progress” to come out during the Jackson Hole symposium. They see tapering beginning “in late-2021 or early-2022 at a pace of $10 billion per month, with the option to increase or decrease that rate depending on economic conditions,” she said.

If tapering goes according to plan, Thomas added, rate hike could start in 2023.

“If the economy continues to improve and tapering progresses smoothly, the Fed could commence hiking rates in 2023.”

Also of interest to Thomas is “how the Fed is incorporating the rising concern around the Delta variant into its growth outlook and also the Fed’s reaction to the slump in the 10 year yield.”

But AXA’s Page thinks the FOMC will need more time to figure out a taper plan and doesn’t anticipate a big announcement at Jackson Hole. He expects the Fed to issue a “warning” of coming tapering in September, followed by a taper announcement in December.

At Jackson Hole, the chair could say “something that suggests that a decision is imminent, perhaps specifically referring to the September meeting,” Page said, “but we see no reason why he would want to commit” except through an official FOMC meeting.

Of course, the “markets will closely watch for any signs that the Fed is starting to doubt its transitory inflation explanation,” he added, noting, “we do not expect Powell to provide any here.”

Primary market to come

King County, Washington, is set to price on Tuesday $333.56 million of taxable limited tax general obligation refunding bonds (payable from sewer revenues), 2021, Series B (Aa1/AA+//) and taxable sewer revenue refunding bonds, 2021, Series A (Aaa/AAA//) Morgan Stanley & Co. LLC.

Philadelphia (A2/A/A-/) is set to price on Tuesday $297.76 million of general obligation bonds. Goldman Sachs & Co. LLC.

The Michigan State Housing Development Authority (Aa2/AA+//) is set to price on Thursday $289.28 million of single-family mortgage revenue social bonds, consisting of $177.77 million of non-AMT and $111.51 million of taxables. Barclays Capital Inc.

The New Mexico Finance Authority (Aa2/AA//AAA) Is set to price on Tuesday $234.6 million of state transportation revenue bonds, serials 2025-2026, 2028-2030. Wells Fargo Corporate & Investment Banking.

Colorado Springs (Aa2/AA+//) is set to price on Tuesday $229.145 million of utilities system refunding revenue bonds. BofA Securities.

The Massachusetts Institute of Technology (Aaa/AAA//) is set to price $225 million of corporate CUSIP bonds on Tuesday. Barclays Capital Inc.

Durham, North Carolina, (Aa1/AAA/AA+/) is set to price on Thursday $217.215 million of utility system revenue refunding bonds, serials 2022-2051. PNC Capital Markets LLC.

The Michigan Finance Authority is set to price on Tuesday $200 million of state aid revenue refunding notes. PNC Capital Markets LLC.

The Eagle Mountain-Saginaw Independent School District, Texas, (PSF guarantee) is set to price on Thursday $177.18 million of unlimited tax school building bonds, serials 2022-2051. HilltopSecurities.

The Texas Department of Housing and Community Affairs (Aaa/AA+//) is set to price on Tuesday (retail Monday) $150 million of single-family mortgage revenue bonds 2021 Series A (Non-AMT) (Social Bonds), serials, 2022-2033, terms 2036, 2041, 2046, 2051, 2052. Barclays Capital Inc.

The A.B. Won Pat International Airport Authority, Guam (Baa2///) is set to price on Tuesday $144.765 million of taxable general revenue bonds. Barclays Capital Inc.

The New Jersey Housing and Mortgage Finance Agency (Aa2/AA//) is set to price on Tuesday $135.8 million of single-family housing revenue social bonds, serials 2022-2033, terms 2036, 2041, 2046, 2052, 2052. Jefferies LLC.

Philadelphia is also set to price on Tuesday $131.525 million of taxable general obligation refunding bonds. Goldman Sachs & Co. LLC.

Rapid City, South Dakota, (Aa2///) is set to price on Tuesday $102.210 million of taxable sales tax revenue refunding bonds, serials 2021-2041, term 2046. Baird.

The El Monte Union High School District, California, (Aa3//AAA/) is set to price on Wednesday $101.140 million of exempt and taxable general obligation bonds. RBC Capital Markets.

The Unified School District No. 500, Wyandotte County, Kansas, (Aa3///) $98.57 million of taxable general obligation refunding bonds. Piper Sandler & Co.

In the competitive market, King County, Washington, will sell $334 million of general obligation bonds at 9 a.m. eastern on Tuesday.

Philadelphia will sell $298 million of general obligation bonds at 9 a.m. eastern.

On Thursday, Washington is set to sell $316 million of general obligation bonds at 10:30 a.m. eastern and $282 million of GOs at 11 a.m. eastern.

The Michigan State Housing Development Authority is set to sell $289 million of revenue bonds at 9 a.m. eastern.

Christine Albano contributed to this report.